What the price of gold says about Britain's house prices

When measured against the price of gold, UK house prices still have a very long way to fall. As Adrian Ash explains, we may only be half way to the bottom.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Beware the clamour to call the bottom in house prices. Because with a tired predictability, the UK experience of seeing "green shoots" in every new survey says the global bust has a long way to run yet.

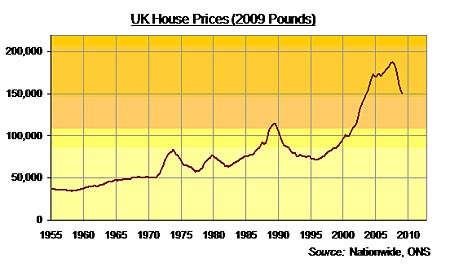

People who bought UK residential real estate in 1973, for instance, took until 1986 to break-even, on average, after accounting for inflation.

Prices then doubled in the last half of the eighties, before falling again for the next six years running, dropping nearly 40% (inflation-adjusted) and only regaining their peak in 2002.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Just as today, however, estate agents and lenders were eager to call the bottom early and often:

"House prices to recover next year" November 1989

"Recovery forecast for house prices in market awash with loan funds" January 1990

"The bottom of the current house-price cycle may have passed" July 1991

"House-price surge on the way, but wait for it" September 1991

(All from The Times)

Both up and down, in short, UK house prices the very model of today's synchronised cycle always run further, for longer, than most people expect.

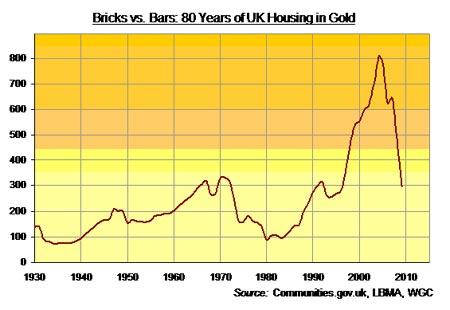

Now the latest UK bubble has burst, average prices have seen only half that 40% loss to date. Priced against gold, in fact also touted as a "long-term" store of value, but proven through financial and economic turmoil instead of consumer-friendly bubbles in credit UK real estate values could yet have much further to fall.

Already down by two-thirds, they might yet drop another two-thirds again.

Top to bottom, UK house prices during the last bull market in gold the inflationary Seventies lost four-fifths of their value all told, dropping to equal just 89 ounces of metal on average in 1980.

So far in this post-bubble slump, anyone swapping gold bars for bricks has already seen their investment head for a treble, basis the 2004 average to first-quarter 2009. (NB: The former Office of the Deputy Prime Minister, now the bizarrely office- and department-free "Communities & Local Government", seems to have trouble matching its annual to monthly data. But its 17% drop in nominal prices used year-to-February above rhymes with the big other surveys.)

The value of gold priced in sterling, however, remains below its eight-decade average in terms of housing. One ounce of metal now buys one-third of one per cent of the typical British pile, compared to the 1930-2009 average of 0.4%.

Given UK housing's habit of over-shooting both at the top and the bottom, however, returning to that extreme valuation beneath 100 ounces between 1980 and 1983 would see real-estate sellers switching to gold today treble their investment once more before housing turns higher in terms of ounces of metal.

You might charge that Britain's housing stock has gained in real utility since Margaret Thatcher took power. But running water, gas and electricity were supplied long before, and central heating became commonplace during the '70s. Still "the barbarous relic" squashing house prices back towards Great Depression levels, approaching but not quite reaching the 76-ounce level hit from 1934-1938.

In nominal prices, average UK home prices have risen 350 times over... going from £545 just before the Second World War to some £190,000 this month. Gold prices, in contrast, have risen some 140-fold to stand near £610 an ounce at today's London close.

Those multiples may or may not now squeeze together. But either way, the loss of value in sterling is clear a long-run inflation that's sent property prices sky-high for both bricks and gold bars.

Adrian Ash is editor of Gold News and head of research at BullionVault

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Adrian has written all things gold related from if it’s worth buying, what the real price of gold should be and what’s the point of gold for MoneyWeek. He has also written for other leading money titles on his gold expertise including Business Insider, Forbes, City A.M, Yahoo Finance and What Investment Magazine. Now Adrian is head of the research desk at BullionVault, a physical market for gold and silver for private investors online.