Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

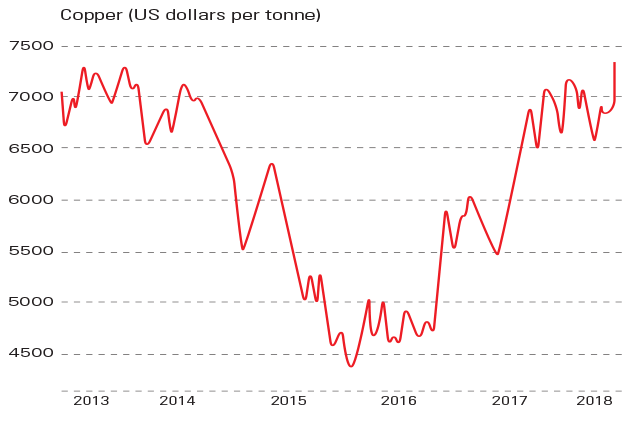

Copper has been treading water in 2018 after a jump of over 30% in 2017. It is highly geared to global growth. Fears of a trade war have dented confidence in copperof late, but the longer-term outlook is encouraging. Demand is climbing steadily as China, the top consumer, continues to develop rapidly, while the shift towards renewable-energy technologies is also key: the average electric vehicle contains 85 kilograms of copper, compared with 25 in a normal car, notes Richard Mills on The Market Oracle. With too few new mines in the pipeline to cover the likely growth in demand, the supply deficit will grow steadily wider from 2020 onwards.

Viewpoint

What is Mario Draghi waiting for? Since 2015 the European Central Bank (ECB) has been hoovering up euro area government and corporate debt with printed money. The total value of its purchases is a staggering €2trn. There is no reason to continue with this policy.It has distorted bond yields and made it much harder to gauge the risk involved in holding securities. What's more, inflation has reached the ECB's target of below, but close to, 2%. So the central bankers have no excuse for keeping going. Some will insist that the latest jitters in Italy warrant continued monetary easing, but this won't wash. If the ECB's approach were to tighten only when there is no political turbulence in the eurozone, it would wait forever. Savers, meanwhile, have been waiting forever for higher interest rates. Even if the ECB does stop easing soon, their suffering will endure.

Dennis Kremer, Frankfurter Allgemeine

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.