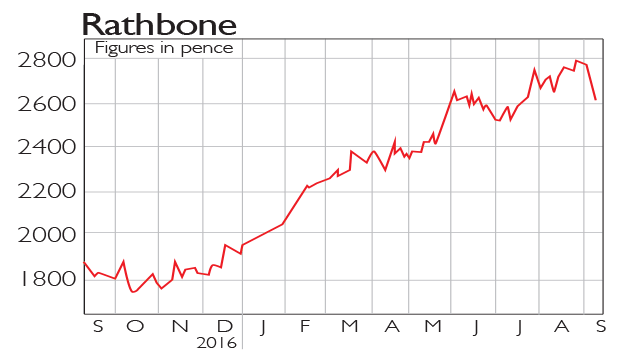

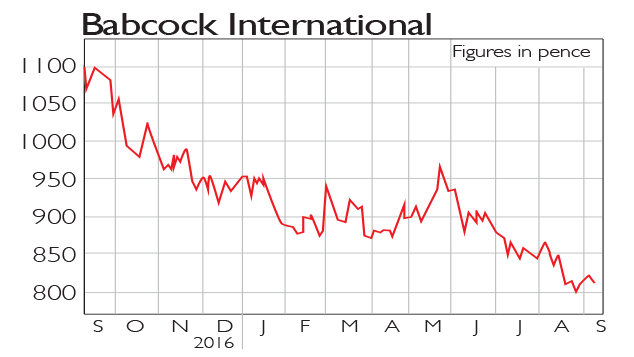

If you'd invested in: Rathbone Brothers and Babcock International

Wealth manager Rathbone is boosting its shareholders' wealth, while support services contractor Babcock has seen three years of unremitting share-price declines.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

Rathbone Brothers (LSE: RAT) is an independent provider of investment and wealth-management services for private investors and trustees. With £36.6bn of assets under management, the firm's shares rose amid its merger talks with industry rival Smith & Williamson. The new entity would have had assets under management of £56bn and around 3,000 staff, but the deal was called off last week.

Be glad you didn't

Babcock International (LSE: BAB) provides facilities management, training and support services to defence, rail transportation, marine and other public-sector organisations in Europe, Africa and North America. The firm has seen three years of unremitting share-price declines, and its stock now trades at just 10.5 times earnings. Earnings per share growth is also expected to slow to 3% in 2018, as Brexit is a big concern for its business.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

March Premium Bonds jackpot winners revealed – did you win £1 million?

March Premium Bonds jackpot winners revealed – did you win £1 million?Over two million historic Premium Bonds prizes are still waiting to be claimed, according to NS&I