Was 2016 a false dawn for gold?

In the first half of 2016, gold shone like no other asset class. But the second half was different, says Dominic Frisby. The truth is, we’re in a bear market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In the first half of 2016, it shone like no other asset class. It rose, rose and rose again.

Come the second half, it's hard to find anything as awful.

Welcome to another year in the life of gold

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We're near a tradable low for gold

It was a bull market. In bull markets, even dogs fly. Heck, even pigs do.

Coming out off gold's miserable, four-year bear market, the meteoric gains were understandable. But in July a full dose of sobriety was injected into proceedings. The music was switched off, the lights were switched on and the revellers were sent home.

It's been hangover time ever since.

In October, I suggested we'd reached a tradable low, with an ounce of gold trading in the $1,250s. We got a nice rally to $1,310 after which I got stopped out then we got the madness of Donald Trump night, when gold went to $1,340.

Since then the unforgiving, iron grip of the bear has taken hold once again. We come close to $1,150 yesterday. That's nigh on a $200 drop in a month.

For my money we're near a tradable low once again. The reasons aren't so different to the ones I suggested in October.

Firstly, some of the technicals look promising.

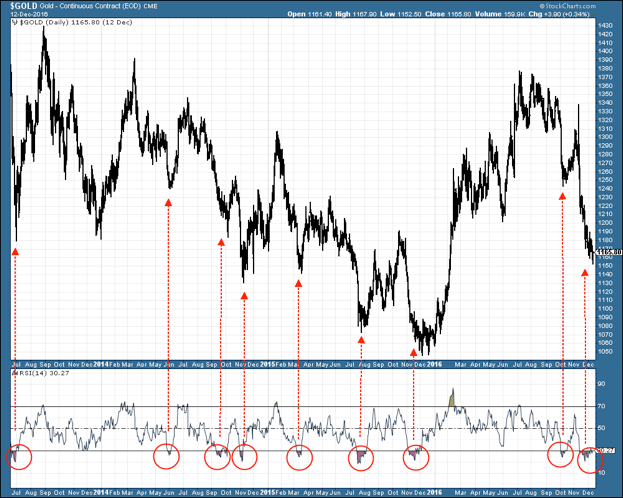

The chart below shows gold over the last three years with, underneath, the relative strength index (RSI). You don't need to understand what RSI is, only to observe that every time it has fallen below 30, it has marked a tradable low, albeit one of varying magnitude.

Most of these have just been bear market rallies. Nevertheless, with risk properly managed, there has been money to be made.

I've circled each occasion in red.

You can see that by the measure that is RSI, gold is extremely oversold to the same extent that it was in August and December 2016.

I'm also keen on the moving average convergence/divergence (MACD) readings. I haven't shown those here for the sake of simplicity, but they're currently giving a buy signal.

The fact that both silver and gold shares have held up over the last week or two, while gold has continued to slide, is also promising. Both silver and gold shares tend to lead gold. Some might describe what we're seeing as a positive divergence.

Other technical signals are less promising. All the moving averages are sloping down as they do in bear markets for example. So, all in all, the trade I am postulating is of the short-term, small stake variety.

I'm not calling the end to this bear market. Happy though I'd be to be proved wrong, I don't think it's over. The broader trend is down.

My concern is that $1,050 may be calling once again and we will need to re-test that level, just as gold double-bottomed at $250 in 1999 and again in 2001. What we may or may not see here is a bounce from oversold levels.

I'd be tempted to advocate a buy with a stop just below $1,140, but the risk is that you'll be stopped out with all the volatility that will come with the US Federal Reserve's announcement later today. Maybe in this case it is better not to use a stop until things settle.

but the risk-averse might be better to wait

It often means that losers get sold down lower than they would otherwise go, which allows bargain-hunters to pick up bargains.

The best opportunities here will be in the small-cap sector. These get the most oversold and will rebound by the most in January.

The easiest way to play the mid-cap sector as a whole is through the GDXJ (Van Eck Vectors Junior Gold Miners) and GLDX (Global X Gold Explorers) gold miner exchange-traded funds.

Or you can hunt around and look for some Canadian small-caps and tiny-caps that have at least some merit and have been heavily sold.

If you do buy though make sure you've sold them before the end of February.

Why? Because the bottom line is, this is now a bear market. Investing in a bear market is hard. In fact, it might be better to wait for another bull market.

PS Have you subscribed to MoneyWeek magazine yet? If not, now's the best time of year to do it. Buy yourself an early Christmas present here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets