My oil trade has done well – so should we pull out now?

A while ago, Dominic Frisby suggested oil would be the best trade of the next five years. Today, he checks back in to see how it’s doing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Keener readers out there will remember from March 2016 my trade of the lustrum.

A lustrum, by the way, is a five-year period not an unreasonable amount of time to hold an investment, I would suggest.

Today we check in on that trade. We're going to look at it no more, I hope.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This was a five-year plan and we're going to stick with the plan, no matter how tempting it gets to fiddle.

Our play on oil has nearly doubled

In March 2016, West Texas Intermediate (WTI) crude oil was $33 per barrel. Brent crude oil was $36. We felt it was cheap. It could get cheaper, of course. A fortnight before, WTI had touched $26. But in the context of our five-year investment plan we felt it was cheap.

It was also cheap relative to other assets. The gold/oil ratio, for example, was as low as it had been since the 1930s (in other words gold was expensive, oil was cheap). And relative to the S&P 500, oil had not been this cheap since 1998-99, which proved to be a historic buying opportunity.

We went in with our eyes wide open. We knew that it might not be the low; just that it was cheap. We knew that the oil price can be subject to all sorts of political games. We knew that what goes down (the oil price in this case) can stay down and go lower.

As a vehicle for oil, I don't like the exchange-traded funds (ETFs). They don't always track the oil price as closely as you might like (because of the complications in the rolling over of futures contracts). The same goes for BP and Shell, worthwhile investments though both may be (Shell is yielding a dividend close to 7%). Neither of the two giants track the oil price as closely as you might want.

So, as a vehicle we proposed, of all things, BHP Billiton (LSE: BLT), a company mostly known for producing metal. In fact, 20%-25% of its revenue and about a third of its profits come from oil and, for whatever reason, historically, it tracks the oil price extremely well. The price then was 700p.

Since that recommendation, WTI has gone from $33 to $52 to $39 to $55 to $42 to its current price of $46. Up and down the greasy pole of financial speculation, in other words.

BHP has gone from 700p to 1,500p and currently sits pretty at 1,345. We've almost doubled our money. Already it gets very tempting to fiddle. Perhaps we should we sell half and take our initial stake off the table? That would make us bullet-proof on the trade.

And what if oil sinks from here? I don't want to give my profits back.

At this point we get up from our desk and walk around the block. We pledged not to fiddle, so fiddle we shall not.

Oil at $46 is not the compelling buy it was at $33, but neither if we are taking a lustrum time horizon is it a compelling sell.

I admit: I look at the oil price and get the jitters a bit. Since March I can see a sequence of lower highs and lower lows. It's trending down.

I feel more confident about BHP, on the other hand, thanks to steadying metals prices. But again, I am thinking along the wrong lines. That way fiddling lies.

I repeat to myself that this is a five-year plan.

Though I am as mystified about the global economy as the next man, I do know that, despite any progress which may be being made in alternative technology, we live in a world still heavily dependent on oil.

I know about today's pledge to ban the sale of new diesel and petrol cars in the UK by 2040, but 2040 is a long way away and there is a lot that can happen between now and then. (I must say that pledge has alarm bells ringing for me we just don't know what the world will be like in 20 years' time.)

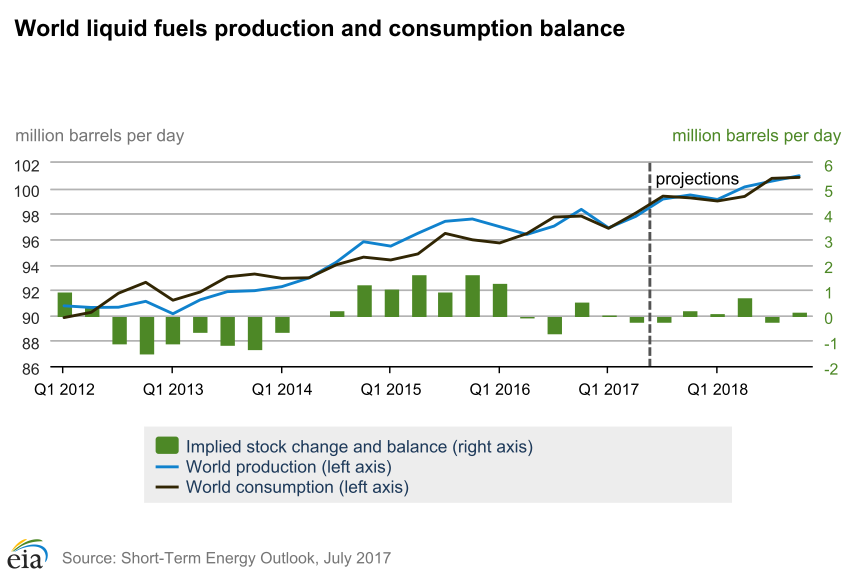

Nevertheless over the next five years, global oil demand is not going to disappear. In fact, according to the Energy Information Administration, it is going to increase, as the following chart shows.

Oil makes all sorts of wonderful things possible. There is, currently, no more effective source of energy. That may change. But we are not there yet.

My suspicion is that, rather than investing too much in oil exploration and production, we are not investing enough. But that's an argument for another column.

The benefit of just sitting

We're certainly due some inflation and that would be good for oil. Maybe the inflation that quantitative easing and low interest rates were supposed to induce (instead we got deflation) will come when the expected deflation of turning the monetary taps off doesn't actually materialise.

I don't know and, ultimately, it's pub talk.

BHP could easily trade in excess of 2,000p. It was 2,600p in 2011. It could go back below 1,000p. WTI could easily trade at $75 or $100 a barrel over the next three years (it could also go back to $30). I'm not saying that will happen. I'm not about to identify that supply-demand fundamentals or the market psychology that will take us there.

My point is that now is not the time to sell. We've got lucky with the trade. We see plenty of volatility ahead. I would rather not give back any of my profits, but the bottom line is that I see more room overhead, than I do down below.

Thus we watch, we take note, but we do nothing. We continue, as best we can, to enjoy the ride. And we do our best to think as little as possible. Thinking gets in the way.

In the spring of this year we recommended another trade of the lustrum, which was to sell gold and buy platinum. We'll give that one a while longer to percolate before we reconsider it, but we're conscious that it's a trade that hasn't really moved.

Two ways to look at it: one that it's stagnating (which it is) and so get out. The other is that the market has blessed us with more time to jump on board. I favour the latter. But more on that another time.

For now, to use the terminology of the broker, our oil trade of the lustrum is a hold.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.