Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

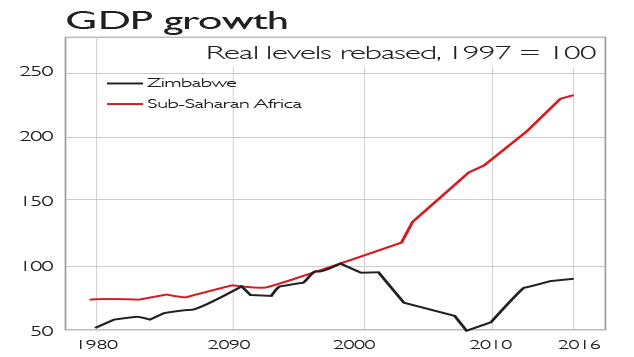

Robert Mugabe is reportedly about to receive a $10m payoff as a reward for ruining his country. In 1980, Zimbabwe was among the top ten sub-Saharan African economies. It was relatively diversified and its healthy agricultural sector made it the bread-basket of southern Africa. Between 2000 and 2008, however, thanks to farm seizures, rampant corruption, hyperinflation and rapid emigration, GDP halved. A gradual recovery over the past ten years has barely returned the economy to late-1990s levels. Inflation-adjusted per-capita incomes are still 15% below the 1980 figure.

Viewpoint

"Productivity is a measurement of output per employee hour, and in this France leaves the UK trailing. This is probably an effect of France's employment laws: it is much more expensive there than here for firms both to take on and to fire employees, so its businesses invest more in machinery that replaces workers. Yet, also at least in part because of its labour laws, France has a significantly higher percentage of unemployed than the UK. And as by definition they don't work, they are not part of the productivity statistics. [This means that] France, in its output per person of working age, is probably not ahead of the UK at all."

Dominic Lawson, The Sunday Times

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?