Markets' New Year resolve proves weak

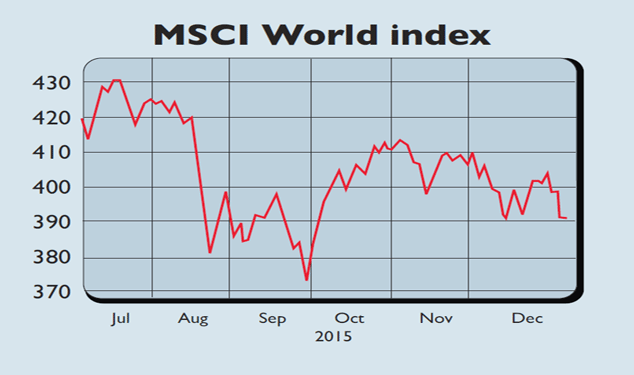

Markets have started the year with a New Year hangover. By mid-week, the MSCI World index – tracking both developed and emerging markets – had lost 2.5% and hit a three-month low.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Talk about a New Year hangover. By mid-week, the MSCI World index tracking both developed and emerging markets had lost 2.5% and hit a three-month low. Monday saw several markets suffer their worst first trading day in years; the pan-European DJ Stoxx 600 index had its worst on record.

Brent crude futures have slumped to under $35 a barrel, a 12-year low. Emerging-market stocks fell to a new post-crisis low and emerging-market currencies followed. North Korea's claim to have tested a hydrogen bomb unsettled investors already worried about mounting tension between Iran and Saudi Arabia.

What the commentators said

China's weakness has dragged down commodities too, which means that "the turn of the calendar will not alleviate pressure" on raw materials exporters and emerging markets in general, said Brown Brothers Harriman. It hardly helps that investors have been turning their back on the sector in anticipation of higher interest rates in America, which always make riskier assets less appealing.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, oil's initial uptick amid the Iran/Saudi row has rapidly dissipated as the focus returns to the huge glut in the oil market. The market is interpreting the tension as bearish "as it means [there] is even less chance of an Opec agreement", said PVM's Tamas Varga. Absent an Opec consensus to stop pumping at full throttle, Saudi is not going to cut back and thus help Iran gain market share.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify