Taxes may be on the rise – but we’re still doing a lot better than our neighbours

Taxes may still be rising, and the economy may still be sluggish, but Britain is the one significant European economy bringing state spending under control, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A squeeze on dividends,new taxes on landlords, curbs on pension tax relief despite having the first fully Conservative government in more than a generation, taxes still seem to be rising relentlessly. Yet it could be far worse.

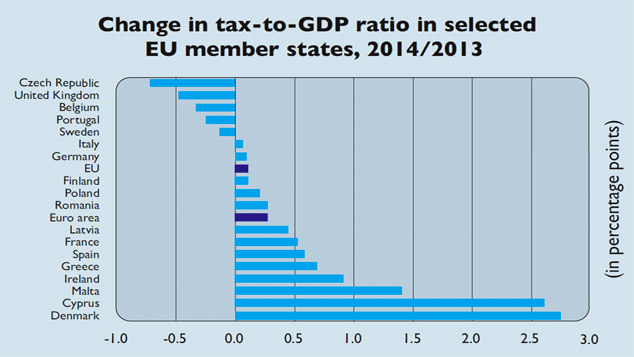

Along with the Czechs, our overall tax burden is coming down at the fastest rate in Europe. And a look at data from the rest of the continent gives a clue as to why it's still high.

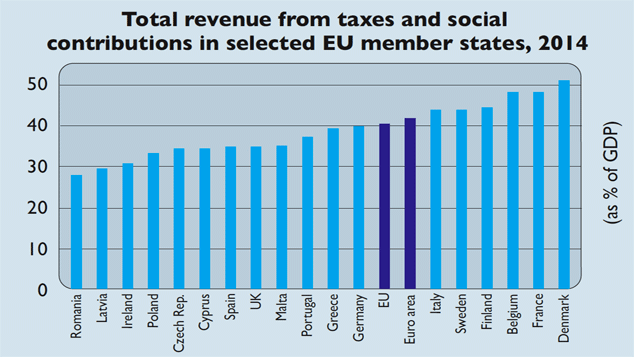

The 2014 figures just published by Eurostat (see charts below) show that the overall tax burden in the European Union (EU) is still rising. EU-wide, the tax take stood at 40% of GDP almost a full percentage point higher than 2013. Very few economies have ever flourished with the state taking that amount each year. The only real example is Sweden during the 2000s, and it had a highly skilled population, a very flexible labour market, and a competitive industrial base. Most of Europe does not.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Denmark, with the highest tax-to-GDP ratio in the EU, added another 2.7%. At that level, it is arguable whether you can really be categorised as a free-market economy. France became the second highest-taxed state (overtaking Belgium), adding 0.5%. Ireland, Malta and Cyprus all saw big jumps in their ratios, a nasty legacy of the euro crisis.

There is a clear, well-established link between lower taxes and faster growth. In America, the lower-tax states have the highest growth. Globally, the relatively lowly taxed emerging markets, and city states such as Hong Kong and Singapore, have created the highest living standards. You can see the same across the EU. The Czech Republic grew by more than 4% in 2015, and the UK by close on 3% two of the fastest-growing EU economies. France and Denmark are stuck in what looks like a depression.

If you wanted to bet on which EU countries would do well over the next decade, and which badly, you could probably ignore productivity, population growth, or even eurozone membership. You could just look at the tax burden. On that basis, you would expect the Czechs to do well there is already evidence that they are. The Swedes would be well on their way to recovery, despite negative interest rates, and a host of short-term problems. Of the countries that went bust during the euro crisis, you would tip Portugal to make a robust comeback its tax burden is falling, while the Greeks' is still rising.

Of the rest, France and Denmark look to be in big trouble. Cyprus looks like the new Greece, and Malta may be the next country to get caught up in the euro crisis. The Irish recovery looks vulnerable its rising tax burden spells trouble ahead. The Baltic states, such as Latvia, will lose a lot of competitiveness if they can't stop their tax burdens from rising. And Germany, Italy and Spain are going nowhere.

But of the major European countries, you would tip the UK to do best. Ours is the one significant economy that is bringing state spending under control. Taxes may still be rising, and the economy may still be sluggish but on that measure we are at least doing better than our neighbours.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King