Three long-term reasons to be bullish on gold

There are several reasons to believe that we are in the early stages of a new bull market in gold. Here, Dominic Frisby outlines three of the most compelling.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We're talking gold in today's Money Morning.

This year's "gold standard" of gold-related research has just come out.

Conveniently enough given gold's "safe haven" reputation it's arrived just in time for another major financial market scare, this time in the form of Italy.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Below, I consider some of the most pertinent points...

The monetary tide is turning but how far will it wash out?

Every year, Ronald-Peter Stoeferle and Mark Valek at Incrementum AG, a Liechtenstein-based investment and asset-management company, put together an exhaustive report into the state of gold and gold-related markets. It's known as In gold we trust.

Last year's edition was downloaded some 1.7 million times. This year's, some 230 pages long, arrived in my inbox yesterday and I spent yesterday afternoon flicking through it.

In today's Money Morning I'd like to share some of the thoughts and charts that caught my eye.

The report argues that we are in the early stages of a new bull market for gold. Several factors underpin this thesis, filed under the theme "monetary turns of the tide".

First, Incrementum notes that central bank monetary policy is changing. What was quantitative easing (QE) is now quantitative tightening (QT). The equivalent of $14.4trn an almost unfathomably large number has been created by the world's five largest central banks over the past decade.

But this year they turn from net buyers into net sellers of securities. It has already begun in the US and the euro area will soon follow (although it'll be interesting to see what the situation in Italy does to that plan).

There has been a "global debt accumulation orgy". But now interest rates are starting to go up, and "the tide of global liquidity is beginning to go out".

However, while I agree with Incrementum that there has been a change in gear, I'm just not sure quite how much QE has affected gold. It's so hard to monitor. Easy money saw gold rise between 2009 and 2011, but gold then fell for five years. Investors went elsewhere.

So a change from QE to QT might help gold or it might not. It depends on how much QT there is, I guess, and what its consequences prove to be. The same goes for interest rates. Sometimes, gold rises when rates go up (as happened in 1980), but this is not always the case.

I do not see rates rising by that much. Central banks will be well aware of the consequence of higher rates not least to government debt servicing costs and will only put them up by the smallest amount possible.

We remain at what seems an eternal stand-off: so far, all of this debt hasn't mattered. One day it will, but nobody knows when.

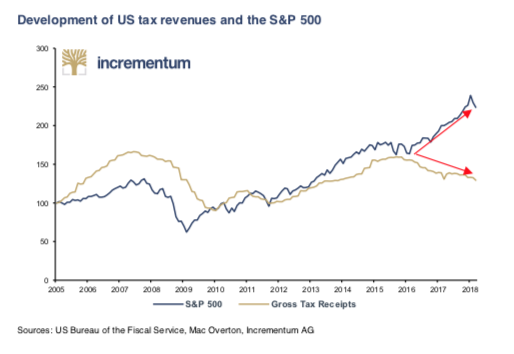

On the debt front, the chart below in particular stood out for me.

It shows US tax revenues against the S&P 500. Since 2015, US tax revenues declined, even as the S&P has risen.

The US already runs a deficit (ie the government spends more than it collects in taxes each year). Donald Trump is not going to cut spending; if anything he is going to spend more at least that's what he has indicated.

Where's the money going to come from? More debt. And there will pressure to keep the cost of that debt down.

The only way interest rates are going to go up by any significant amount is if some kind of crisis forces them up. It will not happen voluntarily.

On that note, Incrementum also observes that "in the great tug-of-war between inflationary and deflationary forces, inflationary forces have gained the upper hand in the course of the past year".

That certainly seems to be so, and it will put some upward pressure on rates. If wages go up, and with high employment they might at last, inflation will self-reinforce. Inflation should be good for gold.

Even so, I remain of the view that rates will be suppressed where possible.

King Dollar will one day be de-throned but not for some time

Incrementum's second changing tide is in the global monetary order, what it calls "de-dollarisation".

According to the report, "the creeping loss of the hegemonic status of the US dollar as the senior global reserve currency could have far-reaching consequences for the US. Declining global demand for the US dollar and Treasury bonds could boost domestic US price inflation and drive interest rates up further."

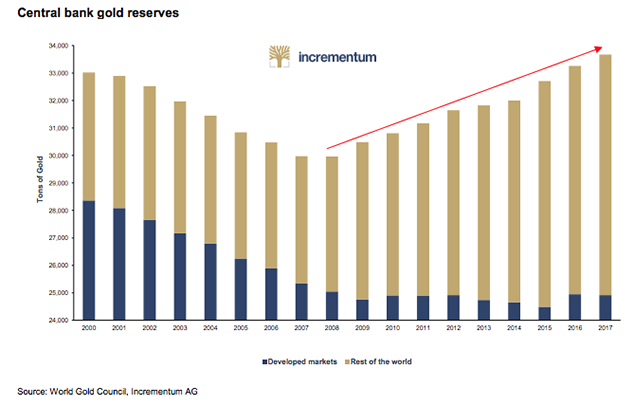

Gold will see increasing demand as a substitute. To back up this point, Incrementum presents a chart showing central bank gold reserves, which are clearly rising.

In the ten years since 2008, central banks have increased their gold reserves by about 3,000 tonnes or 10%.

However, in the context of the global economy this is drop-in-the-ocean stuff, especially given that it came off deeply oversold levels. Yes, the dollar's absolute status as the global reserve currency is slowly being chipped away yuan-denominated oil futures are a recent example.

But the dollar is still the global reserve currency. It is currently rising. It remains the world's default port-of-call in a panic. This time next year and this time in five or, I dare say, even ten years the dollar will still be the world's reserve currency. That will not change overnight (though it will change).

Gold and cryptocurrencies allies or mortal enemies?

Incrementum's third main theme and this is what presents the biggest threat, in my view, to US dollar hegemony is the "technological turn of the tide".

"Epochal technological change is taking place at a breathtaking pace", says the report and I could not agree more. As Paypal founder Peter Thiel once noted, technology, not politics, drives change, and we are in the midst of what I have called the Financial Revolution.

Money is changing. From cryptocurrencies to national currencies to something as trivial as reward points, we are moving into a Hayekian era of multiple currencies. "Gold and cryptocurrencies are friends, not foes," says Incrementum.

That may or may not be so. Crypto has "stolen" the extremely powerful "anti-fiat" narrative from gold and used it to its great advantage. It may be that crypto makes gold even more anachronistic it may be that gold eventually becomes the backbone of crypto. The jury is still out.

Overall, Incrementum is more bullish on gold than I am, I'd say.

I think I've said something along these lines before: it's like you're standing up on the cliff tops looking out to sea. Out on the horizon you can see various economic ships sailing about. They are all carrying cargo which will help a gold bull market inflation, credit crises, monetary panic, and all the rest of it but they are not yet sailing into harbour. They will one day, but not yet.

When they do, it may be that they move so quickly you will not have time to get positioned in gold so you need to get positioned now. But gold's big day in the sun is still a way off.

One day, Rodders just not yet.

If you want to take a look at Incrementum's report and it is full of excellent research, even if our overall conclusions are not in line you can do so here.

And folks, if you are around in London next week, there are two more previews of my financial gameshow in sunny Plumstead on Thursday 7 June, and at the Backyard Comedy Club in Bethnal Green on Sunday 10 June. The latter is free (we'll just pass a bucket round at the end), but you can reserve a place here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge