Black Monday: A storm in a teacup?

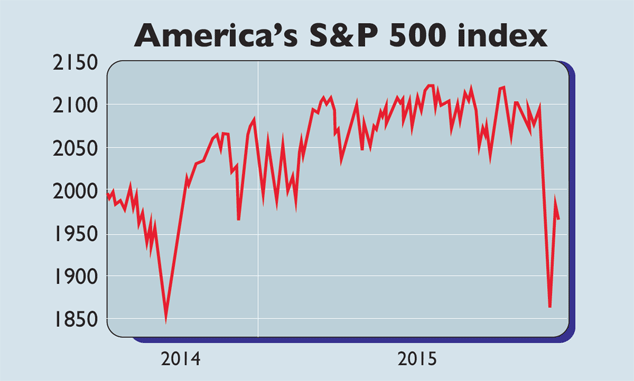

Many investors were horrified by Black Monday's sharp falls in the stockmarkets. But the jitters seem unlikely to lead to a bear market yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"August does seem to specialise in episodes of market turmoil," says Economist.com's Buttonwood blog. August 1998 saw Russia's default; August 2007 was when the subprime crisis really started to bite; and four years later the eurozone crisis threatened to spread across the region's peripheral nations.

This time, European stocks have suffered their worst August since 2011, with the pan-European FTSE Eurofirst 300 index down 9%.

Many investors will have been horrified by the sharp falls early last week. The Dow Jones index opened 1,000 points lower at one stage, and blue chips such as General Electric lost 20%. Around 40% of the world's stockmarkets were plunged into bear market territory (defined as a decline of more than 20% from recent highs), according to research from Absolute Strategy. The majority of them 80% slid by more than 10%, the definition of a stockmarket correction.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

One reason August often sees such violent moves is that many traders and investors are on holiday, so liquidity drops (buying and selling tends to move the market more than it otherwise would), while the rattled junior staff members temporarily in charge of funds may be wary of acting as buyers once prices fall. The spread of computerised trading doesn't help either, as these programmes can "feed on each other", or simply get switched off in a crisis, notes Buttonwood.

Black Monday fades to grey

But so far, the Chinese data provide little evidence of a sharp slowdown certainly not a sharper slump than investors should already have been aware of. Investors cheered up when the Chinese central bank cut interest rates, while the US turned out to have grown much more strongly in the second quarter than first estimated. It grew at an annualised rate of 3.7%, 1.4% up from the first reading.

A Federal Reserve official then said a September interest-rate hike seemed "less compelling" than before the turmoil. The US market, which often sets the tone for the world, is especially jittery about higher US rates this time round because American earnings growth is turning negative, as US investment adviser Peter Bernstein points out. Normally, just before a rate hike, earnings are increasing rapidly, reflecting a strengthening economy, and the Fed raises rates to prevent overheating.

But earnings growth has faded away, and with profit margins at historic highs, there is scant scope for yet more cost-cutting to lift earnings. Valuations are high too, adds John Authers in the FT. So the American market was very vulnerable to a correction; China fears were merely the trigger.

The bear will stay away for now

As we noted last week and as Capital Economics reiterated this week if there is a downturn, central banks still have a wide range of measures they can employ, from printing more money to promising to keep interest rates lower for longer, keeping liquidity flowing into asset markets. There are still plenty of problems with the world economy but this squall seems likely to pass.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.