Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We try to use [this newsletter] as a platform for our general thinking and offer insights. One thing that holds true is that compared to most portfolio managers, we do things differently. The reason for this is very simple and is embodied in the following statement: "At different times, for different reasons, different asset classes behave differently". Any investment process that relies predominantly on one particular asset class such as equities might, for a long time do very well but then eventually, unless the investor makes big changes to his portfolio, suffers a period of disastrous returns.

We believe the most recent bull market for equities started in 1975 and ended in the year 2000 25 years of year-on-year returns that required no imagination, no thought process, just adherence to the simple principle that equities always do best in the long run! Except, and this is the snag, they don't.

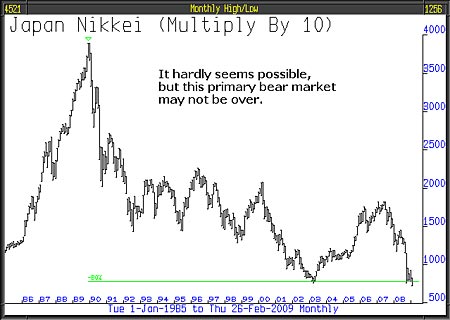

The current abiding example of this delusionary thought process is the Japanese stock market. In 1990, the Japanese stock market was, by capitalisation, the biggest stock market in the world. You can see from the chart that from that lofty perch it progressively declined and, horror upon horror, since the last issue of this newsletter, has made a new post-1990 low. [Since the time of writing, it has fallen lower still]

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Some say, and we don't disagree, that there is much to compare to Japan since 1990 to what's been going on now. The real worry here is that it is quite possible that our stock markets in 2019 will be at new lows following their highs in 2000 and 2007. On asking oneself the question "Is that possible, are the conditions today extraordinary enough to deliver such an outcome?" the answer has to be "Maybe, Yes" - the natural forces at work could deliver such a terrible outcome. In which case, to get up each day hoping the bottom of the stock market has occurred and existing loss-making equity investments will get better, might be the equivalent of financial suicide.

The CRB indexand the Japanese stock market, both finding new lows this year, deliver a stark warning.

It is the worst of all depressions, at its foundation is the banking collapse. In October last year it created such a serious condition that there was a genuine likelihood of major banks failing. At the time, there was a run on banks, people were panicking and electronically withdrawing money. However, and this we found very interesting, on Wednesday 25th February, the Daily Telegraph, on the front page, not in the business section, reported that, in January, UK savers withdrew £2.3bn from UK banks, the largest withdrawal since the British Bankers Association records began in 1997. The reason given was the poor returns, but we think there may also have been a genuine concern about the safety of their money.

Importantly, this gives evidence that the run on banks continues and the problems the government has of ensuring that banks are suitably capitalised will become more onerous as the amount of new capital required by banks will increase in proportion to the scale by which depositors funds are withdrawn.

Further cuts in interest rates are not going to help matters one little bit. Optimism that governments can underpin banks sufficiently to set them on a path of lending is unfounded. The propositions they are being offered are, in the main, poor in quality from both the point of view of financial information and the value of the security offered. We would say again that natural forces are at work that mere governments have no power to deflect.

This article was written by Full Circle Asset Management,as published in the threesixty Newsletter on 27 February 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how