Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

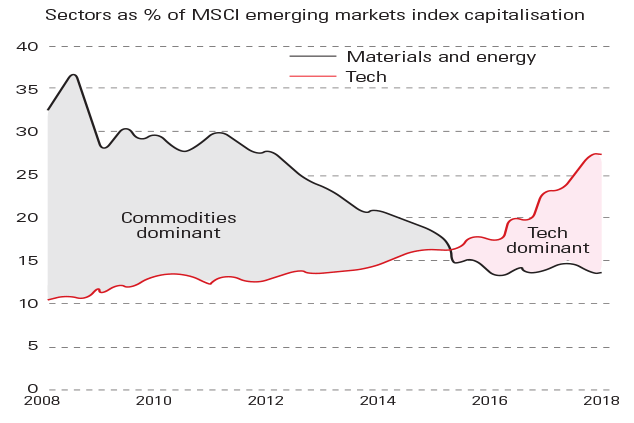

Investors tend to associate emerging markets with commodity producers. And no wonder: a decade ago raw-materials companies accounted for 37% of the benchmark MSCI Emerging Markets index. But times have changed. Technology is now the single biggest sector, comprising 27% of the index, up from 10% in 2008. A strong dollar, which makes commodities more expensive for investors outside the US, has provided an additional tailwind in the past few months. Emerging markets have gone from Brics to clicks, notes Kate Allen in the Financial Times. The new tech giants include Chinese firms Baidu, Alibaba and Tencent, along with South Korea's mobile group Samsung and Taiwanese semiconductor maker TSMC.

Viewpoint

"The political, diplomatic, technical and intellectual work that goes into the management of [Brexit] will allow for few other undertakings of real weight Leavers will contest this neat line between constitutional change and the real' work of government. They see the EU's curbs on a member state's freedom of action as the true block on domestic reform. A bold government must be sovereign in the first place. But even leaving aside the obvious rejoinder (which Thatcherite idea was stymied by Brussels?), there are only so many hours in a day... Central to politics is the picking of battles, and Britain has picked an all-absorbing one [it] volunteered for a new challenge before fixing such old ones as productivity and infrastructure. These are the Lost Years. We can but guess how many of them there will be, and what we might have done with them instead."

Janan Ganesh, Financial Times

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.