Mapping out the P2P funds universe, part 2

A look at the difference in risk and return when investing via P2P platforms such as Zopa and Ratesetter, and putting your money in a P2P-lending fund.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's been a busy time for funds investing in peer to peer lending. Funding Circle has succeeded in launching its first investment trust, raising £150mfor a fund that invests solely in its loans, with a target yield that will probably be around 6.5%. This is an impressive achievement, especially when you compare it to the other big bit of news, which was that investment manager Ranger pulled its imminent C issue of shares the target was to raise £135m.

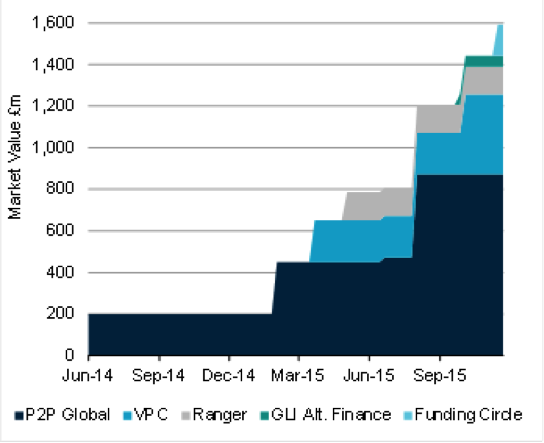

Our guess is that we'll now see an extended pause for fundraising. The chart below from investment trust analysts at Numis shows the sheer weight of money raised over the last year we'd wager that we'll see no new issuance for at least another six months.

The table below, also from Numis, shows the seven funds now vying for attention in the P2P lending arena as you can see from the target dividend yield column, the range is between 6% and 10%, with an asset-weighted average somewhere between 7% and 7.5%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

| Funding Circle SME Income | 150 | n/a* | Nov-15 | 6-7% |

| GLI Alternative Finance | 54 | 2.1 | Sep-15 | 8% |

| P2P Global Investment | 464 | (1.3) | May-14 | 6-8% |

| P2P Global Investment C | 397 | 0.0 | Jul-15 | 6-8% |

| Ranger Direct Lending | 140 | 5.5 | May-15 | 10% |

| VPC Specialty Lending | 193 | (2.3) | Mar-15 | 8% |

| VPC Speciality Lending C | 169 | (6.0) | Oct-15 | 8% |

The big table below gives average yields for a very wide range of funds, including those that invest in equities (equity income funds), as well as other alternative credit structures including infrastructure, and asset backed loans.

I've also included the yield for the iShares ETF that invests in a broad range of UK sterling corporate bonds the yield on this is currently running 3.43%, and is a good indicator of likely returns from investing in corporate bond funds.

On the theme of bonds, an investment trust called the Twenty Four Monthly Income fund is also separately included with a yield of over 6%. This is a fascinating comparison as this highly regarded fund invests in asset-backed securities, and especially mortgage-related securities ie riskier, more complex credits that are not entirely dissimilar to direct loans.

You'll also see at the bottom of the table yields from investing in three-year products provided by Ratesetter and Zopa, plus the average return for investing in Funding Circle's loans. Lastly, we've also included the best composite measure of returns from investing in P2P loans the LARI index run by AltFi Data, which looks at trailing 12-month returns from investing in loans on Zopa, Ratesetter and Funding Circle.

P2P funds compared to investment alternatives

| Direct lending | 6.5-8 |

| Average Equity Income investment trust | 4.9 |

| UK Equity income | 3.5 |

| Infrastructure funds | 5.1 |

| REIT | 3.8 |

| iShares Corporate Bond ETF | 3.43 |

| Twenty Four Monthly Income | 6.8 |

| Asset backed and secured loans funds | 4.5 |

| Asset leasing | 7 |

| Ratesetter (3 year) | 4.8 |

| Zopa | 3.8 |

| Funding Circle | 7.1 |

| LARI composite 12 months trailing returns | 5.95 |

Obviously, when comparing yields in this very simplistic fashion, we need to make some very important observations.

Bonds on average will probably be less risky than loans, because they're issued by major institutions with a solid credit rating. That means they will inevitably yield less.

Equities will also inevitably yield less, but that's because you also have the potential for capital gains. Direct-lending funds or P2P-lending funds are shares, and trade like equities but it isn't investing in equities (although there are some small equity stakes within these funds). You are highly unlikely to make very large capital gains from investing in P2P-lending funds, whereas invest in the right equities and you could easily make 5%-10% a year in bullish markets

Investing directly in platforms such as Zopa and Ratesetter does come with some protections both have their own funds that should protect your capital if defaults do start to rise. This back-stopping is not available in the listed funds.

Reits (real-estate investment trusts) in particular are an interesting contrast. These invest in commercial property, which gives these funds significant asset backing underlying P2P loans by contrast rarely come with the same level of explicit asset backing.

Given all these important observations/caveats, what to make of the range of returns from alternative funds?

In aggregate, it appears that you are receiving a roughly 4% premium in yield terms for investing in loan funds compared to bonds (relatively lower risk) and equities (higher risk). When compared to investing in individual P2P-lending platforms that premium shrinks considerably to just a few per cent and bear in mind that with both Zopa and Ratesetter you still get those protection funds.

As we observed last week, investors need to weigh up whether a direct investment in a platform is the better bet versus a fund. With a platform you get easy access to your money, no exposure to the stockmarket, the possibility of some protection for your funds, and no transaction costs. With funds, you get a diversified set of underlying investments, proper managers looking after risk, and global diversification.

We'd make one last observation: we're inclined to think that direct lending and P2P loan funds don't compare terrifically well with alternative credit vehicles such as funds that invest in asset-backed securities, secured loans and asset leasing. This latter mix of structures tend to return between 4.5% and 7% per annum and contain within them loans to much bigger organisations, usually with some form of explicit asset backing. This broad alternative credit spectrum they are nearly always loans to a corporate in one shape or another looks to offer a decent yield. The downside is that these alt credit funds are more complex, and invest in structures that sometimes confuse a rocket scientist but the yield is a decent return for the opacity.

This article was first published on AltFi.com

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sam Hodges writes for AltFi.com

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.