The tea leaves are dancing (and other great metaphors for rising interest rates)

Markets are trying to get used to the idea of higher interest rates. With no way of telling what the future holds, investors need to keep their wits about them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Right now, the market is trying to get used to the idea of higher interest rates. For the moment, it's struggling with the concept.

Bond prices and share prices have both fallen as central banks have lined up to start talking about "tapering", or raising interest rates.

Ray Dalio of Bridgewater, the world's biggest hedge fund, notes that this is it the zero percent "era is ending". That means we're now into the phase where "central bankers try to tighten at paces that are exactly right in order to keep growth and inflation neither too hot nor too cold".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If that sounds like a tricky balancing act, then that's because it is. Investors, he says, now have "to keep dancing, but closer to the exit and with a sharp eye on the tea leaves".

That somewhat mangled mixed metaphor echoes the ill-fated words of Chuck Prince before the financial crisis (in summer 2007, the ex-Citi CEO talked about having to "keep dancing" in an interview with the FT, despite concerns about liquidity drying up). I'm pretty sure Dalio is aware of the reference and would have used those words as a deliberate warning (though where the tea leaves came from I have no idea).

So what does this brave new world mean for markets? Well, in this morning's MM, I said there were a couple of things that might need to happen for investors to feel they can cope with higher rates.

One is that governments take over from central banks and start spending more money. That currently seems unlikely.

Alternatively, the economic data needs to get stronger. And that's where this afternoon's big release came in. The US added 222,000 jobs last month. That was a big chunk more than the 179,000 expected. Meanwhile, readings for May and April were revised higher.

Wages didn't do much of any interest and the unemployment rate actually went up slightly (which is in this context probably good news because it has to do with a rise in the number of people who are actively looking for work, rather than feeling "discouraged" by a lack of available jobs).

So what's that meant for markets? It cheered investors up. There was no sign of weakness in the economy, so it looks as though, even if the Fed does keep raising interest rates, it should be able to cope. Better yet, there wasn't much by way of wage inflation, so the Fed might feel little need to raise rates anyway.

Gold

So how is that affecting the various assets we're keeping an eye on?Firstly, it's more bad news forgold, which is now trading at below $1,220 per ounce (the chart below only goes to the end of play on Thursday).

Low inflation and rising interest rates are bad for gold, because it means real' (after-inflation) interest rates are rising.Stick with your gold, but don't be surprised if it struggles in the short term.

US dollar index

Second, the US dollar index started to pick up having changed little last week. In a reversal of the impact on gold, rising real interest rates are good news for the dollar.

US Treasury bonds

Third, there's ten-year US Treasury bonds. These have spiked a fair bit higher over the last couple of weeks as investors have started to price in higher interest rates. Following the jobs data, the yield ticked higher again.

Copper

Onto our fourth chart copper. Copper was little changed on the week - it's clearly not quite bought into the growth story, but this latest data won't have hurt it either.

Bitcoin

Source:bitcoincharts.com

Compared to the bubbly shenanigans of last month, bitcoin has been rather becalmed in recent weeks, which is probably a fairly healthy development for anyone who wants to see crypto currencies achieve more widespread usage.

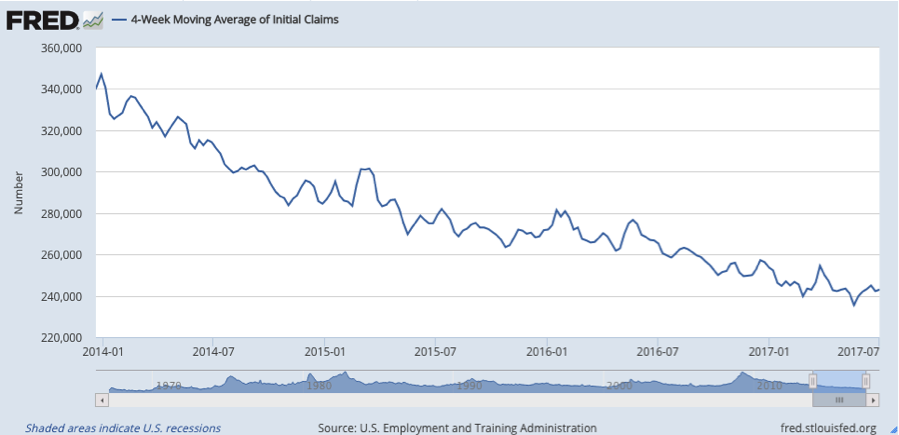

US jobless claims

US jobless claims

David Rosenberg of Gluskin Sheff reckons this is a valuable leading indicator.When the figure hits a "cyclical trough" (as measured by the four-week moving average), a stock market peak is not far behind, and a recession follows about a year later.

The four-week moving average hit a fresh low of 235,500 on May 20th this year, and is now at 243,300, which remains near its lowest level since April 1973.

Oil

Chart number seven is the oil price (as measured byBrent crude, the international/European benchmark). The chart for the last three years or so is above. Oil has rebounded strongly in recent weeks but stalled somewhat this week.

Amazon

If we use Amazon as a bellwether - representing the whole "major beneficiary of 0% rates" sector - then we can get a good idea of whether a genuine turning point has now been reached or not.

Until next time keep your sharp eyes on those tea leaves while you're dancing near the exit door...

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how