Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

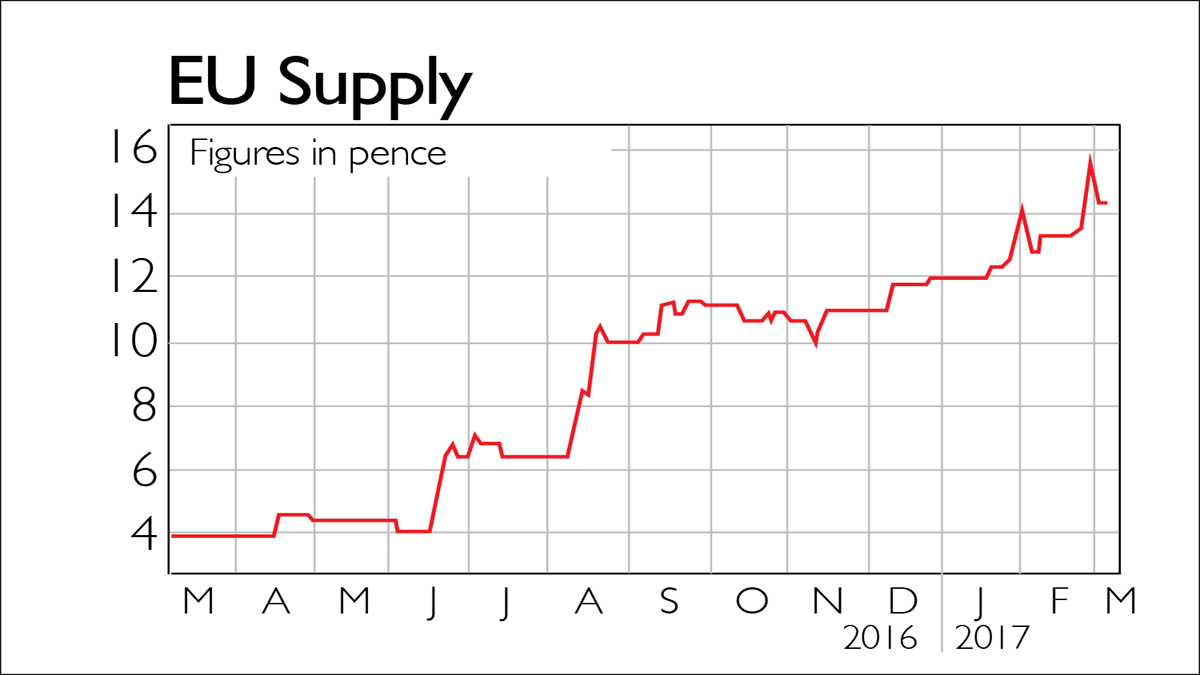

EU Supply (LSE: EUSP) develops procurement software and systems to facilitate tendering and supply-chain and contract management. It was formed in Sweden in 1999 and listed on Aim in November 2013. It expects to make a pre-tax loss of £0.8m in the year to 31 December 2016, down from £1.4m the previous year, but it recently reported its first profitable quarter and expects its first annual profit in 2017 on the back of an "exceptionally strong" order book. The share price has risen by more than 260% in the last year.

Be glad you didn't

Topps Tiles (LSE: TPT) sells wall and floor tiles to retail and trade customers from more than 350 shops across the UK. The 52 weeks to 1 October 2016 saw "very robust" trading with record sales of £215m, like-for-like sales up by 4.2%, and pre-tax profit rising by 7.8% to £22m. However, with a "notable shift" in consumer confidence in the second half of the year, like-for-like sales in the first eight weeks of the new financial year fell by 0.3%, and the share price has fallen by more than 40% in the last 12 months.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?