Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

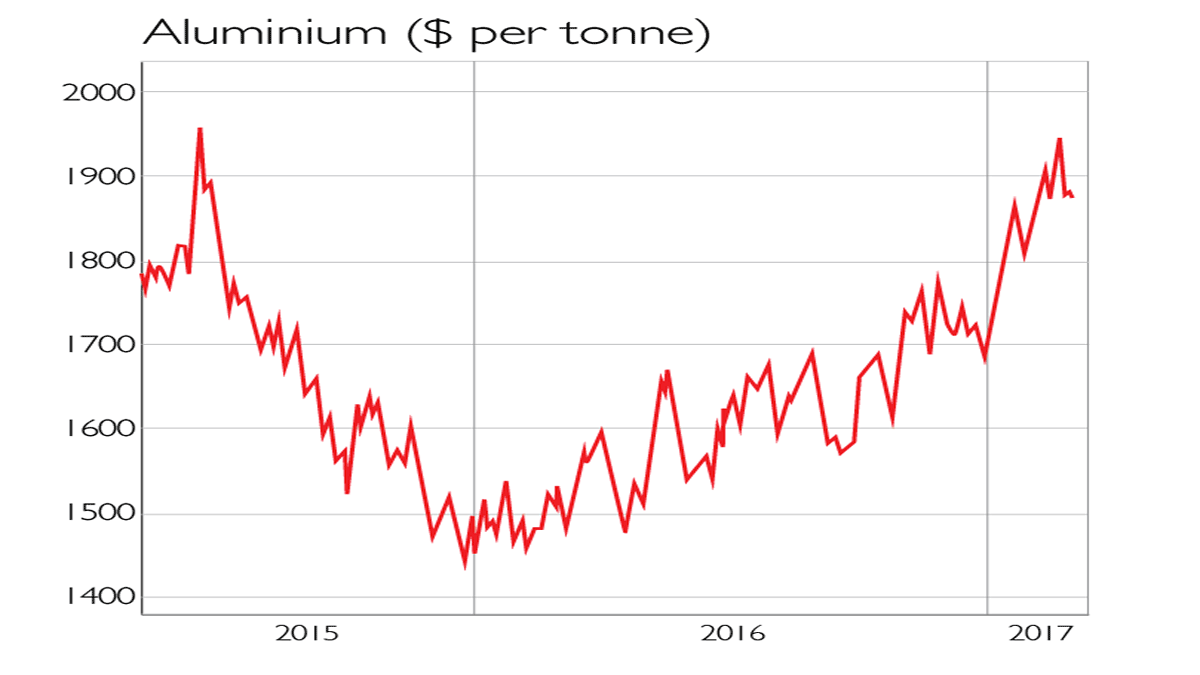

Aluminium futures have charged ahead of those of other metals in 2017, hitting a 22-month high in early March, but the rally has now faltered.

Prices had soared because China, which has doubled output since the turn of the decade and accounts for over half of global supplies, had announced its intention to clamp down on production in order to cut pollution from smelters. But so far, at least, there is scant sign of action.

China churned out a monthly record of 2.95 million metric tonnes of the metal in January, says Rhiannon Hoyle in Barron's. That's up from 2.89 million in December.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"Emerging markets are on the way back If China avoids a financial accident, and President Donald Trump's reflation trade comes through as promised, it is hard to see how emerging markets can fail to benefit. The final propulsion behind emerging markets is that they are correctly perceived to be cheap [they are] on a [cyclically adjusted price-earnings] multiple of 12, compared with a historic median of 17 and a high of 35. This is of no help in timing the re-emergence of emerging markets, but it does show that in the long run buying them now should pay off. It is seldom a bad idea to buy something when it is too cheap."

John Authers, Financial Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.