The charts that matter: the US dollar strikes back

Janet Yellen’s final meeting as Fed governor was more “hawkish” than expected. So investors got a little bit nervy, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: Forget the Italian election here's the eurozone power shift you really need to fear

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Beating the market: simple in theory, tough in practice

Wednesday: The one asset I feel tempted to bet on right now

Thursday: The twin beliefs propping up this market are crumbling

Friday: Neil Woodford is buying more AA shares I'd suggest you don't follow him

And we'll have a new podcast up next week (our apologies for missing this week's episode).

This week, it feels as though the market has been taking a pause for thought. The Federal Reserve released the minutes from Janet Yellen's final meeting as governor. Overall, they were a bit more "hawkish" than expected. As a result, investors got a little bit nervy.

So how has that affected the charts?

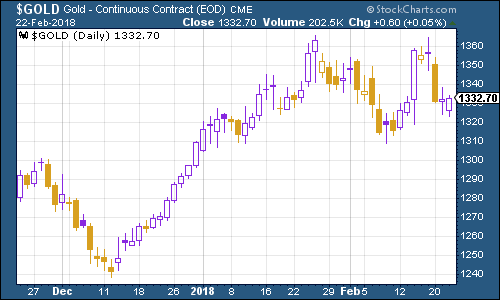

Gold wasn't enamoured of the idea of higher interest rates. Higher rates are fine as long as "real" rates (interest rates adjusted for inflation) keep falling. But that requires inflation to keep ticking higher. Gold's reaction suggests that markets are not yet convinced that this will happen (although I suspect they're overly gloomy).

(Gold: three months)

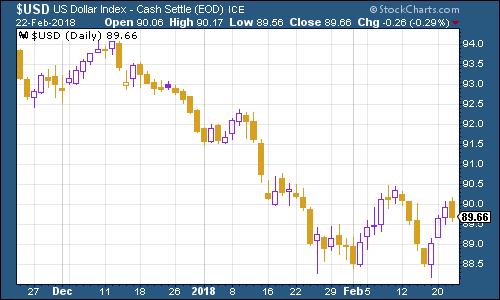

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners rebounded somewhat this week, as the minutes persuaded the market that we might see more interest rate hikes than expected this year.

(DXY: three months)

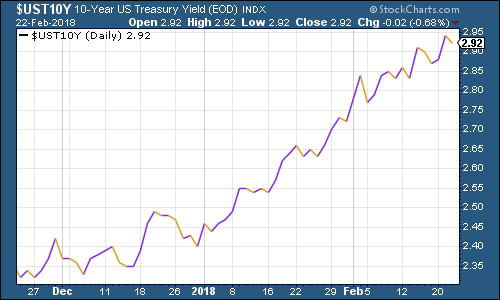

Interestingly however, the yield on the ten-year US Treasury bond was little moved. You'd think that a relaxing of inflation fears might see the yield fall again, but there's also supply to think about - the markets may be concerned about rising US debt, arising from Donald Trump's tax cuts.

(Ten-year US Treasury: three months)

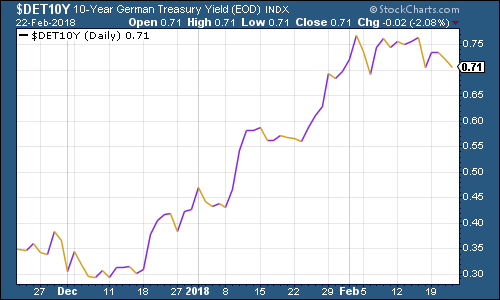

As for the yield on the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate it ticked lower, which means that the "spread" (the gap) between US yields and German yields is rising.

(Ten-year bund yield: three months)

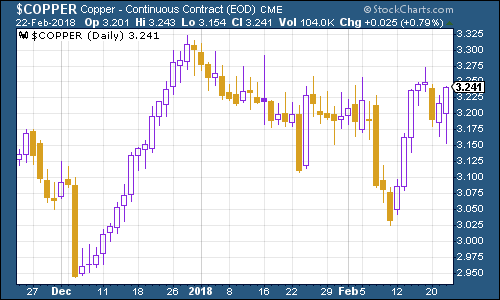

Copper consolidated last week's gains. The stronger dollar would typically be bad for copper but at the same time, investors seem to be growing bullish on raw materials again.

(Copper: three months)

Bitcoin, the king of cryptocurrencies, marched itself up the hill towards the end of the week, and then began to march right down again.

(Bitcoin: ten days)

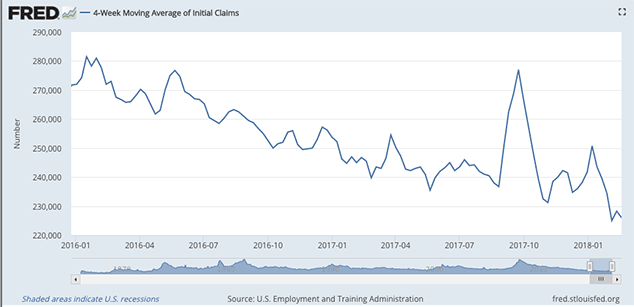

As for US employment the four-week moving average of weekly US jobless claims, rose to 226,000 this week, while weekly claims came in at 222,000. Claims have now been below the 300,000 level associated with a strong labour market, for the longest period since 1970.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. We hit a fresh cyclical trough two weeks ago, and another could be on the cards if the numbers continue to come in strong.

(Four-week moving average of US jobless claims: since start of 2016)

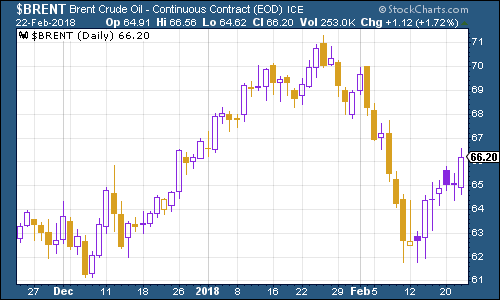

The oil price (as measured by Brent crude, the international/European benchmark) rose strongly this week, despite the headwind from the US dollar.

(Brent crude oil: three months)

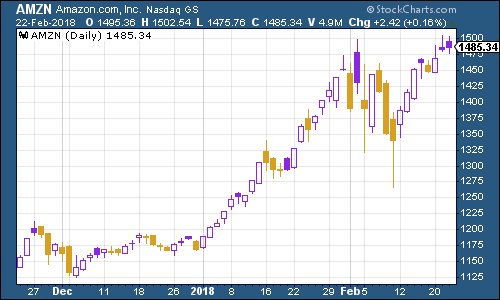

Meanwhile internet giant Amazon briefly managed to top the $1,500 a share mark this week for the first time. That was partly because Walmart - arguably its main rival - came out with disappointing figures for its own internet business, which investors had grown somewhat over-excited about.

(Amazon: three months)

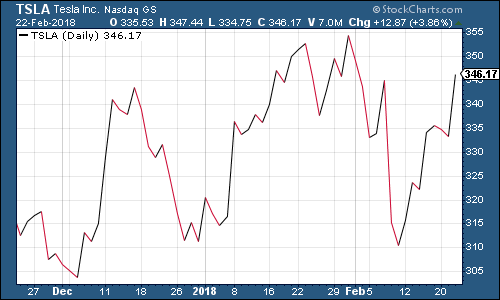

Meanwhile Tesla continued to make gains after reporting that it is expanding its charging network in China. It really is a company where investors only seem to hear the good news. But it's a fascinating one to watch.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how