Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

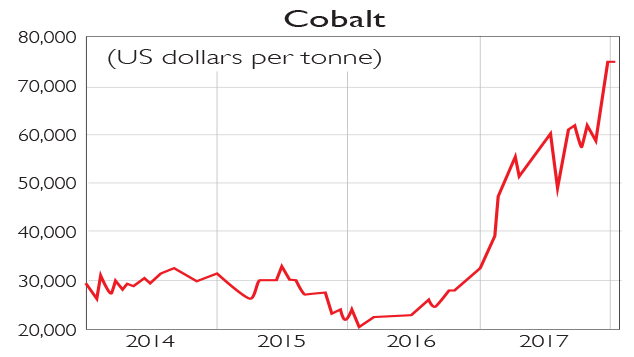

Cobalt left other industrial metals "in the dust" in 2017, says Mark Burton on Bloomberg. Prices jumped from $30,000 a tonne to $75,000; they have tripled in two years. The surge is due mainly to the electric-car boom, as cobalt is a key ingredient in the batteries required to power them.

It may be a bit late for investors to jump on this bandwagon, however. Demand continues to soar, with orders in China up 51% year-on-year in the first 11 months of 2017. But new supply is finally coming on stream now that Glencore and Eurasian Resources are boosting production. Prices look set to "level out" in 2018.

Viewpoint

"Behavioural economists chalked up a small victory this week. MPs recommended a so-called latte levy of 25p on non-recyclable disposable coffee cups after discovering the power of loss aversion. Consumers are far more likely to change their behaviour and bring their own cup...to the coffee shop when confronted with a 25p surcharge than when offered a 25p discount. Irrationally, consumers get more satisfaction from not losing a pound than from gaining a pound. A tax, therefore, is likely to be highly effective It's one of the reasons that the plastic-bag tax has been so successful in slashing demand for carrier bags."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Patrick Hosking, The Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how