How rising interest rates could be inflationary

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week it's been all about the market questioning exactly how serious central bankers are about raising interest rates.

This is the juggling act:on the one hand, you have central bankers trying to get the market used to the idea of higher rates, but without causing a panic. On the other, you haveactual economic data coming in and revealing that the economy is doing OK, but there's no real inflationary pressure comingthrough.

So markets remain sceptical enough not to rush headlong into a full-blown sell-off. And meanwhile, stocks are hitting new highs again. Thebuy-the-dip'mentality is alive and well, and until there's some sort of central bank move or economic data outlier that really shifts the view, that seemsunlikely to change.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In turn, that means our charts - which all had a bit of a lurch last week, as the idea of higher rates started to take hold - have changed little on this time last Friday.

Gold

Gold had another fragile week, but in all honesty, it could have been worse. The yellow metal was helped by "dovish" comments from Federal Reserve boss Janet Yellen (see below), and also by US inflation coming in pretty flat (thus negating one argument for rising interest rates), and so is now trading above the $1,220 per ounce mark (the chart below only updates to last night's close). My colleague Dominic will be writing about precious metals in more detail in Monday's Money Morning.

Meanwhile, Charlie Morris, one of the best gold analysts I know, wasn't upbeat in his latest Atlas Pulse newsletter. As Charlie points out, gold prefers"low real rates, or better still, falling real rates. The problem here is that while real rates are still low, they are now rising."(Real'rates are interest rates adjusted to take inflation into account).

However, he does note that there is apossiblescenario in which inflation takes off, which would be good news for gold."Imagine that credit conditions deteriorate as bonds decline. That would put pressure on the debt-fuelled US oil producers. Tighter credit conditions would reduce oil production, and if demand remained strong, oil could rise sharply. That's not my central view, but certainly one that deserves consideration."

It's an interesting line - the idea that inflation could surge, even as interest rates are rising. And it does make some sense. If you think about it, low interest rates have short-circuited the process of creative destruction.

That means they have fostered the misallocation of capital, and thus excess capacity. Excesscapacityis deflationary. If rising interest rates start to shut off excess capacity in general, then as Charlienotes, you'd get a situation where rising rates were inflationary.

It's definitely one to keep an eye on.Meanwhile, my own view on gold is that you should own some as a diversifier and as an insurance policy. Your precise holding will vary according to your other portfolio exposure and your own risk appetite, but I'd think that at least 5% makes sense.

Right now, everything else is going up, so I wouldn't expect gold to be going great guns. And if you're a short-term trader, it's hard to argue that you'd be long' gold just now - the charts don't look appealing enough (at least, not according to the chartists I pay attention to). But for the long run, if you own it, hold on to it.

US dollar index

The US dollar index was little changed on the week. The market is still trying to get to grips with the idea of central banks possibly raising interest rates at some point.

This week, Yellen reached out to pat investors on the head with the message that rates wouldn't rise too fast.She said that central bankers were looking at inflation closely, "but gave no further clues on the timing of the next rate rise or plans to reduce the central bank's balance sheet," reports the FT.

Ten-year US Treasury bonds

Again, not much change on this front as markets tried to figure out just how serious central banks are about raising rates - and also whether it would be a big mistake for them to do so.

Copper

Same goes forcopper, which was barely changed on the week. It's neither convinced that we're back off to the races, nor that the world is coming to an end.

Bitcoin

Source:https://bitcoincharts.com/charts/bitstampUSD#rg90ztgSzm1g10zm2g25zv

By contrast,bitcoin has been struggling in the last few weeks. This may be a case of some of the hype around crypto currencies wearing off, or it might be to do with the fact that there are more internal battles over how best to "scale" bitcoin, with a schism in the ranks of the believers apparently set to come to a head this August.

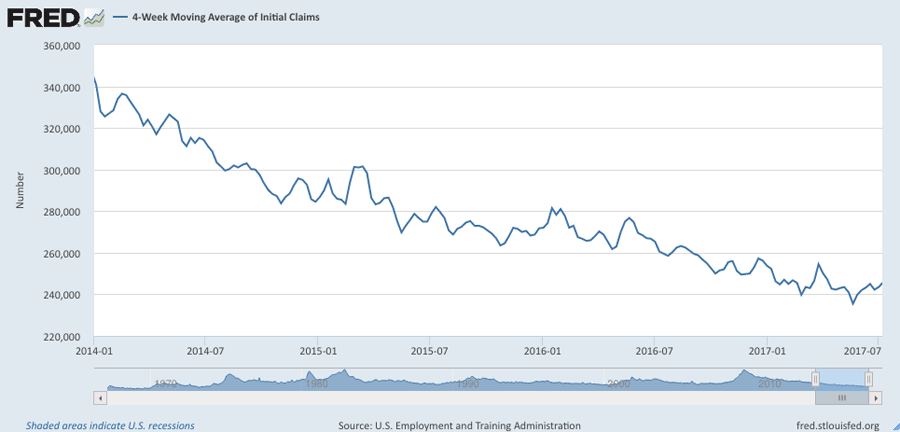

US jobless claims data

David Rosenberg of Gluskin Sheff reckons this is a valuable leading indicator.When the figure hits a "cyclical trough" (as measured by the four-week moving average), a stock market peak is not far behind, and a recession follows about a year later.

This week, US jobless claims came in at 247,000, versus expectations of 245,000. The four-week moving average pushed up to 245,750, having hit its lowest level of the year on May 20th. If that holds as the cyclical trough, then if Rosenberg is right (and to be fair, it's a small data set) we might be looking at a stock market peak later this year - but it's something to keep an eye on.

Oil

Chart number seven is the oil price (as measured byBrent crude, the international/European benchmark). The chart for the last three years or so is below. Oil has rebounded strongly in recent weeks and after a tougher time last week, it recovered again somewhat this week.

Amazon

The tech giant slid in recent weeks as markets assumed boththat interest rates would go up and that fondness for tech stocks would falter.

That appears not to be the case anymore, as the chart abovesuggests.

Of course, the fact that the company had the most successful sales day in history with its"Prime Day"sale this weekprobablyhelped. (I nearly bought an Amazon Echo but the idea of having a device that records your every conversationsitting in your home still concerns me a little I'd be interested in your views on this if you've got one).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?