The charts that matter: US jobless claims hits a new low

It’s been an eventful week in central bank land, says John Stepek. Here, he looks at how this week’s events have affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's been an eventful week in central bank land. Next week, we'll take a look in more detail at what the Bank of England's first rate rise in more than ten years means for us all. But for now, let's look back at how this week's events have affected our charts that matter.

Also, if you missed any of this week's Money Mornings, here are the links to catch-up.

Monday: What Spain's constitutional crisis means for your money

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Want to know where stocks will go next? Keep a close eye on Japan

Wednesday: History is a useful guide for investors but which period are we in today?

Thursday: It's Super Thursday: get ready for the first British interest-rate rise in ten years

Friday: How the tulip mania of 1636 became the mother of all bubbles

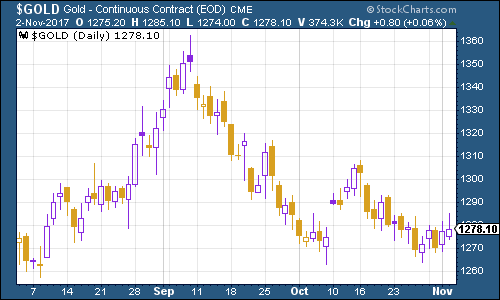

Gold rallied somewhat after a few tough weeks. The US Federal Reserve didn't spring any surprises at its meeting on Wednesday it's steady as she goes for a December rate rise. I'm writing this before the non-farm payrolls data came out on Friday afternoon, so any major surprises on that front could move the dollar quite aggressively, which in turn would have an obvious impact on gold. But for now, gold has enjoyed some relief.

(Gold: three months)

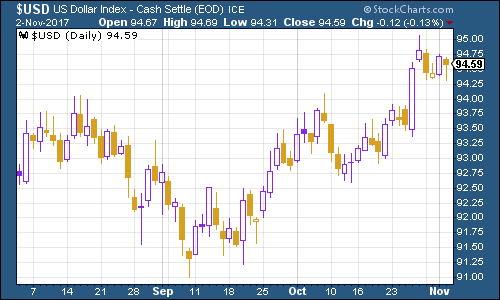

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was little changed this week after last week's sharp spike higher.

(DXY: three months)

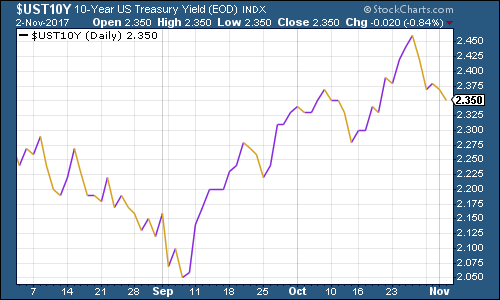

Another chart that got everyone excited last week came back down a little this week. The yield on ten-year US Treasury bonds dipped back below the 2.4% mark that's now seen as a major line in the sand by many analysts. The bond bull market remains intact for now.

(Ten-year US Treasury: three months)

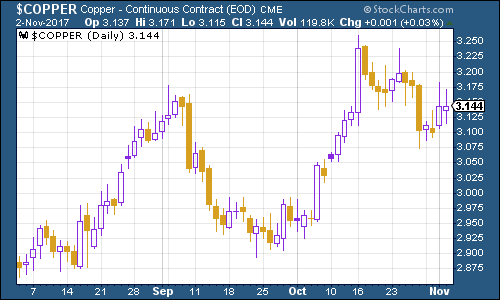

Copper had another mixed-to-lower week, although it's still holding on above $3 a lb.

(Copper: three months)

Bitcoin has had another stonking week getting to the $7,000 a coin mark now. Can anything break this extraordinary run?

(Bitcoin: six months)

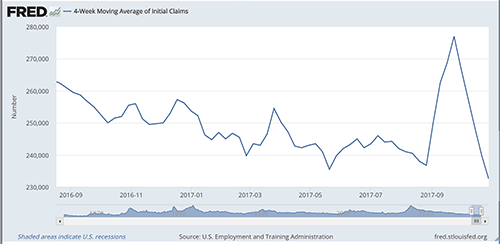

This week, weekly US jobless claims remained low. The four-week moving average slipped back to 232,500 as claims came in at 229,000. According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

Well, as the chart below shows, 232,500 is a new cyclical trough (the previous one was on May 20th). So perhaps the stock market "melt-up" can continue for a while longer.

(Four-week moving average, US jobless claims, since 2014)

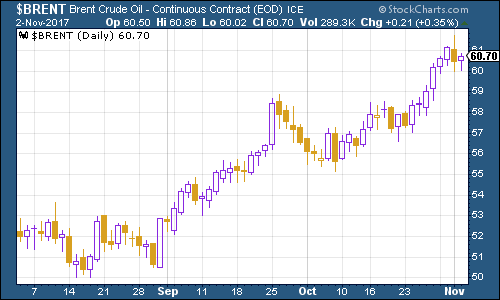

The oil price (as measured by Brent crude, the international/European benchmark) continued to rally this week. It's burst through the $60 a barrel level, the slightly arbitrary price at which most investors expect shale oil production to prove very attractive. But at this rate, we might be heading closer to $70 more quickly than most in the market had expected.

(Brent crude oil: three months)

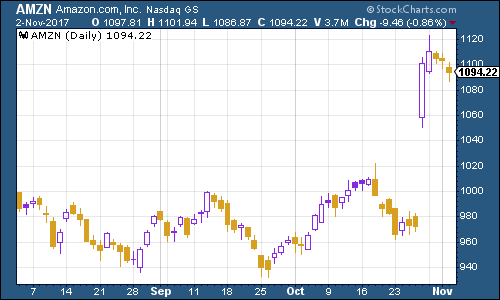

Finally, internet giant Amazon continued higher this week after the tech companies in general posted results that trounced expectations. Politics may not be in their favour right now, but for the moment at least, the figures are certainly impressive.

(Amazon: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how