This wizzy airline's shares have further to climb

WizzAir, the budget airline based in Hungary, is targeting underserved areas in growing economies. Matthew Partridge picks the best way to play its success.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Budget airline WizzAir is targeting underserved areas in growing economies.

The last two years have been very profitable for those who own shares in European airlines. The rebound in eurozone economies has boosted sales, while low energy prices have reduced costs, and both of these factors have helped the bottom line. It shouldn't be surprising therefore that some airlines have seen their share prices surge. Since October 2016, easyJet and British Airways have seen their share prices rise by more than 70% each, while shares in German airline Lufthansa have gone up by more than 140% (at one point the share price had more than tripled).

However, there are fears that the good times could be about to end. One concern is rising oil prices, which could either force airlines to cut their margins, or to pass unpopular price rises onto travellers, which would inevitably hit volumes. Another big concern is Brexit, with a worst-case scenario resulting in British and European airlines being denied licences to operate in each other's markets. As a result, the share prices of all the major airlines have cooled this year.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet despite these concerns, there is still some value to be had. One firm that looks interesting is budget airline Wizz Air. It was founded in Hungary in 2003, and its main focus is on eastern and central European countries. Not only are the economies of these countries growing faster than the rest of the continent, but they are currently underserved by the main carriers. This gives Wizz Air greater room for further expansion, which should allow it to keep on going strong for a long period of time.

However, as well as continuing to expand its presence in its core market, Wizz Air has taken steps to broaden its horizons by moving westwards. These include starting new bases of operations out of Luton in the UK (securing take-off and landing slots vacated by the now-collapsed Monarch Airlines) and Vienna in Austria. Last year it also set up a UK subsidiary. As well as helping it to expand its revenue, this should help ensure that it continues to have access to both Britain and Europe whatever happens. Outside of Europe, Wizz Air also currently flies to Morocco, Israel, the United Arab Emirates and Kazakhstan.

Overall, Wizz Air's revenue has more than doubled over the last five years, and is expected to grow by around 20% over each of the next two years. While the airline's profits have been a little more volatile than its sales, it has gross margins of 15% and a return on invested capital of 25%. Despite this, it trades at 14 times forward earnings, which is similar to larger airlines such as easyJet, which are growing much more slowly.

Overall, I think there is still a lot of value left in Wizz Air's share price and you should buy it at £35.60 at £1 per 1p. In this case, you should put the stop-loss at £26. This will give you a total potential downside of £968.

Trading techniques death crosses

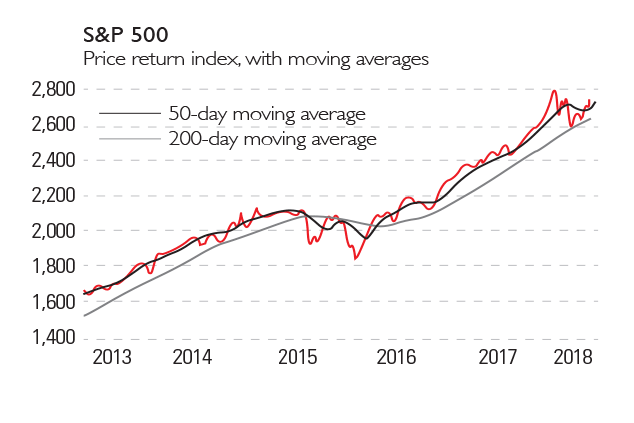

As we've discussed before, a lot of traders use the moving average (MA) to guide their trades. In its simplest form, this involves taking the average price over a period and comparing it with the current price level. When the current price rises above the MA, it is time to buy, and when it falls below, it is time to sell. Some people like to take the analysis one degree further and compare different MAs with one another. A "golden cross" is where the short-term MA (such as the 50-day MA) rises above the longer-term one (100- or 200-day). A "death cross", meanwhile, is where the short-term MA falls below the long-term one. As you'd expect from the names, a golden cross is seen as bullish; a death cross is considered to be bearish.

The last proper death cross for the S&P 500 occurred two and a half years ago, at the start of 2015 (see chart). Since April 2016 the bull market has kept the 50-day MA average well above the 200-day one. But in April it fell below the 100-day MA, and is now close to the 200-day.

One study by the research service Wall Street Courier seems to suggest that this may be more than a trader's superstition. Buying into shares after a golden cross and going into cash after a death cross between 1950 and 2002 would have boosted annual returns from 7.2% to 7.5%, compared with a simple buy-and-hold strategy, while cutting annual volatility from 15.6% to 11.2%. But and it's a big but this doesn't consider the transaction costs that would result from the 65 trades.

How my tips have fared

The last fortnight has been rather mixed. Brazil has been crippled by a wave of strikes by truckers, due to anger over rising oil prices. When the government indicated that it was going to restore price controls, Petrobras's CEO Pedro Parente resigned. This caused shares in the company to fall to less than $10 at one point. This means that the position stopped out at a reduced paper profit of £646.25. Still, it could have been worse had I not put the stop-loss in place, or had the market fallen so quickly that it jumped through the stop-loss.

The remaining four long positions have been treading water, with two rising and two falling. Greene King has gone up to 604p, which means that it is now making a profit of £580. And despite the Chinese government launching a probe into price-fixing in the computer memory market, Micron's shares have jumped to $59, netting us £324 on paper. Housebuilder Redrow fell back to 601p, due to concerns that house prices may be about to fall, which means it is £77 in the red. IG Group slipped to 870p, but this still puts the trade £599 ahead. Overall, the remaining open long positions are making a £1,425 profit.

My short positions are also doing well overall. Despite further production problems, including revelations that the company has paid out refunds on nearly a quarter of the deposits for its Model-3 car, Tesla's price has actually risen to $297, which means I'm losing $56 on the trade. The S&P 500 has also gone up to 2,746, which puts it £335 in the red, as well as perilously close to the stop-loss of 2,775. However, the good news is that bitcoin has plunged to $7,348, increasing profits to £947.

Overall, I'm in profit by £556 on my shorts. In all, my current positions are making combined paper profits of £1,981 (£1,500 counting all open and closed trades so far).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

IAG shares look shaky despite the travel recovery – one to avoid

IAG shares look shaky despite the travel recovery – one to avoidAnalysis IAG, owner of British Airways, looks to be getting back on track, and hopes to turn a profit in the next quarter. But don't think that makes IAG shares a buy, says Rupert Hargreaves. Here's why.

-

British Airways' controversial head Álex Cruz expelled

British Airways' controversial head Álex Cruz expelledNews BA boss Álex Cruz has been booted after a turbulent tenure that nonetheless left the airline in better shape. What happens next? Matthew Partridge reports

-

IAG shares will regain altitude – here's how to play it

IAG shares will regain altitude – here's how to play itFeatures IAG's business is fundamentally sound, and the current turbulence being experienced by BA should soon pass.

-

If you’d invested in: Wizz Air and Royal Mail

If you’d invested in: Wizz Air and Royal MailFeatures Wizz Air is the largest low-cost airline in central and eastern Europe – and it is flying high.