The charts that matter: some respite from the rising dollar

The US dollar finally hit something of a wall this week. John Stepek looks at what that's done to the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Tuesday:Why the oil price is likely to remain high and rising

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday:Why investors should be grateful for short-sellers

Thursday:The weakest link in the UK housing market right now

Friday:Unreliable central bankers are leaving investors bamboozled

You should also check out Merryn's updates on the surge in Japanese wages, and the changing nature of the investment trust market.

And don't miss this week's podcast. Merryn and I discussed house prices, Argentina, and the notion that perhaps just perhaps everyone is getting a bit sick of living in big, expensive, self-important global cities.

Now over to this week's charts.

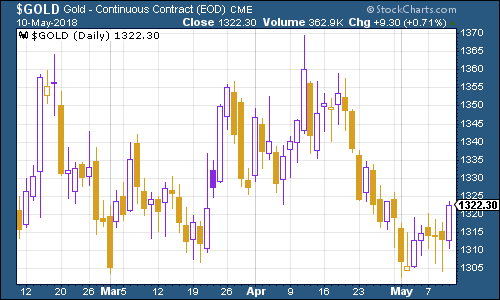

Gold has been struggling against the resurgence of the dollar, but that eased off somewhat this week, for reasons we'll discuss below.

(Gold: three months)

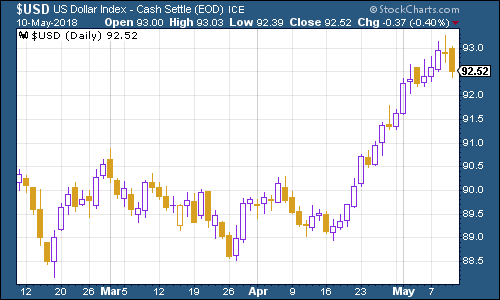

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners finally hit a bit of a wall at the end of the week, as US inflation data came in weaker than expected.

Note that the inflation data was still above the Federal Reserve's target it just happened to be lower than predicted. The lower US dollar will be some relief to emerging markets, which have been feeling the pinch in the last couple of weeks (Argentina's latest trip to the International Monetary Fund has everyone watching nervously for another emerging market crisis, although so far that looks to be off the cards).

(DXY: three months)

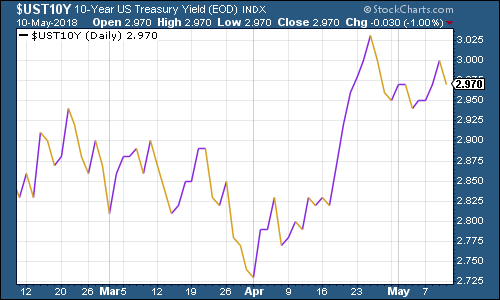

The yield on the ten-year US Treasury bond remained below the 3% mark by the end of the week. With inflation coming in slightly tamer than expected, investors were more inclined to bet that the Fed won't be under as much pressure to raise interest rates, even as growth remains pretty solid. That's a combination the wider stock market likes too.

(Ten-year US Treasury: three months)

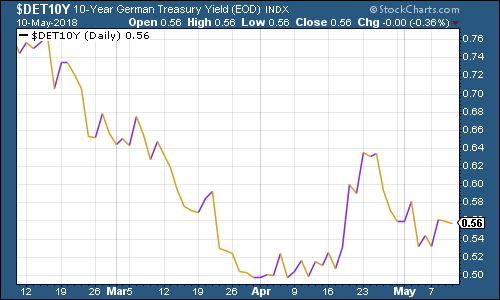

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate was little changed on the week too.

(Ten-year bund yield: three months)

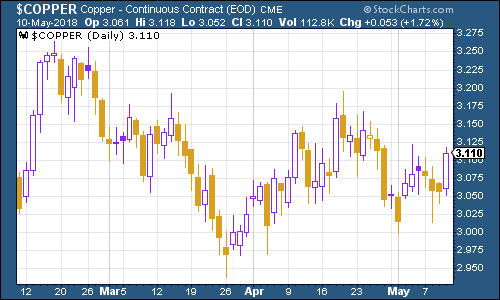

Copper spent the week trading in a range, but got a bit of a boost as the recent relentless US dollar rise stalled.

(Copper: three months)

Bitcoin has by its own standards had a pretty calm week. It was $10,000 at the start of the week and now it's more like $8,700 (at the time of writing). That would be a big fall for most assets but it's part for the course for King Crypto.

(Bitcoin: ten days)

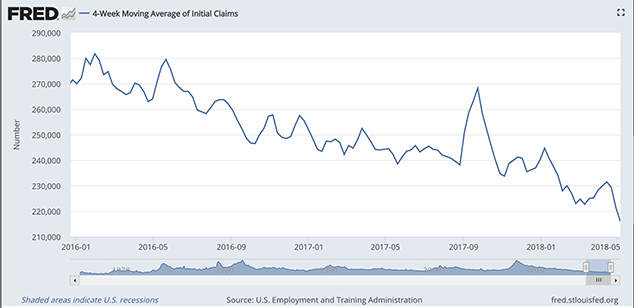

Turning to US employment, the four-week moving average of weekly US jobless claims hit a fresh low for the cycle of 216,000 this week which, incredibly, is the lowest level since 1969 while weekly claims came in at just 211,000, which again, is hovering near multi-decade lows.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

So yet again, we've just hit a fresh trough, so if there's anything to Rosenberg's observations (and of course, they are drawn from a limited pool of past cycles), then really, we should see the stockmarket hit new highs before this cycle is out.

More to the point, we should surely start seeing some wage inflation pressure coming through in the official statistics. There are already reports of high wage inflation in the freight industry, while some parts of the US are even paying younger people to come and live there in order to add to the local workforce. So even although US inflation data was pretty tame this week, it still feels like it can only be a matter of time before there's a big surprise to the upside on that front.

(US jobless claims, four-week moving average: since January 2016)

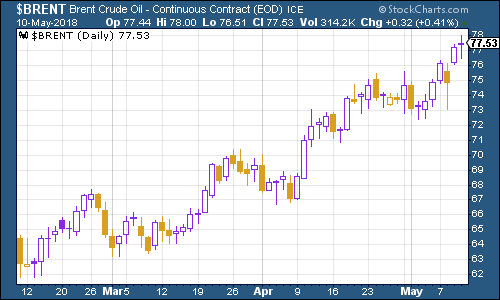

The oil price (as measured by Brent crude, the international/European benchmark) has shot up this week. Two things helped: firstly (and most obviously), the re-imposition of sanctions on Iran. Secondly, the US dollar lost a bit of steam which is generally helpful for commodity prices.

Something I'd just watch out for though (not that you should be betting directly on the oil price anyway) is that oil analysts are starting to get excited about the oil price again. You're seeing some headline-grabbing calls. Bank of America this week warned that oil prices could spike above $100 a barrel next year.

I've noticed in the past (and this is anecdote, not data, but I'll just point it out anyway) that when oil analysts start to get ahead of the price rather than lagging behind it, that's when it tends to hit a bit of a wall. Given the pace of the increase and the enthusiasm on the long side, it would make sense if it took a breather.

(Brent crude oil: three months)

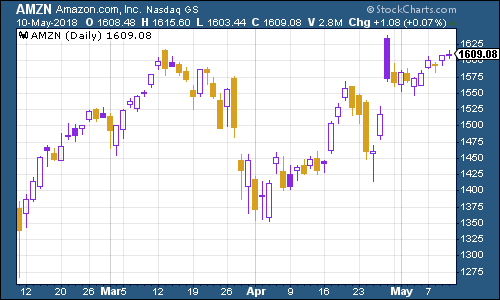

Internet giant Amazon continued back towards its recent record spike above $1,600 as markets recovered their poise this week.

(Amazon: three months)

Tesla rose right alongside all the other tech stocks. The electric-car maker is still being propped up by faith in Elon Musk.

(Tesla: three months)

Faith sure is potent stuff.

Speaking of which, just before I go if you get five minutes, you should watch this CNBC clip of venture capitalist Tim Draper defending his investment in Theranos, the high-tech blood testing group that turned out to be nothing more than a billion-dollar pile of hype. It's a very impressive illustration of confirmation bias in action.

You might argue that he's still very rich, for all his wilful obstinance. But I'd still say it's a far more useful trait as an investor to be able to hold up your hands and admit to your mistakes when you make them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how