The charts that matter: everybody still hates the UK

Investors around the globe are shunning UK stocks. John Stepek examines why, and looks at what's going on with the global economy's most important indicators.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: What investors can learn from Carillion's collapse

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: What the weakening US dollar means for markets

Wednesday: The bitcoin crash as it happened

Thursday: Why the oil price rebound could be the catalyst for a stockmarket crash

Friday: Does it matter if the US government shuts down?

And don't forget to listen to the podcast you can hear Merryn and I mulling over the events of the week here.

Turning to this week one sentiment indicator I like to keep an eye on is Bank of America Merrill Lynch's fund manager survey. The investment bank asks fund managers where they're putting their money each month, and it can give you a good idea of how money managers are feeling.

That matters, because they're the ones who control the money flows (or at least a good chunk of them). And in the short term that's what drives markets is money flowing into them, or out of them?

So does anything stand out from the January survey? There are no absolute screaming buy or sell indicators in this one, I have to say, but it's worth taking a quick look to gauge the temperature, which is definitely heating up fast.

Investors as you'd expect, given where markets are now are getting pretty cocky. Last month they reckoned (on average) that the equity bull market would only last until the second quarter of this year. Now they're betting it'll last all year. That does show that the bull market mentality is getting more widespread, as people find it harder and harder to imagine how it could end.

They're also increasingly fully invested cash levels have fallen from 4.7% to 4.4%, a five-year low, while the proportion of money invested in equities has risen to a two-year high (and a 12-year high for hedge fund investors). That's not especially striking but it does show the direction of travel.

Investors also have little interest in insuring themselves against any imminent fall in markets (by investing in options, say) those who admit to protecting themselves is at its lowest level since 2013 and they are more confident of corporate earnings rising than they have been since 2011.

In short, there's a lot of bullishness around.

At the same time, they're not blind. In fact, they're very self aware. Professional investors are worried about volatility picking up "short volatility" is deemed the most crowded trade (followed by long FAANG [Facebook, Amazon, Apple, Netflix and Google] stocks and bitcoin). Going "short volatility" of course, describes exactly what most of them are doing, by neglecting to insure their gains, for example.

Meanwhile, inflation is seen as the biggest tail risk, and managers hate bonds. This dislike of bonds is spreading to "bond proxies" stocks that are generally higher yielding and cashflow generating. So utilities and telecoms stocks have suffered.

So the concern that inflation is coming back and that bonds are overpriced is clearly pretty mainstream right now. It'll be interesting to see whether there's another brief deflation scare to derail everyone's assumptions.

However, what I think is the more likely message here, is that equity investors are currently quite comfortable with the idea that bonds are bad and inflation will rise, but be contained. But they're not quite thinking ahead to what might happen if inflation really gets out of control. They still believe that the biggest mistake the US Federal Reserve can make would be to raise rates too soon rather than too late, which I suspect is a bigger risk.

Oh and one more interesting thing they still really hate the UK. Fund managers around the globe are more underweight the UK than at any point since 2001. Food for thought perhaps there's scope for a catch-up trade, although the UK is hardly cheap in absolute terms.

Let's move onto the charts now.

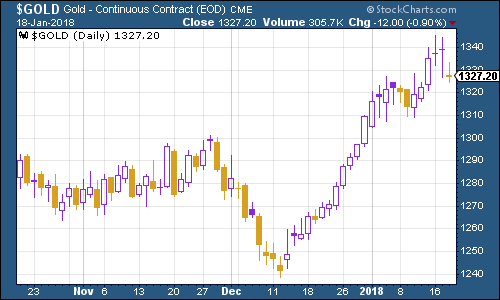

Gold has paused for breath this week after the dollar's big move last week, but it's still holding the line. General concerns about inflation combined with the risk of a US government shutdown are the sorts of things that gold tends to thrive on.

(Gold: three months)

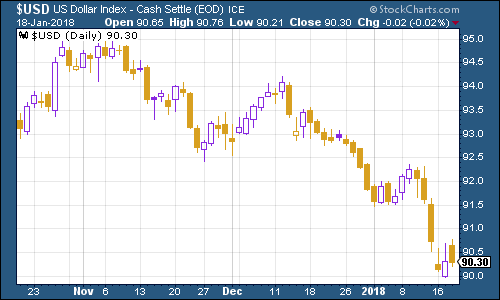

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell sharply but rallied somewhat as evidence grew that some in the eurozone aren't happy about the single currency's recent rally (the euro comprises the biggest chunk of the dollar index measurement). It remains close to three-year lows however.

(DXY: three months)

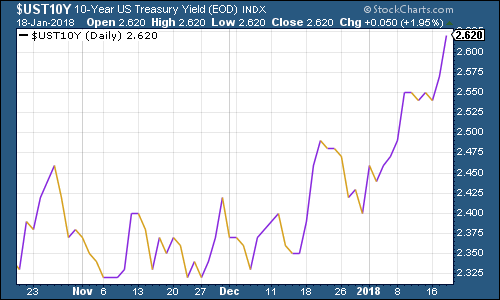

The yield on ten-year US Treasury bonds managed to claw its way above 2.63% on Friday morning. That means that it's now passed the points where both Jeff Gundlach and Bill Gross, two of the highest-profile bond investors, reckon the bond bear market has begun. In fact, it reached its highest level since September 2014.

Does that mean it's all downhill from here? Nope, these things never move in a straight line. But it's another sign that in all likelihood, summer 2016 marked the very bottom for this bull market.

(Ten-year US Treasury: three months)

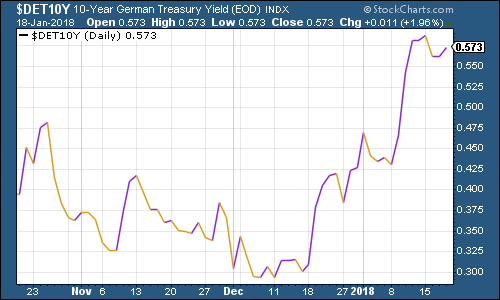

How about the ten-year German Bund? This the borrowing cost of Germany's government essentially represents Europe's "risk-free" rate. As you can see, it's also a lot lower than the US equivalent (there's a large "spread" or gap between them). It fell a touch this week after last week's rapid run up.

(Ten-year bund yield: three months)

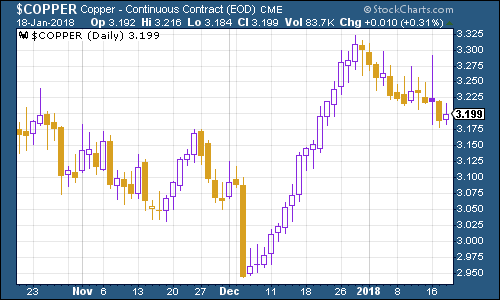

Copper fell again this week, which is interesting given that everyone reckons China is growing much more strongly again. It may just be correcting after the rapid run-up at the end of 2017, but it's one to keep an eye on.

(Copper: three months)

Bitcoin has had a tough year so far, but this week was probably the biggest test for the buy and "HODL" bitcoin brigade. The cryptocurrency plunged this week. For a flavour of the fear, check out my colleague Dominic's mid-week Money Morning. However, it's clearly still got people willing to buy back in it rebounded sharply.

I'm not looking for an opportunity to buy in, I have to say. But it's clear from the defensive comments under Dominic's piece that the crypto-space has yet to shake out all of its most ardent backers.

(Bitcoin: ten days)

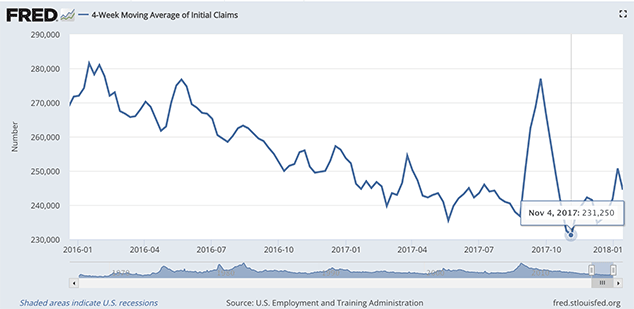

As for US employment the indicator we like to keep an eye on is the four-week moving average of weekly US jobless claims, which fell back to 244,500 this week, while weekly claims fell to 220,000, their lowest level since 1973.

As I've said for the last few weeks, this is a volatile period and I wouldn't read too much into either this low or the recent higher-than-expected readings. In any case, according to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

But as the chart below shows, the most recent cyclical trough was in November, at 231,250. So we could still be some way from the peak. And if they stay at current levels then we may hit a new low before too long.

(Four-week moving average of US jobless claims: since start of 2016)

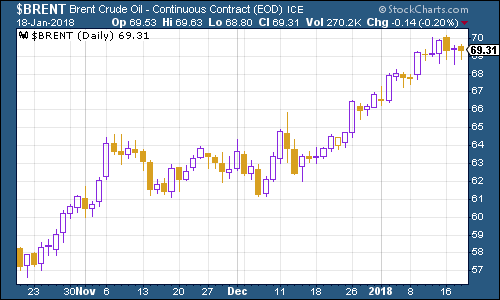

The oil price (as measured by Brent crude, the international/European benchmark) came off a bit this week, having breached the $70 mark last week.

(Brent crude oil: three months)

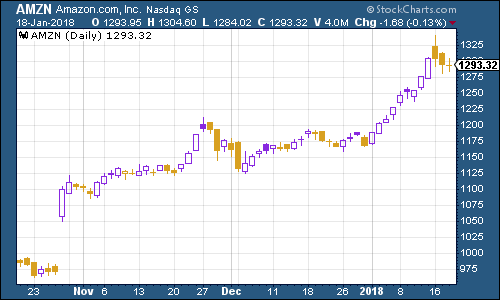

Internet giant Amazon continued on its merry way higher this week. According to various excitable analysts, it's one of the best ways to play the market "melt-up" and now one of them has whacked a $1,500 price target on it.

(Amazon: three months)

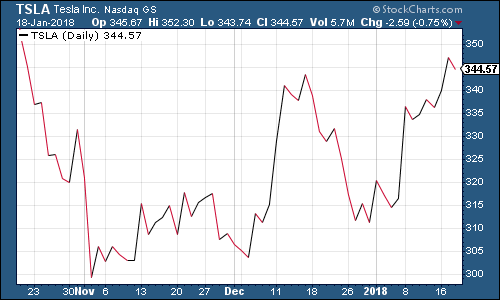

And Tesla is also continuing to enjoy a rebound. Perhaps I'm wrong to be so sceptical on Tesla. In this week's issue of MoneyWeek magazine, Merryn interviewed James Anderson of the Scottish Mortgage Trust. It's been a fantastic performer, partly because of Anderson's holding in Tesla. I'm not saying I fancy buying the electric car manufacturer and cash incinerator, but it's well worth reading the piece just to get a less grumpy view of the world than I'll normally give you.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how