Why bitcoin still has a lot further to go

After a spectacular 2016, digital currency bitcoin has had a rocky start to the year. But this is just the beginning. Dominic Frisby looks at where it goes from here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

To say it's had a rocky start to the year is an understatement.

It's been up and down like a well, you know the rest of the expression.

Today we turn our attention to what was the world's top performing currency in 2016.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bitcoin

Bitcoin's eventful New Year

But 2016 was even better. It began the year at $434 and ended it at $968. That's a gain of about 120%.

I don't know about top-performing currency it's beaten most stockmarkets as well.

And so to 2017.

As I write, the price is $910, so you might think these first nine days of the year have just seen a gentle decline of five or so percent, perhaps as a result of some profit-taking after a stellar 2016.

The truth is rather different.

The first three days of the year saw the price rise by 20%. The next three days saw it fall by 30%. The following three saw it "stabilize" around $900.

How's that for volatility?

Having been bearish or neutral in 2014, I've been banging the bitcoin drum for some time now. It's going through a classic hype cycle.

What does that mean?

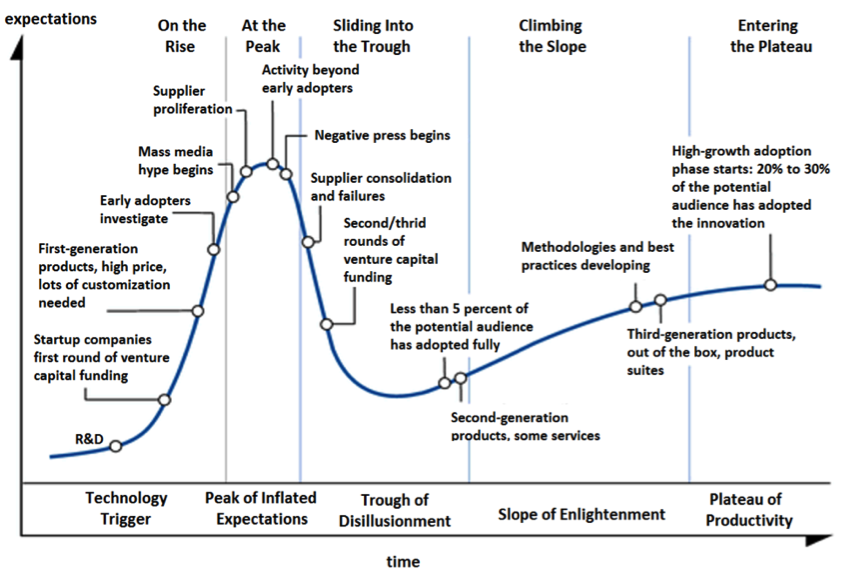

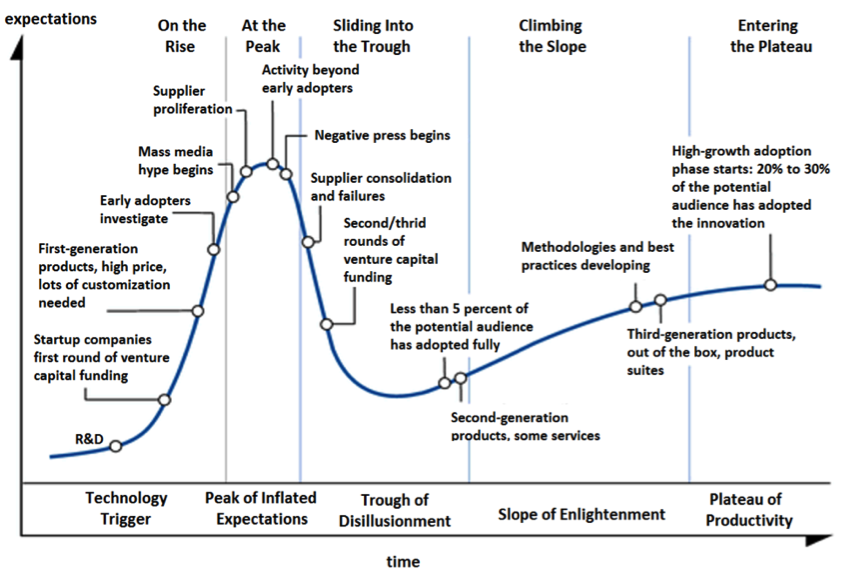

It's a term, for which tech research company Gartner in the US has been credited, to describe the cycles a new technology goes through as it evolves from conception to mainstream adoption.

Gartner has put the chart below together. It's a wonderful tool to help you gauge where a tech is in its emergence. I've posted it before, but I post it again now as I think it is so useful.

A tech is conceived, the prototype finds some sophisticated, early adopters, who begin to get very excited about it. That's the technology trigger stage.

That excitement spreads to the media, who hype it, significant investment pours in and the whole thing gets overblown. That's your peak of inflated expectations. Bitcoin was there in late 2013 when it, briefly, became as valuable as an ounce of gold.

Then it's discovered the tech doesn't work as well as people hoped. There are some negative stories. People get bored and lose interest. There are some high-profile failures. And the reality sets in that there is a long way to go before this thing catches on. That's your trough of disillusionment. Bitcoin sunk into that trough in 2014.

But then, quietly, it began to emerge from that trough. More and more people start to use the tech. The second-generation products start to work. Better practices pervade the industry and you are on the slope of productivity.

That's where I argued that we were in April last year and I'd say we are somewhere further up that same slope today.

Why this is still just the beginning for bitcoin

Bitcoin, as an alternative internet cash system, is pretty useful. It will find more and more users. But alternative competing crypto currencies already exist that in many ways are better. Either they're more anonymous, or they're faster, or their mining systems are more efficient, or there's some other way in which they have improved on the original.

Bitcoin has tremendous first-mover advantage, of course. It has had far more coverage, investment and usage. But it may be that as an alternative cash system it gets superseded.

Already on the Dark Net, for example, monero is rapidly gaining popularity.

But in designing an alternative cash system, Satoshi Nakamoto accidentally stumbled upon something that has a much wider potential application. I'm talking, of course, about blockchain tech.

As far as I can see and I'll be glad for readers to suggest better solutions in the comments the simplest, most uncluttered way to play this blockchain technological revolution is to own bitcoins.

You might find a fund that invests in start-ups, you might find a start-up, but there is so much that can go wrong. Owning bitcoin is like owning an exchange-traded fund (ETF) for the whole movement.

As Charlie Morris, investment director of The Fleet Street Letter says, owning bitcoins is the equivalent of owning "shares in the internet" in the early to mid 1990s. You don't have to pick individual company winners, which is nigh on impossible at this early stage.

Ethereum is a legitimate alternative by the way more on that another time.

Just as the international monetary system used to be built on top of a gold base the so-called gold standard so is bitcoin the bedrock of the crypto system.

What's next for bitcoin?

Either way, the area from $1,150 to $1,250 is a huge barrier of resistance overhead.

Last week, bitcoin made its first attempt at that hurdle and was slapped down. I imagine it will take several attempts to get through.

There are so many parallels between gold and bitcoin that I imagine the gold price, wherever it is, will also act as a barrier. As soon as they hit parity and they did for a few moments at $1,150 last week, as well as in November 2013 bitcoin gets slapped down.

The volatility of the past few days will also, I imagine, need some time to work off.

However, as more and more vehicles come on board by which institutions can invest, we should comfortably see enough capital come into bitcoin to take it past its old highs and much higher.

Once it is through $1,250, there is nothing but blue sky overhead. It has the potential to soar. But investing is, as much as anything, a patience game and my outlook is that over the next few weeks or months patience will be needed as it consolidates and settles after all the recent volatility.

But if you like the idea of this sector, make sure you have a position. When bitcoin moves, it moves like a rocket. You want to be in your seat and strapped in. Not hoping to hop aboard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how