Fund in focus: Marlborough Special Situations Fund

The Marlborough Special Situations Fund is based on a very simple premise: smaller companies tend to grow more quickly than large ones.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

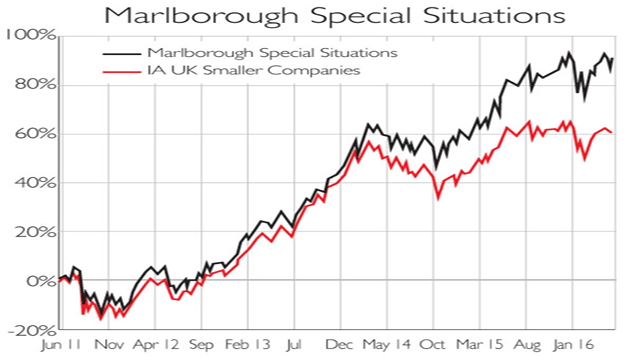

The Marlborough Special Situations Fund is based on a very simple premise: smaller companies tend to grow more quickly than large ones, so investors looking for rapid capital growth should focus on smaller shares. The fund is one of three small-cap funds that highly rated manager Giles Hargreave runs, and is the one with the strongest record: it's ranked third in its peer group over a ten-year period, returning 205% against a sector average of 107%. It has also strongly outperformed its peers over one, three and five years.

Hargreave and co-manager Eustace Santa Barbara look for simple companies in niches that have high barriers to entry. However, their single most important criterion is excellent management.

"The quality of leadership is particularly important in small caps," Santa Barbara told FT Adviser earlier this year. "Only in very rare circumstances would we invest without meeting the management first."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The portfolio is constructed in a "sector-agnostic manner", says Santa Barbara, with major holdings including plastics manufacturer RPC Group, sports retailer JD Sports, and Fevertree Drinks, which makes premium mixers and soft drinks.

Though smaller companies can grow more quickly than large caps, they also tend to be more volatile. In order to limit risks, Hargreave and Santa Barbarahold more than 200 stocks and even the fund's largest holdings rarely exceed 2% of the portfolio. "If you have too concentrated a portfolio in small caps, you can have terrific performance one year, and then run the danger those stocks have done all they can And so the following year you might have very poor performance," Hargreave told MoneyWeek last year."For us, it's about diversified portfolios."

Ongoing charges are 0.8% per year for the "P" class shares, available through major stockbrokers and fund supermarkets.

Contact: 0808-145 2500.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Mischa graduated from New College, Oxford in 2014 with a BA in English Language and Literature. He joined MoneyWeek as an editor in 2014, and has worked on many of MoneyWeek’s financial newsletters. He also writes for MoneyWeek magazine and MoneyWeek.com.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how