The world’s most bubbly housing markets

Swiss bank UBS has compiled an index of the most bubbly housing markets in the world. No prizes for guessing who comes top.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

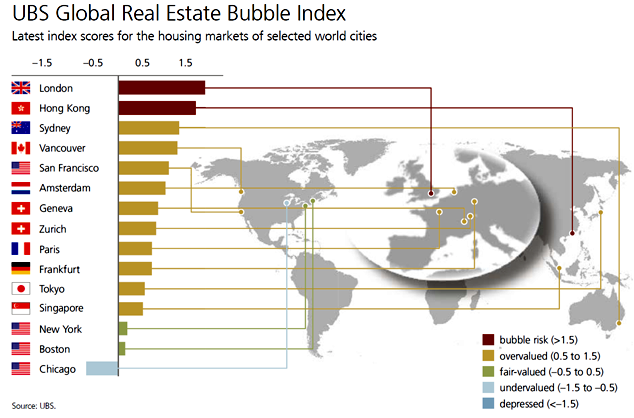

House prices are bubbling over in several of the world's top cities, says UBS, which has created a Global Real Estate Bubble Indexto measure the potential for housing bubbles. Here are the five most at risk, with their index score. A score over 1.5 is a "bubble risk", while a score between 0.5 and 1.5 is "overvalued".

1. London 1.88

UBS reckons London is the most overvalued market, based bothon price-to-income and price-to-rent ratios. Average real (afterinflation)dwelling prices are up by almost 40% since the startof 2013, more than offsetting all financial-crisis-related losses.House prices no longer bare any resemblance to local householdearnings due to purchases for investment purposes by both localand global buyers.

2. Hong Kong 1.67

3. Sydney 1.39

4. Vancouver 1.35

5. San Francisco 1.15

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marina Gerner is an award-winning journalist and columnist who has written for the Financial Times, the Times Literary Supplement, the Economist, The Guardian and Standpoint magazine in the UK; the New York Observer in the US; and die Bild and Frankfurter Rundschau in Germany.

Marina is also an adjunct professor at the NYU Stern School of Business at their London campus, and has a PhD from the London School of Economics.

Her first book, The Vagina Business, deals with the potential of “femtech” to transform women’s lives, and will be published by Icon Books in September 2024.

Marina is trilingual and lives in London.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how