The four stages of enterprise finance

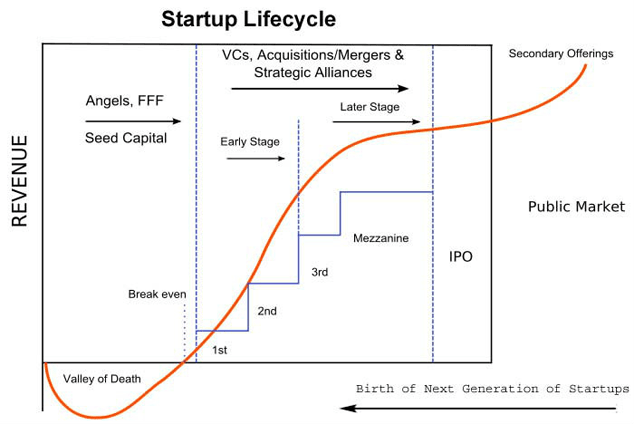

A look at the stages of the enterprise finance cycle, from seed capital to IPO, to help investors understand the various stages of capital fundraising.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Crowdfunding platforms categorise investment opportunities is several ways: industry sector, region, and risk, for example. And we are increasingly seeing platforms group investment opportunities by the company's growth stage.

Here, we take a look at the traditional stages of the enterprise finance cycle to help investors understand the various stages of fundraising.

Before we dig into the detail it's important to note that the finance cycle is evolving. The alternative finance sector is blurring the edges of the traditional investment ecosystem. Now new deal structures are emerging, and partnerships between equity crowdfunding platforms, "angel" investors, funds and venture capitalists are becoming commonplace. Financing rounds that combine all investor types will inevitably continue as the alternative finance industry develops.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Equity crowdfunding has recently overtaken angel networks in being the most active form of enterprise finance; some analysts are even predicting that it may soon surpass venture capital and become the leading source of startup funding.

Source: Wikipedia

Seed capital

Entrepreneurs need to get their ideas out of their heads and into a real-life product or service and to fund their idea they usually use their own money. When this is unavailable or exhausted they turn to their network of friends and relatives for capital. This is known as the "friends and family" round though some commentators call it the "friends, family, and fools" round due to the high incidence of startup failure.

Usually, a very small amount of capital is committed at this stage and funds are used to develop the product or service and undertake market research.

Seed capital can be received as a loan or equity investment. Founders typically sell between 5%-10% of the company equity to friends and family in this round.

Angel investor funding

Angel capital fills the gap between friends and family and the institutional investor round. The enterprise is likely to be at the pre- or early revenue stage and the founders need to get the business off the ground. These businesses may have already validated their product or service and are ready for expansion.

Angels are usually wealthy individuals who invest their personal capital in startup companies in return for equity in the company. Some angels take an active role in the invested business.

A large percentage of angel investments are lost completely when early stage ventures fail. Most angel investors expect to see a return on their investment of between two and 40 times their original investment within three to eight years. Research carried out by business innovation-focused charity NESTA and the UK Business Angels Association suggested that business angels in the UK typically make 22% internal rate of return (IRR) on their deals. The Siding with Angels report found the figure was 27% in the US.

Angel investmentscan beanywhere between £5,000 and £250,000. Angels invest their own cash so take more risks than venture capital firms. They tend to invest in more early-stage or seed startups and can oftenfollow upwith later rounds of financing for the same company.

As well as individuals, there are angel syndicates and a new breed of "super angels" who typically invest larger amounts.

The UK Business Angels Association estimates that there are over 18,000 business angels who privately invest an average of £850m each year (more than two and a half times the amount of venture capital invested in a typical year) in the UK.

The Enterprise Investment Scheme and the Seed Enterprise Investment Scheme (government incentive schemes that give generous tax breaks to investors in small companies) stimulated the UK angel investment market.

Venture capital financing - series A, series B, series C, etc.

Venture capital (VC) funding is typically used by companies that are already selling their product or service. Even though they may not be profitable, they usually have a solid business model. The business model is proven and capital may be needed for expansion into new markets or to develop new products or services.

If the company is not yet profitable, the venture capital financing is often used to offset the negative cash flow. There can be multiple rounds of VC funding and each is typically given a letter of the alphabet (A followed by B followed by C, etc.)

The different VC rounds reflect different valuations (eg if the company is prospering, the series B round will value company stock higher than series A, and then series C will have a higher stock price than series B).

If a company is not prospering, it can still get subsequent series-rounds of financing, but the valuation will be lower than the previous series: this is known as a down round.

In the series A, B, C rounds of financing, funds are typically received in exchange for equity. VCs try and negotiate for preferred shares so as to limit their risk, as opposed to the ordinary shares that earlier investors are likely to hold.

VC investment is usually in excess of £1m and investors are looking for access before an initial public offering (IPO), or companies that have a clear and defined route for growth and an exit opportunity for their investment.

Because VC firms need to see a profitable return fairly quickly and their focus is on returns and exits, this financing round can have a big impact on the ethos of the business and the founders' vision.

VCs usually want board positions to ensure their objectives are met; in addition, their terms can be onerous. They may want a high proportion of equity, preference shares and terms, anti-dilution clauses, restrictive covenants, personal guarantees and warranties.

Mezzanine finance & bridging loans

Mezzanine finance is employed when companies are considering opportunities that require additional funds on an interim or "bridging" basis. Instances such as before an initial public offering, acquisition of a competitor or a management buyout are common reasons for this type of financing.

Mezzanine financing is often used six to 12 months before an IPO and then the IPO's proceeds are used by the company to pay back the mezzanine finance.

Initial public offering

Finally, companies can raise money through selling shares to the public in an IPO.

An IPO raises money for the company and is usually the point when earlier investors realise or exit their investments.

The shares become traded through a stock exchange and companies can choose to offer additional shares or buy back and cancel them as their cash flow and capital structure changes.

This article was first published on Altfi.com

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how