Your cheat-sheet guide to the French election

John Stepek looks at how the French election could pan out, and what it would mean for the markets. Plus, his weekly roundup of the charts that matter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I don't advocate taking short-term punts on any market, but I know some of you have a speculative streak. So if you're keeping an eye out for the market reaction to the French election, here's what I know about the timings.

The polls close at 7pm on Sunday night, when the markets are all closed. The exit polls come out at 8pm. Those are expected to be pretty accurate. By midnight, the final result should be known, probably before then.

As a recap, there are three basic scenarios which would affect the markets differently. You've got two "mainstream" (although that stretches the definition) candidates Emmanuel Macron (left) and Francois Fillon (right). And you've got two populists Marine Le Pen (right) and Jean-Luc Mlenchon (left).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The most likely result is that a mainstreamer (Macron) and a populist (Le Pen) go through to the next round. In that case, you probably don't see much change in the market, and the assumption will very much be that Macron will win.

Less likely, though possible, is that both mainstream candidates will go through which would probably see the euro and wider markets rise.

Also unlikely, though again possible, is that both populist candidates get through. That would be very euro-negative, and probably hammer wider markets too. And unlike with Donald Trump and Brexit, I'm not sure we'd see a rapid rebound.

If it was just a local French story, it ultimately wouldn't matter, but both Le Pen and Mlenchon are pretty market-hostile, and the ramifications for the eurozone are existential ones, as Daniel Christen of Capital Economics puts it.

"Le Pen advocates withdrawing from the euro, while Mlenchon wants to exempt France from EU-wide deficit rules, monetise the national debt, devalue the euro and restrict the free movement of capital."

In short, come Monday, it will probably be business as usual, but there's an outside chance that it'll be Vive la France and a rising market, or Zut alors! and a crashing euro (and, selfishly, an easier Monday morning for me, as the daily email will practically write itself that's journalistic moral hazard at work right there).

The charts that matter

Anyway let's see what's going on in the rest of the world through the prism of our six charts that matter

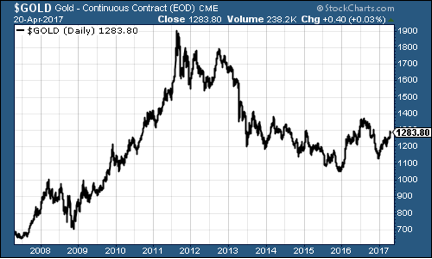

Gold

Gold has had another good week. It's partly down to the whole "safe haven" trade amid various geopolitical concerns. But the big driver is still the concern that US President Donald Trump isn't going to be able to get an awful lot done, and that he'll instead be reliant on a weaker dollar and weaker interest rates.

One thing I will point out US Treasury Secretary Steven Mnuchin said this week that "major tax reform" will be brought forward. If and when that happens, it is likely to reignite the reflation trade, assuming that it actually produces some sort of reform that the market likes. Ironically enough, the "strong economy" reflation trade would set gold back, as other investments become more appealing (until stagflation looks to be back on the cards, at least).

However, the Trump administration has bad form on making and breaking promises, so I imagine that the market will need them to "put up or shut up" on this one.

US dollar index

The US dollar has had another tough week, almost corresponding to gold's decent week. It's worth keeping an eye on the US currency in general and if Trump starts to make any sort of progress, it might rally but in particular for sterling investors, I think it's fair to say that the dollar is more likely to be weak, than strong, for the forseeable future.

That means that stronger sterling' stocks will start to recover (retailers are a good example companies that rely on imported goods will see their costs start to slip back again).

Ten-year US Treasury bonds

Yields have slipped back again (ie prices have risen). Again, this is a sign that the reflation trade has been put on the back burner for now.

If the French election goes pear-shaped, expect yields to fall even further. Alternatively, a mainstream outcome on the French election could be just the boost to animal spirits the market needs to get back into more expansive mode.

Copper price

This is just confirming the story told by the others. Markets are rattled by the fact that Trump is not quite living up to expectations.

Bitcoin

With the US dollar weakening again this week, it's been a pretty good week for the cryptocurrency.

Source: bitcoincharts.com

US jobless claims data

To recap, David Rosenberg of Gluskin Sheff reckons this is a valuable leading indicator. When the figure hits a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind, and a recession follows about a year later.

Source: https://fred.stlouisfed.org/series/IC4WSA

As the short-term chart above shows, it did look as though jobless claims troughed at just under 240,000 at the end of February. So we'd be looking at the market (the S&P 500) peaking around the end of May.

However, in the last few weeks, jobless claims have been falling back again, and we're not far off that trough seen earlier this year.

So there could be life left in the bull market yet. But if there's not, it looks as though we should find out pretty soon.

A random collection of stuff that looks toppy

I like to keep an eye out for weird stories and indicators that might suggest we're approaching some sort of turn. A couple of stories caught my eye this week.

The luxury juicer that's even more redundant than it sounds

One is this belter of a story. Juicero is a private company that raised a lot of money from private investors to create a fancy juicer. They also sell bags of vegetables and fruit to go in this juicer. So it's meant to be your classic "razor blades" or "ink cartridges" business model where a customer buys the original implement, and then you make the money on the refills.

Trouble is, a couple of Bloomberg reporters found that you don't need the machine (which costs several hundred dollars) to create juice from the bags. If you want to, you can just squeeze them with your hands. The company has gone into full damage limitation mode

It's not exactly the levels of madness we saw during the tech bubble, but the fact that a company can raise this much money for something so fundamentally flawed does highlight the fact that there is a fair bit of malinvestment out there right now.

Then I saw this other story which is in a different area, but might be even better.

The ETF ETF

We love passive investing. You love passive investing. We all know it's a good thing: it's low-cost, it's wonderful. But as I've already mentioned several times, it's also a new financial technology, it's taking off rapidly, and when that happens, it's only inevitable that it'll play some sort of role in the next financial crash.

As if to confirm my suspicions that the excitement around exchange-traded funds (ETFs) is getting a bit overheated, a brand new financial product launched last week.

It's an ETF ETF. That's not quite as mad as it sounds. It's an ETF that tracks an index of companies that will make money from the boom in ETFs. Actually, on second thoughts, that is as mad as it sounds.

It's not quite up there with the CDO-squared (basically a security backed by a pool of other securities that are backed by pools of subprime mortgages), but it does all start to feel a little incestuous.

None of this is scientific. Markets can get a lot wilder before they collapse under the weight of their own contradictions. But an increasing quantity of stories that make you double-take is a good sign that things are getting a bit unhinged.

Send me any examples that you spot

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club