The charts that matter – is it turnaround time for the dollar?

The US Federal Reserve’s slightly more aggressive than expected stance gave the dollar a fillip. John Stepek wonders if it’s time for a turnaround.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's been another potentially significant week for most of our charts that matter'. Gold took a bit of a knock again this week as the US Federal Reserve's decision came out as being a little more hawkish than anyone had expected.

On the face of it, the Fed didn't do anything particularly surprising. The market had expected the Fed to announce balance sheet "normalisation" in October. But it was a tiny bit more punchy than that there's still a feeling among those on the Fed's rate-setting committee that it'll raise interest rates at least once more this year.

The market tends to lean towards expecting the Fed to surprise on the dovish side rather than the hawkish side, So that made for a stronger dollar.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

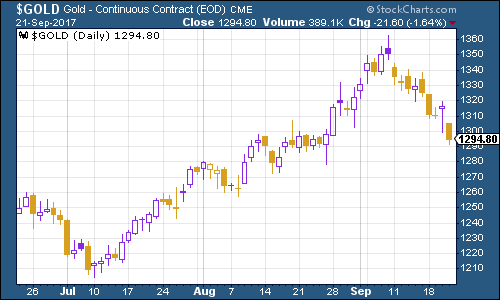

Gold

As a result, gold's fallen down through the $1,300 an ounce mark again.

(Gold: three months)

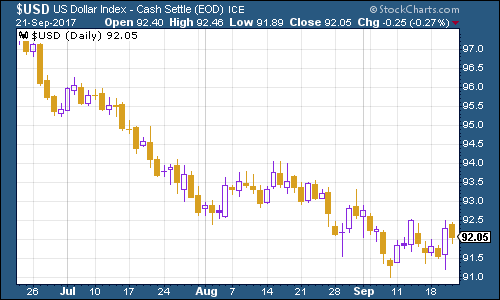

US dollar

Meanwhile, the US dollar index has perked up significantly. Is this a turning point for the dollar? It's one of the most important prices in the world, but if it does start to rise significantly, then the already-expensive US stockmarket could be in trouble (S&P 500 companies make a lot of their earnings around the globe when the dollar goes up, their products become a little harder to sell and earnings fall under pressure).

This is vital to watch a blip higher is one thing (the dollar has fallen a lot) but if this is a genuine long-term shift higher, then it could make a big difference to markets across the world.

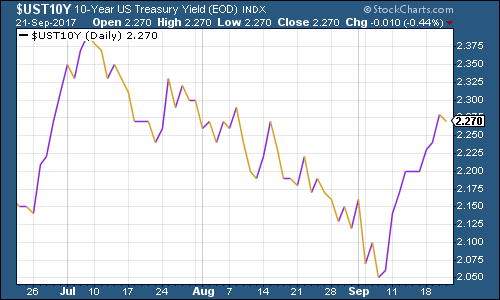

US Treasuries

As investors started to re-evaluate the chances of rates rising again, ten-year US Treasury bond yields perked up a little.

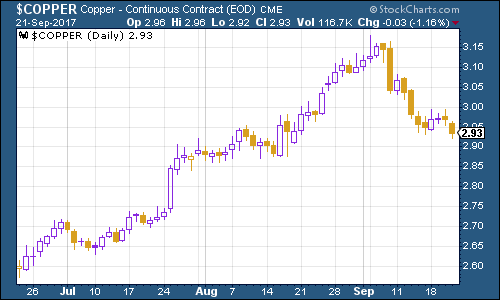

Copper

Copper is still on a breather. It's fallen harder than I expected and it's interesting to note that it hasn't taken a lot to get the market extremely bearish on it again. To me that's a good contrarian sign that the market psychology remains sceptical of the inflation story, which in turn means it's the one thing that we really should be watching out for.

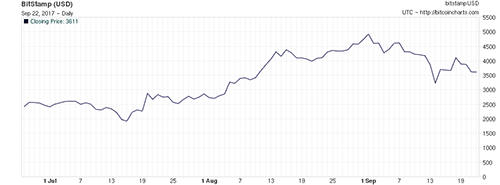

Bitcoin

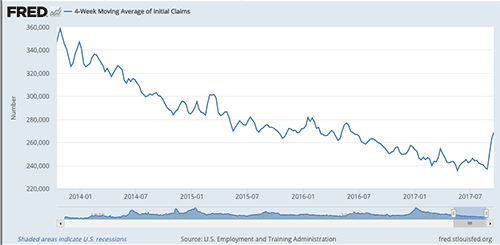

US jobless claims

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stock market peak is not far behind (on average 14 weeks), and a recession follows about a year later. If 20 May holds as the cyclical trough, then if Rosenberg is right (and to be fair, it's a small data set) we might already have seen the stockmarket peak, but I'd withhold judgement for now.

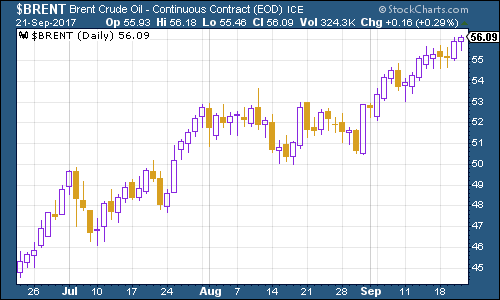

Oil price

(Brent crude oil: three months)

Chart number seven is the oil price (as measured by Brent crude, the international/European benchmark). Oil has headed higher again this week, partly due to hurricane disruption and partly as a side effect of the falling dollar. What's interesting to me here is that oil has just steadily crept higher and it's fair to say that no one is paying a lot of attention to it.

My colleague Dominic wrote about this phenomenon in Money Morning earlier this week and I have to say that while I have no strong desire to invest in oil right now, the charts do seem to be going oil's way.

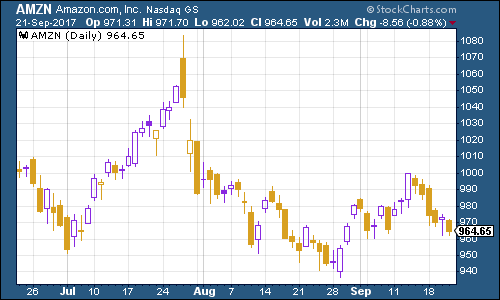

Amazon

(Amazon: three months)

Finally there's Amazon. As the wider US markets remain close to record highs, Amazon remained well off its August high. The political attitude towards the big tech stocks is starting to sour (as my colleague Merryn discusses in this week's MoneyWeek magazine) and this showed up in Amazon's share price this week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King