Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Security firm G4S (LSE: GFS) came in for a lot of criticism during the 2012 Olympics, when its operational failures meant British troops had to step in to perform security duties. But a restructuring programme has turned the firm around since then. In 2016 G4S won £2.5bn of new contracts, with revenue rising by 10.6% and profits up by 17.9%. The share price has risen by more than 80% in the last 12 months.

Be glad you didn't

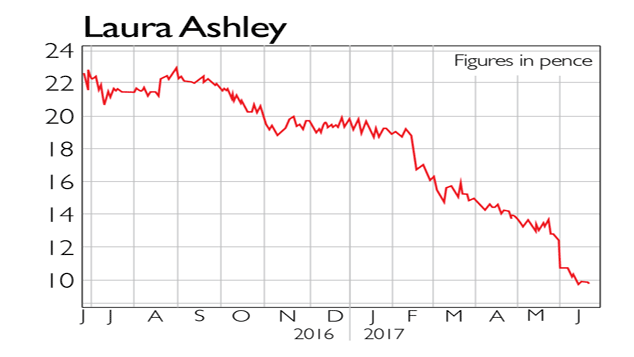

Laura Ashley (LSE: ALY) designs and manufactures home and fashion accessories, which it sells throughits 190 stores and to commercial clients, and licenses to other businesses. Difficult trading conditions, a softening market and increasing costs have taken their toll, and led to a profit warning earlier this year. Like-for-like sales fell by 3.5% in the six months to the end of 2016, and pre-tax profits fell by 29%. Shareholders have not fared well: the shares fell by 57% in the last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King