The charts that matter: inflation fears come creeping back

As inflation rears its ugly head again, John Stepek looks at what the charts can tell us about the way the global economy could be heading.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:The one investment that might be hit hard by the war in Syria

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:You don't need to worry about the robots taking over

Wednesday: Why gold is a better bet than gold miners

Thursday:The cheapest bet on rising oil prices

Friday:The slow but steady return of inflation and how to profit from it

And if you missed this week's podcast, tune in now to hear Merryn and I debate investing in Russia (as you may have gathered from this week's Money Mornings, I am not keen on investing there, but I have to accept that it's cheap). We also discussed the significance of Mark Zuckerberg wearing a suit when he was up in front of US politicians this week when Big Tech meets Big Govt, it's Big Tech who pays tribute, not the other way around.

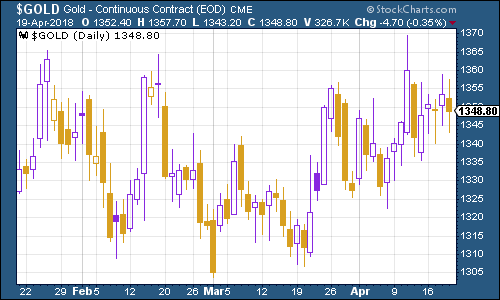

Gold continues to hover on the cusp of a "technical" breakthrough. The level everyone is watching is around $1,360 an ounce.

How meaningful is any of this stuff? It's a good question. It's easy to dismiss chart patterns as a form of market hocus pocus. At the same time, you'd have to be pretty close-minded (and, I think, in denial) to believe that investors do not take price action into account in any way.

The reality is that when most investors see a price going up, they want to buy. And when they see a price going down, they want to sell. It's instinctive.

So if gold can get enough conviction behind it to rise and stay above $1,360 in a convincing manner, then it might help to shove a few more investors on to the side of the bulls, and therefore drive the price even higher from there.

Alternatively of course, people might get fed up waiting and gold will drop down into its trading range once again. We'd hold some as financial and geopolitical insurance anyway, just in case.

(Gold: three months)

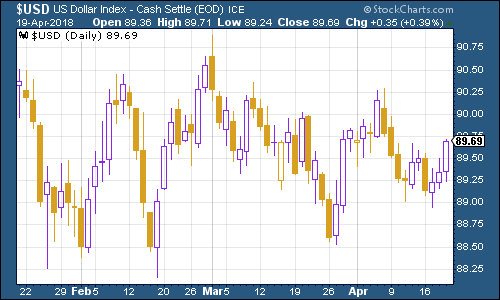

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was again little changed this week, with economic data in the US reasonably solid.

(DXY: three months)

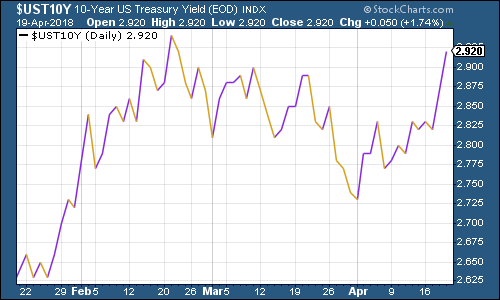

What's more interesting is that the yield on the ten-year US Treasury bond has continued to bounce back. Investors have grown less fearful this week as threats of escalation both in terms of physical war and trade war have diminished (obviously that could change over the course of a bad weekend on Twitter, right enough).

(Ten-year US Treasury: three months)

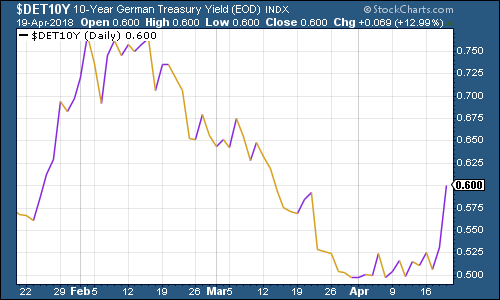

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate has rebounded sharply too (again as concerns over global growth ease up a little) which also helps to explain the rally in US Treasuries (these things all tend to go in the same overall direction as one another).

(Ten-year bund yield: three months)

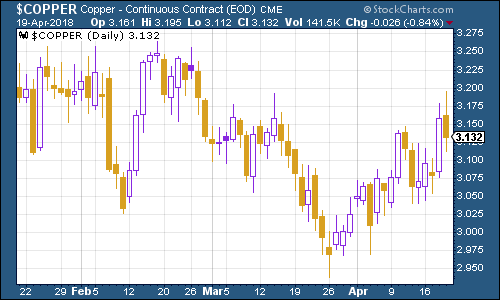

Copper has rallied quite strongly this week, as inflation is creeping back into the minds of investors.

(Copper: three months)

Bitcoin has had a much better (and calmer) week than in recent times. People are perhaps remembering that a purely digital asset that can cross borders relatively easily is a good thing to have in an era when you can't be sure of exactly how the next round of sanctions will affect your portfolio.

(Bitcoin: ten days)

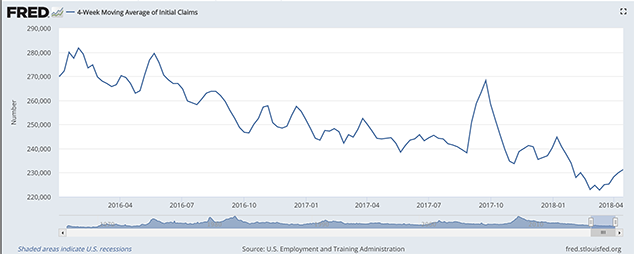

Turning to US employment, the four-week moving average of weekly US jobless claims remained low at 231,250 this week, while weekly claims came in at 232,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

As you can see, we're still only just above the most recent trough.

(Four-week moving average of US jobless claims: since start of 2016)

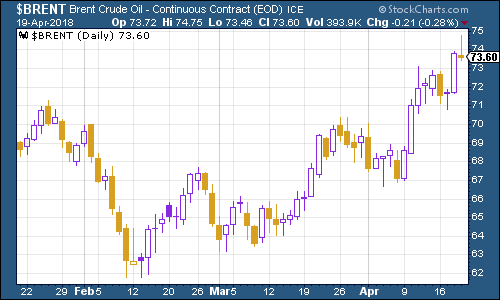

The oil price (as measured by Brent crude, the international/European benchmark) has continued to surge in the last week (I discussed why in Money Morning a couple of days ago).

(Brent crude oil: three months)

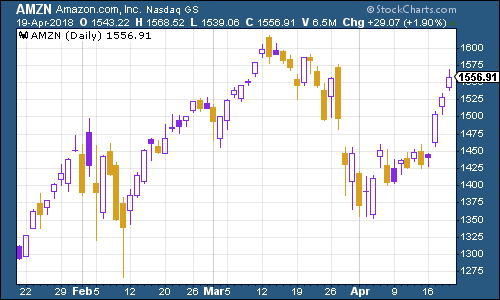

Internet giant Amazon did well as Jeff Bezos released his latest letter to shareholders and revealed that the company now has over 100 million subscribers to its Amazon Prime service.

(Amazon: three months)

Tesla continues to hold the line around the $300 mark. It does feel as though CEO Elon Musk really needs to show some progress soon to justify the shaky faith in his company. But he's done that before.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton