I warned you to avoid these five trades – but how did they turn out?

In September, Dominic Frisby picked what he saw as the five worst investments you could make. Today he checks on his “dumb” investments to see how they have done.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Back in September I outlined what I saw as the worst five investments you could make.

Today we check in on those "dumb" investments. How have they done?

Let's take a look

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Five dumb trades yet one of them came good

These were, I stress, the five worst investments, at least as I saw it, you could make at that point in time.

The aim was to test our contrarian prejudices. I made the point that some of the investments would probably come good. Indeed one of them actually did, and that's where we'll start.

Dumb trade no.1: Buy Deutsche Bank

In late September last year, we hit peak anti-Deutsche Bank sentiment. The share price had fallen by more than 90% from its 2007 highs. Its bond yields had spiked (ie its bond prices had fallen too) and it found itself with a $14bn fine to pay the US, while its market cap was only $18bn.

It said it didn't need a bailout. The German government said that it would not bail it out. It all reeked of the chairman giving his manager the vote of confidence.

Yet even then, I understood that of all my dumb trades, this was the one that might actually work out best. Despite the talk of bankruptcy, Deutsche Bank really is too big to fail. It would never be allowed to go under. We all know the rules by now banks get special treatment. Meanwhile anti-Deutsche-Bank sentiment had hit extremes.

As it turns out, I wrote that piece on the day of the low. Anyone who had the cojones to buy this dumb trade has seen their investment, before costs, rise from €10.70 to €15.44. That's a 45% gain!

But the share price is now mired in another downtrend. So caveat emptor.

Dumb trade no.2: Buy US government bonds

Meanwhile, in September, global interest rates were hovering around the lowest levels they'd ever seen. In some cases, bond yields were even negative. Just one month previously the value of negative-yielding government bonds worldwide had risen to more than four times the value of UK GDP.

The government bond market is a market that's long made little sense, but it had reached positively dotty levels. So I suggested it was a bad time to buy US Treasuries.

Since then the long bond (the 30-year) has fallen from $168 to $151. Meanwhile the yield on the ten-year US Treasury has gone from 1.55% to 2.37% in other words, the price has fallen sharply.

It looks as though the government bond market peaked in summer 2016. It could easily bounce (it had a good day yesterday, for example). But it continues to make no sense to yours truly.

Dumb trade no.3: buy a new-build London flat on the South Bank, and pay the full list price

In terms of dumb property trades, I was tempted to recommend buying in Sydney, where prices seem extraordinary. Or perhaps in Vancouver, which tops the UBS Global Real Estate Bubble Index. But I don't have the local knowledge. So I opted for London.

Bottom line: there are too many over-priced two-bed flats in bland glass-fronted tower blocks coming to market in London. Locals won't buy them any local with enough dough will buy somewhere more stylish. Stamp duty, as well as prices, is deterring foreign buyers, while new legislation and rock-bottom yields have deterred the buy-to-let investor. These flats aren't selling.

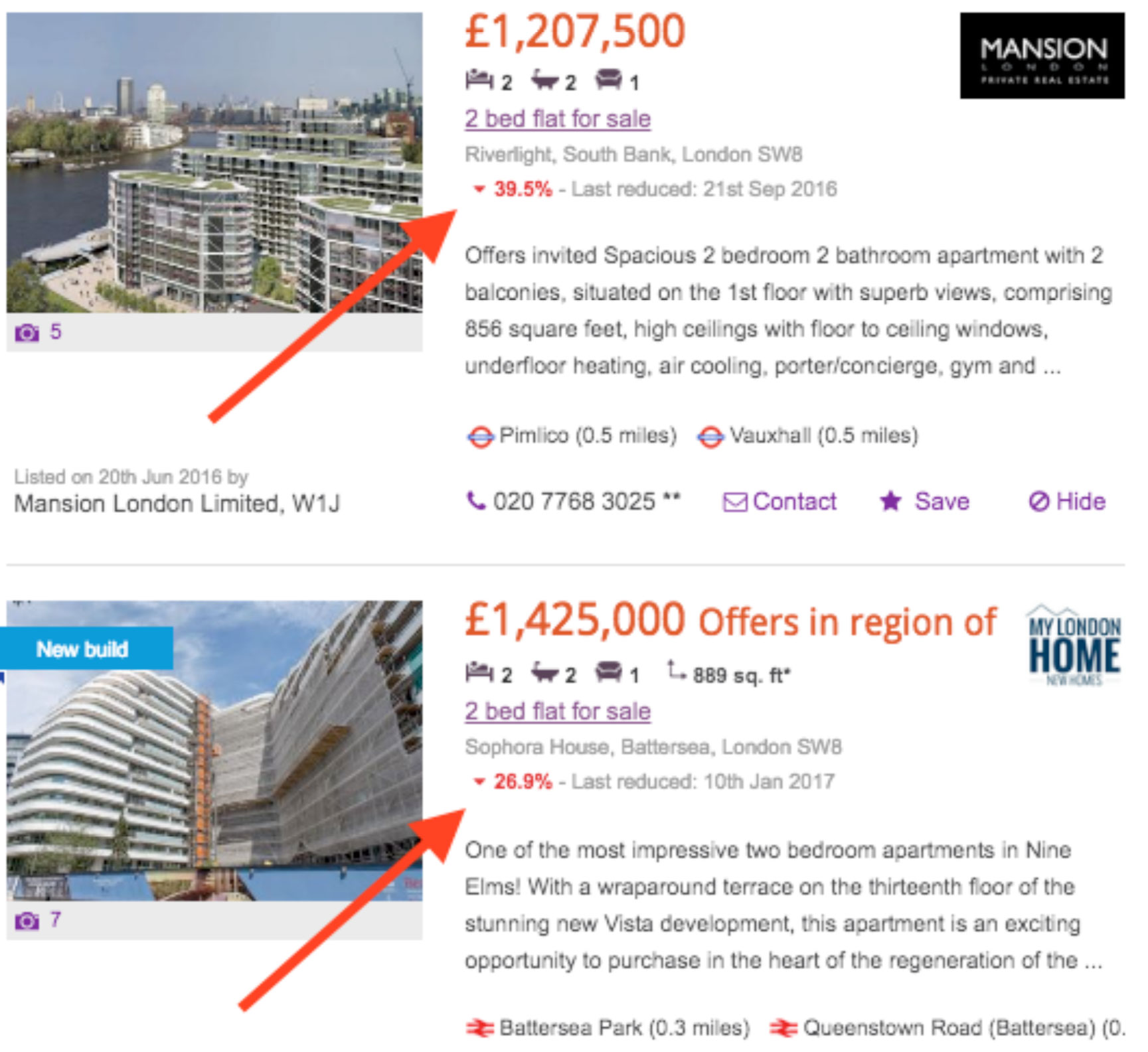

Search Zoopla for flats in SW8 and filter it by "most reduced". You'll find at least 25 pages of reductions over 1,000 flats in SW8 alone (!), starting with these two blandities (I don't believe there was such a word until now. No other will do to describe modern British riverside architecture.)

"One of the most impressive two bedroom apartments in Nine Elms" has already seen its asking price reduced by 26.9%.

It's a trainwreck and yours truly was the first journo to warn about it many moons ago, in late 2014.

Dumb trade no.4: buy Hillary Clinton

Yup. Back in September the bookies gave her a 74% chance of winning.

My view was that "The world is sick of the establishment and Clinton represents the old establishment. Forget New York and LA, this election gets decided by the voting folk in between and them thar folk are mighty hacked off.

"Don't listen to experts" was one of the takeaways of 2016. Add bookies to the list.

A bet on Hillary looks dumb now. It didn't at the time. Those who made the bet made a 100% loss. Ouch.

Dumb trade no.5: play the Aim natural resource game

Here is the strategy: take a list of Aim-listed stocks with market caps of less than £10m, which claim to be exploring for some kind of natural resource. Pin said list to the wall, put on a blindfold, and throw three darts at the list.

The dumb trade is to buy the three companies that get hit by your darts.

It's impossible to know which companies got selected, of course. Maybe yours struck gold. More likely, it milked the shareholders, compensated the management, depleted its capital and saw its share price sink. That's what usually happens.

So there we are. Your five dumb trades. Over the next few weeks, I'll have to come up with five more dumb trades. Although, Clinton aside, the other four trades above still look pretty hard to top to me.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.