Lessons from the Gilded Age

Mass immigration has led to populism across Europe. The best way to tackle that, says Ed Chancellor, is to address the festering problem of inequality.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Immigration fears may well have tipped the scales in the Brexit vote. But it's wrong to decry opponents of unfettered immigration as "bigots", as ex-British prime minister Gordon Brown put it. These concerns should be seen in the context of decades of globalisation whose gains have been very unequally distributed. With populism growing across the West, the best way to reverse the trend is to address the festering problem of inequality, which globalisation tends to exacerbate.

Take the US in the 19th century. This was the period of the "second industrial revolution", large-scale capital flows and unrestricted immigration, all of which increased the gap between the richest and poorest. The rise of manufacturing wiped out many skilled trades, while the "skill" premium paid to white-collar staff rose. Labour-saving capital goods imported from Britain hit the bargaining power of industrial workers in America.

Free capital flows in this first age of globalisation fuelled the growth of Wall Street, boosting the relative pay of those who could handle money. The titans of Wall Street amassed vast fortunes as well as political power. The integration of markets in New York and London cut the cost of capital.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Like today, it was an era of continuously falling interest rates, which pushed up capital values. As Peter Lindert and Jeffrey Williamson note in Unequal Gains: American Growth and Inequality since 1700, lower rates "contributed to rising inequality because the gains accrued disproportionately to the older, more established locations and those at the top holding financial wealth".

Luxury flourished in the Gilded Age. But it was also a time of mass immigration. By 1910, around 25% of the US adult male workforce was foreign born, squeezing workers' bargaining power. Lindert and Williamson estimate that, without immigration, the real wage for unskilled workers in the US at the turn of the 20th century would have been 34% higher and the rate of return on capital would have fallen by nearly 25%. Labour's weak position fed populist movements.

In the 1890s, William Jennings Bryan stood for the Democrats in the US election, inveighing against the deflationary impact of the gold standard. In 1894, Jacob Coxey, an Ohio businessman, led a protest "army" to Washington, demanding that unemployment be cut by funding public works with newly printed money.

The second age of globalisation, which began in the early 1980s, has again seen large-scale capital flows boost the financial sector and bankers' pay. Falling interest rates have raised asset prices, benefiting the wealthy. The integration of China and India into global trade has hit manufacturing wages and jobs in developed economies, displacing workers into the less well-paid services sector.

Immigration has increased the pool of low-skilled workers with an inevitable impact on relative pay. The resulting political pressures are coming to a head, as Brexit and the rise of populists such as Donald Trump in the US demonstrate.

After the Great Depression, inequality in the US fell for nearly half a century. Capital controls were in place, and the size of the financial sector shrunk. Immigration was restricted. Inflation eroded the real value of paper wealth, while the inflation "tax" increased the burden of taxes. But it wasn't all bad news. As inequality fell and labour's share of national income grew, the US enjoyed a long period of robust growth.

The stockmarket made decent returns. The Gilded Age gave way to a golden age of capitalism. There are many examples of less pleasant ways in which inequality has been eradicated such as revolution, war and hyperinflation. Unless politicians find benign policies to reverse the current inequality trend, those other options will remain on the cards.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

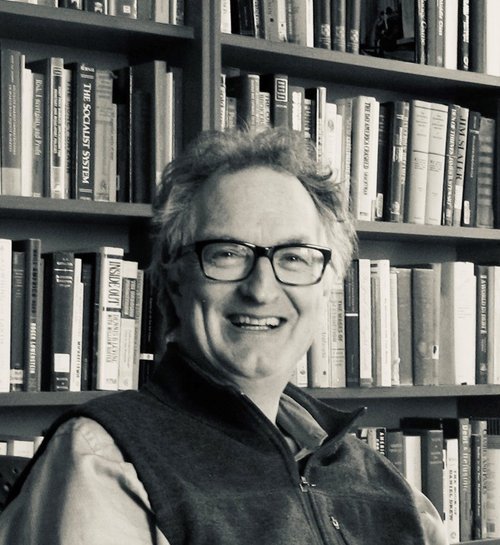

Edward specialises in business and finance and he regularly contributes to the MoneyWeek regarding the global economy during the pre, during and post-pandemic, plus he reports on the global stock market on occasion.

Edward has written for many reputable publications such as The New York Times, Financial Times, The Wall Street Journal, Yahoo, The Spectator and he is currently a columnist for Reuters Breakingviews. He is also a financial historian and investment strategist with a first-class honours degree from Trinity College, Cambridge.

Edward received a George Polk Award in 2008 for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine. He is also a book writer, his latest book being The Price of Time, which was longlisted for the FT 2022 Business Book of the Year.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.