Bitcoin: a mania that can only end in disaster

Bitcoin is a classic bubble and it’s about to pop, says financial historian Edward Chancellor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bitcoin is a classic bubble and it's about to pop,says financial historian Edward Chancellor.

Bubbles aren't just about the madness of crowds, or excess liquidity and leverage. Every major bubble involves a premonition of the future. The trouble is that they turn out to be deeply flawed premonitions. The acting head of New Zealand's central bank, Grant Spencer, is right to say that bitcoin resembles a "classic" bubble.

First, there's the exponential price explosion the South Sea Company stock soared ten-fold in 1720; bitcoin soared 20-fold this year. Great bubbles draw speculators from far and wide. At the high point of France's Mississippi Bubble, also of 1720, up to half a million foreigners are said to have flocked to Paris. Coinbase, which provides bitcoin wallets, now boasts 12 million accounts a threefold increase in a year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

All great bubbles form during periods of easy money, with interest rates low or falling and liquidity super-abundant. The Dutch tulip mania of the 1630s came amid vast capital inflows, falling interest rates and money printing by Amsterdam's Wisselbank, Europe's first central bank. At the start of 2017, the world's largest central banks were expanding their balance sheets as never before. Some $11trn-worth of bonds globally currently offer negative yields. The US stockmarket is more expensive than at any time save for the dotcom peak in early 2000. This leaves savers with an uncomfortable dilemma: speculate or starve.

A perfect vehicle for speculation

The supreme object of speculation is one which generates no yield and is thus impossible to value think tulip bulbs, gold in the late 1970s, or contemporary art in recent years. Bitcoin produces no income; new supply is restricted; and ownership is relatively concentrated (some 95% of outstanding coins are held in just 4% of accounts), providing a very small free float. It may be the ideal speculative asset. Throw in leverage, open a futures market, and there's no limit to bitcoin's potential upside.

The word "speculator" derives from the Latin for a "look out". The financial variety looks out into the future, and backs this vision with money. Great bubbles are often uncannily accurate premonitions of the future. Tulip mania anticipated the evolution of Holland's flower industry. Britain's railway mania of the 1840s reflected the potential of the new transportation technology. The dotcom bubble foresaw how the internet would change our lives.John Law's Mississippi Bubble looks most relevant to what is going on today in cryptocurrencies.

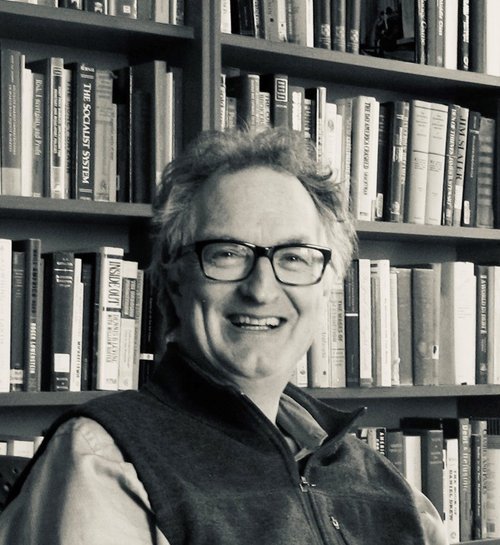

Law (pictured above) believed that money needn't be backed by any commodity. He established a bank, the Banque Gnrale, which issued paper currency and demonetised gold. Law used these bank notes to support the share price of his Mississippi Company and to cut the rate of interest the world's first quantitative-easing experiment.

His vision was prescient. We now live in his world of paper credit and central-bank money. But it was also deeply flawed. Law tried to achieve, in just a few years, what would in fact take two and a half centuries to accomplish only in 1971 was the link between currencies and gold finally severed, with the collapse of the Bretton Woods currency accord.

By contrast, confidence in what Law called his "system" soon collapsed and Mississippi's share price fell by 90%. Law, who once boasted of being the world's richest man, died in penury in Venice. Speculators in all the other great manias have also learned that, in investment, to be early is to be wrong.

Bitcoin is not the future

Cryptocurrencies aim to cure today's monetary problems a lack of confidence in central-bank money with a new technology, the "distributed ledger" or blockchain. Bitcoin believers say this will "change the world". Perhaps they will be correct in the very long run. But if that time comes, bitcoin won't be a contender. Transactions are too expensive, energy intensive and can take days to settle. Reports suggest that the verification process has become centralised in the hands of an unregulated cartel of Chinese miners. Amazon won't take payment in bitcoin. The US government won't accept it as payment of taxes. Bitcoin, for practical purposes, is going nowhere, except in the markets where it's been heading vertically upwards.

Super-parabolic price movements often contain their own premonition that the end is nigh for the mania. When the tulip boom ended, the price of Gouda bulbs fell from 60 guilders to 10 cents, a drop of 99.9%. Bitcoin has soared higher and has less intrinsic value. A similar decline is possible.

A version of this article was first published on Breakingviews. Edward Chancellor is a financial historian, journalist and investment strategist.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Edward specialises in business and finance and he regularly contributes to the MoneyWeek regarding the global economy during the pre, during and post-pandemic, plus he reports on the global stock market on occasion.

Edward has written for many reputable publications such as The New York Times, Financial Times, The Wall Street Journal, Yahoo, The Spectator and he is currently a columnist for Reuters Breakingviews. He is also a financial historian and investment strategist with a first-class honours degree from Trinity College, Cambridge.

Edward received a George Polk Award in 2008 for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine. He is also a book writer, his latest book being The Price of Time, which was longlisted for the FT 2022 Business Book of the Year.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how