Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only

Cambridge-based Bango (Aim: BGO) develops technology that enables payments to be made via mobile phones. Bango collects a fee on each transaction made. Revenue was up by 200% in the year to 31 December, with strong growth predicted this year too. Losses narrowed to £4.6m from £5m the year before, and the firm expects to break even in the "near term", with profitability coming in the "medium term". The shares have risen by more than 150% in the last 12 months.

Be glad you didn't

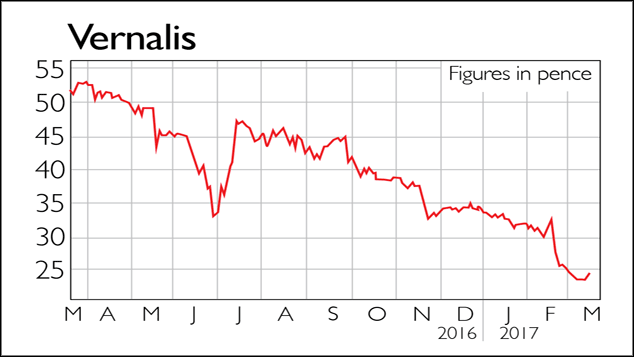

Pharmaceutical firm Vernalis (Aim: VER) markets cough and cold medicine, antibiotics and migraine treatments in the US via its office in Pennsylvania, with more cough and cold products under development at its research centre in the UK. Latest interim results for the six months to

31 December showed losses rising and revenue falling. But the firm has plenty of cash and no debt. Investors have been abandoning the shares, however. The stock price is down by more than 50% in the last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King