Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

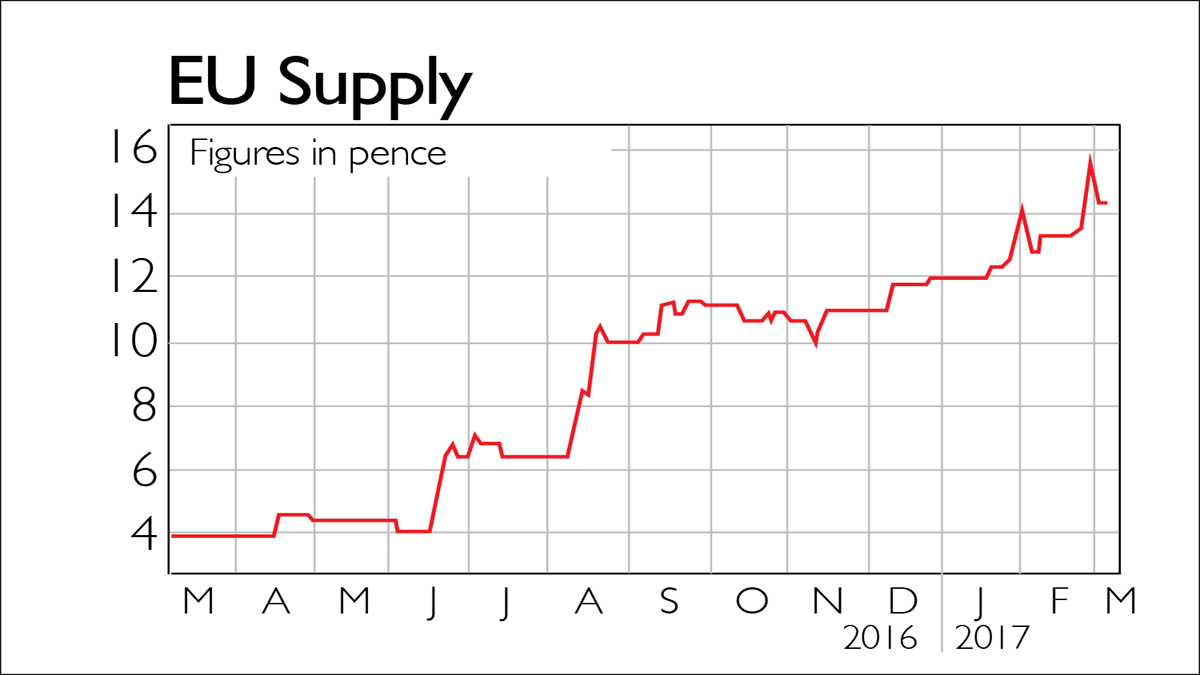

EU Supply (LSE: EUSP) develops procurement software and systems to facilitate tendering and supply-chain and contract management. It was formed in Sweden in 1999 and listed on Aim in November 2013. It expects to make a pre-tax loss of £0.8m in the year to 31 December 2016, down from £1.4m the previous year, but it recently reported its first profitable quarter and expects its first annual profit in 2017 on the back of an "exceptionally strong" order book. The share price has risen by more than 260% in the last year.

Be glad you didn't

Topps Tiles (LSE: TPT) sells wall and floor tiles to retail and trade customers from more than 350 shops across the UK. The 52 weeks to 1 October 2016 saw "very robust" trading with record sales of £215m, like-for-like sales up by 4.2%, and pre-tax profit rising by 7.8% to £22m. However, with a "notable shift" in consumer confidence in the second half of the year, like-for-like sales in the first eight weeks of the new financial year fell by 0.3%, and the share price has fallen by more than 40% in the last 12 months.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King