The one stock to buy to profit from all this fuss about airports

Air passenger numbers doubled between 1999 and 2014. And the industry also plays an increasingly important role in freight. Matthew Partridge picks the best stock to buy to cash in on the growth of the aviation business.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Britain has been debating the topic of airport expansion for decades. Last week, the latest contribution the long-awaited Airports Commission report from Sir Howard Davies concluded that Heathrow was the preferred option for another runway, but that Gatwick was viable too. That dumped the decision right back in the government's lap.

Advocates argue that increased capacity could contribute as much as £150bn to the UK economy, but given how tricky it is politically, there's no guarantee that expansion will ever get under way, at Heathrow or Gatwick. Yet perhaps what's most interesting about this issue is not the location of Britain's next runway, but the fact that there's demand for it at all.

The fact is that despite regular problems battering the industry from disease epidemics such as Sars, to terrorist attacks, to the financial crisis, to highly volatile oil-price movements air travel is a growing business. More and more people are travelling by air, in more and more parts of the world.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The main driving force behind this long-term expansion is rising incomes in developing countries. This continues to increase the size of the global middle class, who become ever more keen to travel and experience other cultures as they grow wealthier. Overall, the World Bank estimates that passenger numbers have more than doubled between 1999 and 2014 a rate of around 5% a year.

Experts believe that this growth rate will continue in the short and medium term. With tourism playing a key role in the economy of many major global cities, it's easy to see why politicians want more airports to take advantage.

And despite constant predictions that email, Skype, or other forms of communications technology will render face-to-face contact irrelevant, business travel also continues to grow. There is now a consensus among politicians that the quality of airport connections plays a crucial role in determining the outcome of trade deals, and influencing where large global firms locate, with sub-standard airports discouraging trade and investment.

Air travel also plays an increasingly important role in moving goods around the world. While most raw materials and basic goods are still transported by either ship or rail, flying is the only viable option for those that need to be delivered fast over very long distances. As a result, air cargo now accounts for a third of world trade by value, rather than volume or weight. The rise of e-commerce, and decline of the high street, should see this share continue to grow for the foreseeable future.

While studies are divided as to whether trade follows airport investment or vice versa, what matters is that policymakers believe firmly that the two are linked. As a result, countries across the world have been pumping large sums into the sector. China is expected to build more than 100 new major airports in the next 15 years. Turkey is upgrading Istanbul Airport so that it has around four times the current capacity of Heathrow.

And it isn't just emerging countries. Four of the major US airports Los Angeles, Dallas, Atlanta and Chicago have recently spent large sums upgrading their facilities. Auditor KPMG thinks that 50 new runways will be built in the world's largest cities within the next two decades including eight more in Beijing and four more in Dubai. We look at a company well placed to profit in the box below.

The stock to buy now

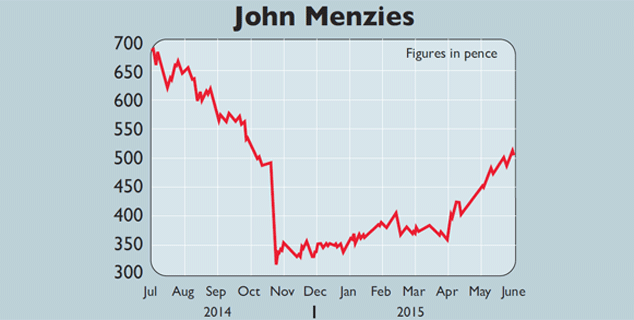

While some of these services are run in-house, most are tendered out to specialists, who can achieve economies of scale. Logistics firms will also benefit from the air-cargo boom. One company grabbing an increasing slice of this ever-expanding pie is John Menzies (LSE: MNZS).

John Menzies currently runs passenger, ramp and cargo-handling services in more than 149 countries, with more than 500 individual clients.At the moment the company still gets a large chunk of its revenue from its newspaper distribution arm. However, there has been pressure from its shareholders to turn the newspaper unit which has been struggling to make money into a separate company.

This would make it a pure play on the aviation industry boosting the rate of revenue growth rates and profits. John Menzies trades on an attractive valuation of 10.5 times 2016 earnings. It also offers a solid dividend yield of 3.2%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.