The brutal global stockmarket crash that hit Britain hardest

In the latest of his series on stockmarket crashes, John Stepek looks at probably the worst in living memory: the crash of 1973/74.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This week, in our series on stockmarket crashes, we're looking at one of the biggies.

From a UK markets point of view, this one was far worse than 1987, 2000, or 2008. In fact, it's probably the worst crash still within the adult memory of a significant part of the population.

Some of you reading this may even have actively invested through it (in which case please do share your war stories in the comments or email them to me direct at john_stepek@dennis.co.uk I bet there are some crackers out there).

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We're talking about the crash of 1973/74...

Yet another good reason to be glad the 1970s is over

My colleague Merryn Somerset Webb has been talking a lot recently about how Britain is in danger of being dragged back to the 1970s.

I won't comment on the music or the fashion. Whether you'd like to return to that or not, depends on whether that was your heyday, I suspect. But in terms of investment and economic conditions, I'm not sure any of us would want to end up back there. (At least, not unless we were armed with a stockmarket almanac and the history of the football results.)

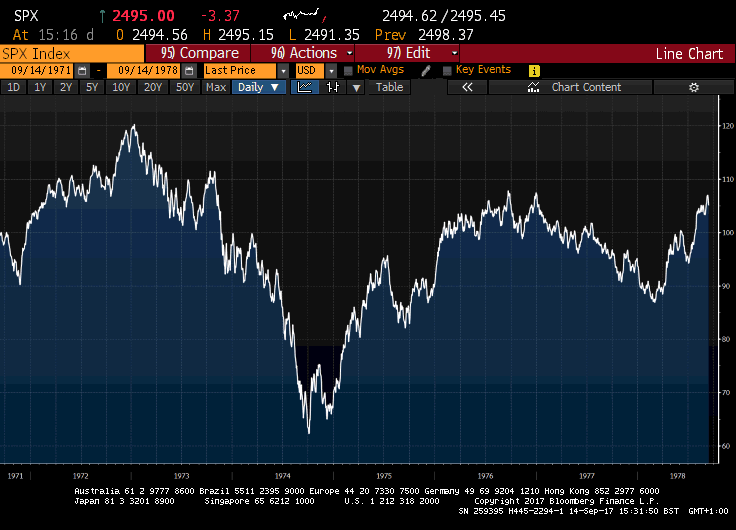

The 1973/74 bear market was brutal. It was a global crash. Everyone took a hit. For example, from its peak on 5 January, 1973, to its bottom on 3 October, 1974, that's a 48% slide in the S&P 500 you're looking at in the chart below.

(Source: Bloomberg)

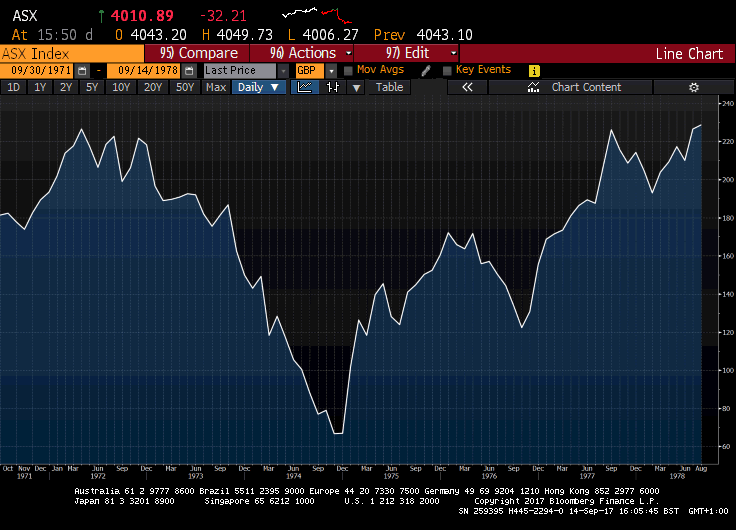

But today we're going to focus on the UK. Because it was even worse for us. The London Stock Exchange's FT 30 market shed an eye-watering 73% from peak (in April 1972) to trough (December 1974), as the chart below shows.

(Source: Bloomberg)

So what happened? Why did everything go so horribly wrong, is there much to learn from it, and could it happen again?

The early 1970s gave us a fair few things to worry about

First a bit of context. This is going to be a very cursory look at the period, but here are just a few of the things that happened on a global scale in the early 1970s.

Firstly, and probably most importantly, the US came off the gold standard and killed off the Bretton Woods regime that had governed currency values in the post-world War II era in the process.

In August 1971, president Richard Nixon severed the link between the dollar and gold, and by March 1973, the dollar was free floating. That was pretty traumatic (a radical change in the world's currency regime) and it was inflationary.

Then, on top of that, later in 1973, we had the oil shock as oil cartel Opec embargoed countries that backed Israel in the Yom Kippur War. By Christmas that year, oil prices had tripled. And then you had Watergate and Nixon resigning in mid-1974.

So, in general, we were embarking on a very inflationary period after a time in which we'd grown used to relative price stability (in 1959/1960 Britain even had a brief, and perfectly harmless, flirtation with deflation). And it was also a time of lots of political instability (inflation and political instability tend to go together, which bodes ill for today).

However, it's also worth remembering that this turmoil followed a long period of bullishness. When we talk about crashes, we tend to focus on the carnage it's the scary bit. But one ingredient is vital to every bust a preceding boom.

The political and economic establishment prefers to treat the boom phase as "normal", and the result of clever policy making. The bust phase is then viewed as a strange aberration to be rectified by any means possible. This attitude, of course, just exacerbates the whole cycle.

So, for example, in the US, we'd had the "Nifty Fifty" boom, where high-quality stocks were regarded as the only things you'd need to buy and hold forever.

Meanwhile, as late as January 1973, US financial newspaper Barron's conducted its annual roundtable discussion. No one was worried about anything. The headline that resulted? "Not a Bear Among Them".

Oops. The market shed 10% by the end of the month. (Good old magazine indicator it's not as reliable as I'd like, but when it hits the mark, it really hits the mark).

The Achilles heel of the British economy bricks and mortar

Looking more specifically at the UK, a property boom (quelle surprise!) was partly behind the scale of our own bust.

A report by property consultants JLL argues that, by the late 1960s, building regulations and fiscal policies had "stifled the supply of new office buildings" in London. As London grew more important, a demand imbalance built up and prices for office space started to rise from around 1968 onwards.

In 1970, the Conservative government (under Edward Heath) was elected and while it relaxed building regulations on the one hand (encouraging added supply), it poured fuel on the demand fire by relaxing lending policies, making interest payments above £35 tax deductible for individuals, and embarking on a big public spending push.

Meanwhile, financial deregulation (instituted by Labour in 1964) had created a tier of "secondary" banks that were more lightly regulated than the big banks. These ended up being the Northern Rocks of their day, as we'll get to in just a moment.

Britain being Britain, notes JLL, "the easy credit policy stimulated bank lending that flowed disproportionately to the property sector". According to Duncan Needham, writing on The Property Chronicle blog, "lending to the property sector increased more than eight-fold from 1970 to 1974 residential prices doubled and commercial prices trebled".

What popped the bubble? Inflation and the political reaction to it. In those days, controlling inflation wasn't just about hiking interest rates (although that happened too). The government thought that the best way to control inflation was to control prices of labour, of rents, of just about everything. (This happened in the US too, by the way it's easy to forget that our blyth view in the West that price controls are delusional is a very, very recent phenomenon and one that remains worryingly easy to reverse, I suspect.)

Business rents were frozen in late 1972, at roughly the same time as the Bank of England was getting increasingly strident in its warnings to banks to curb their property market lending.

So credit was getting more expensive, and rent controls made investing in commercial property less attractive. There was only one way for prices to go. And of course, when that happened, all of those little Northern Rocks blew up.

As JLL puts it: "due to overlending to the property market and excessive gearing, the property market crash and ensuing loan defaults created a significant banking crisis".

The Bank of England launched "the lifeboat operation", whereby it teamed up with the big banks in London to bail out the banking system. Distressed assets were taken over rather than forcing fire sales. It was all very quietly done, apparently a column by Richard Lambert in the Financial Times from December 2008 noted that, unlike the 2008 crisis, the 1973 one wasn't played out in public, with no panicked crowds in the streets.

But clearly, it was yet another factor in the overall stockmarket crash of the period.

We've only scratched the surface of this crash

I could write (and almost certainly will write) a lot more about 1973/74. There's so much to unpack. Yes stocks did badly. But bonds did a lot worse. And really, the whole impact of the unwinding of Bretton Woods is something that we're still feeling the after-effects of today.

But I think that if you want to take one lesson away from the 1970s, it's just how damaging out-of-control inflation is to both the economy and the social fabric. And the risk is that government efforts to rectify all of those things just make them a lot worse.

The other point about the 1970s is that the stockmarket crash was really just a symptom. People remember 1987 clearly, or talk about the crash of 1929 (much as its actual role in the Great Depression is disputed), because they stand out.

But not many people talk about the crash of 74, because to put it bluntly so many other awful things were going on at the time. As if to emphasise that, the bottom in 1974 wasn't really the end of the bear market era. As financial historian Russell Napier points out in his classic Anatomy of the Bear, December 1974 represented a decent buying opportunity. Indeed, from the bottom, the market rose by about 60%-odd in just a few weeks.

But the real "bear market bottom" and the biggest opportunity didn't come until August 1982, which was when inflation was finally conquered, and the long secular bear market that began in 1968 was finally over.

Put bluntly, if you're an investor, you don't want to go back to the 1970s. The question of course, is whether we'll be able to avoid it. If you haven't read Merryn's piece on why she's worried it could happen, take a look at it now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge