Shares in focus: Ceramic renaissance at Portmeirion

Pottery firm Portmeirion is leading a renaissance for Britain’s once-dominant ceramics industry, says Alex Williams.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

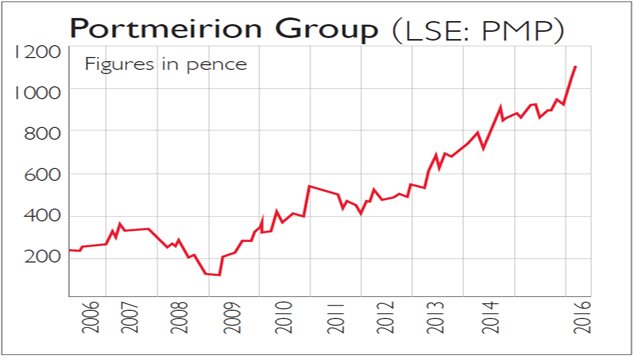

Plates and saucers are flying at pottery firm Portmeirion (LSE: PMP). The firm is listed on Aim and is now leading a renaissance for Britain's once-dominant ceramics industry, reporting seven consecutive years of record growth.

Portmeirion, founded in 1960 and named after the idyllic Welsh village, bought two of the UK's best-known ceramics brands, Spode and Royal Worcester, in the downturn of 2009. Since then the shares have taken off, as consumers in America and Asia have gone crazy for its growing range of dainty patterned ceramics.

Portmeirion makes porcelain, bone china and earthenware goods at its factory in Stoke-on-Trent. It recently spent £1.5m on a new kiln and is turning out 170,000 pieces per week, double its production levels in 2009. It has a showroom on Madison Avenue in New York and sells more in America than in the UK.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company's floral designs are also a big hit in Asia, with sales rocketing in India and China. South Korea is another big buyer, accounting for a quarter of the business. Total revenue jumped 12% last year to £69m, with full-year profit of £8.6m. Online orders are growing even more rapidly, up 27% last year to £2.5m. And sales for the current year are already up, according to a recent statement.

Portmeirion makes 80% of its pieces in England, but some are also made in China. That caused problems in 2013, when the EU introduced swingeing new anti-dumping taxes on ceramics imported from the country, forcing Portmeirion to shift part of its production to Bangladesh. Despite the added cost of more than £400,000, it still ended the year with a record profit.English bric-a-brac is in right now (think Downton Abbey and The Great British Bake Off).

That could change and consumers in the US and Korea might follow a different fad, stalling Portmeirion's growth rate. Its shares are trading at 16 times earnings and a 2.7% dividend yield, pricing in much of the good news.

But on both counts, Portmeirion is still cheaper than Churchill China, its closest listed competitor, which turns over less each year. Portmeirion's profit margins are higher and it is also debt-free, with £11.1m in cash on the balance sheet. It is difficult to find a crack in the company.

And the rest

| BAE Systems | BAE will benefit from a new $80bn bomber project (Shares), 494p |

| Cape | The order book is up and the shares yield 6% (Times), 242p |

| FDM | Software firm FDM is growing and "flush with cash" (Shares), 540p |

| The Gym | The discount gym operator is rolling out new sites this year (Shares), 232p |

| Hochschild | Costs are falling and precious metal prices are rising (Investors Chronicle), 89p |

| Kier | Acquisitions are paying off but the shares are cheap (The Times), 1299p |

| Smiths Group | Results were mixed but the medical business is strong (Investors Chronicle), 1072p |

| Dechra Pharma | Dechra has bought a business in the US that barely breaks even (Times), 1168p |

| Gulf Keystone | The firm is weighed down by debt and interest payments (Telegraph), 9.4p |

| GW Pharma | Its shares have spiked on drug test results; that may be premature (Shares), 507p |

| Inchcape | Margins are falling; the firm's outlook is cautious (Times), 725p |

| Spire Healthcare | CEO Rob Roger is leaving and a takeover isn't forthcoming (Times), 349p |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.