Sovereign defaults: Which will be the first domino to fall?

When countries go bust, others follow suit. Not even our Canute central banks will be able to hold back the coming wave, says Jonathan Compton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When countries go bust, others follow suit. Not even our Canute central banks will be able to hold back the coming wave, says Jonathan Compton.

By 1026, King Canute had established a North Sea empire encompassing most of Scandinavia, the UK and many peripheral territories. Equally at home on land and sea, he was the most nautical English monarch ever.

So, the famous story of him commanding the tide to recede lacks any credibility unless, as many sources suggest, it was to show his fawning courtiers that however great his temporal power, no one could control the cyclicality of nature.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A thousand years later, regulators and central bankers have learned nothing from Canute. Their ongoing efforts to thwart the cyclicality of financial markets by micromanaging interest rates and capital flows are as doomed as his attempts to turn back the tide.

Gordon Brown's disastrous reign as chancellor (and mercifully brief period as prime minister) was a case in point, with his repeated claim to have abolished the business cycle (Tory or otherwise) something no nation has ever achieved.

Despite his ruinous borrowing spree, it is unlikely he believed fully that the UK could avoid such cycles like Canute, he was playing politics. But it is easy to see why no one has hired him for a role in international finance since he left office.

Government bonds are seen as the safest assets around hence in the UK they are known as gilt-edged'. Their yields set the borrowing cost for everyone else. The rationale is that because a government can always raise taxes and (in theory) cut spending, repayment of bondholders is guaranteed.

Thus lending to a government by buying its bonds is risk-free which is why governments get to borrow at lower interest rates than just about everyone else.

Like many theories, this is entirely mistaken, given the global record of sovereign default. Sovereign default can be defined broadly as when a government either reneges on repaying the original loan in full on the due date, or misses an interest payment.

On this measure, default is so common that it is in fact abnormal for a country to have a clean credit record lasting more than three generations when it comes to paying back IOUs issued by dead politicians.

There are many theories as to the causes of sovereign default. But in practice, the pattern is little changed since Edward I Hammer of the Scots became the first modern' international defaulter in the late 13th century. During good times (war in his case!), governments, businesses and individuals take on too much debt.

During the inevitable downturn, interest rates rise (the cost of borrowing surges), which leads to debts turning bad, creating a banking crisis and a general loss of confidence. As a result, government income collapses so it can no longer borrow from the capital markets (the normal route used to repay old bonds), and so cannot repay its debts.

By the turn of this century, however, the proven high risks inherent in lending to governments had been forgotten. Default by advanced countries was considered a curious historical footnote and only likely to recur in unimportant Third World basket cases.

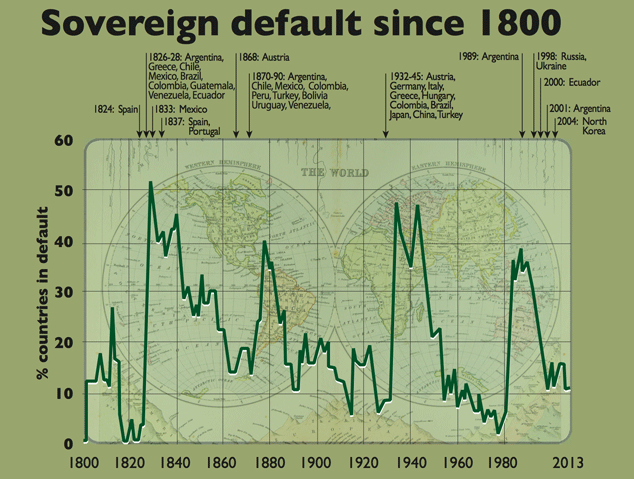

Yet the data tells a different story (see the chart below). During the 20th century, Germany and China each defaulted twice, and Russia defaulted three times. That's a third of the G9 leading nations.

Of the others, France did not pay its bonds during World War II. It then debased the franc so badly that there had to be a 100-to-one currency redenomination in 1960. Then it repeatedly changed the terms of the 7% Giscard', a government gold-backed bond that's three defaults in 50 years.

Japan hyper-inflated and went bust in the 1930s, then wiped out all debt after World War II. Italy did something similar. So in practice, two-thirds of the G9 countries have defaulted in less than 100 years. Yet this group is now expected to return the world to the sunny pastures of prosperity.

Spotting basket cases

There are well-known mechanistic ways to check on the chances of a national default. The most common rule' is that any nation that in peacetime has net government debt of more than 90%-100% of gross domestic product (GDP) has always defaulted eventually.

The sole exception is surprisingly Great Britain between 1816 and 1862 (following debts run up during the Napoleonic Wars). However, at the time Britain had enormous advantages: control of over half the world's freight transport and commodities, a quarter of the world's population, the only stable reserve currency, and a massive technological edge through its leadership of the industrial revolution.

Taking the 90%-100% rule and applying it today, many stand-out potential defaulters among the developed economies are no surprise: Japan (142%), Greece (127%), Italy (118%), America (104%) and Portugal (95%). Note that there are many different numbers around.

You can find figures for debt-to-GDP that make things look either better or far worse because gross numbers are used, each nation produces its own data (economics is a wonderfully trusting science'), and because methodologies vary. As for developing countries, only a few have debt levels at such elevated rates, mostly around the Caribbean.

All the countries noted above are at risk except America, where for now you can ignore the crazies preaching imminent financial collapse and recommending buying guns, canned food and a bunker. The UK's precedent in the 19th century is likely to apply the US now has the global reserve currency, as Britain did back then.

Another test for sovereign default is to look at how much interest a government has to pay on its (net) debt as a percentage of its revenue. If a significant amount of its revenue goes on paying interest on its debt, this means the country is almost certainly under-investing in important areas. As a result, the domestic economy and tax base is likely to be crumbling.

The current world average is roughly 6% for higher-income countries and 4% for the lower ones. All the nations mentioned above (except the US) are substantially above these levels, as are several countries widely peddled as good investments, such as India, Brazil and the Philippines, whose interest costs are over five times the average. (The total no-hopers are Egypt, Jamaica and the Lebanon at 27%, 33% and 41% respectively. Each looks sure to default.)

A third but less common test is to measure a government's net debt as a percentage of its annual tax revenue.This is a useful trick to compare countries with different levels of taxation that simple debt-to-GDP ratios ignore. The runaway winners' on this score are Japan and Greece at 1,000% and 500%, while the runners-up include, as usual, Iberia, Italy and Cyprus.

Countries in the cross hairs

These sorts of tests offer practical filters to investors. But they ignore equally vital soft' issues. Some countries and nationalities seem to be hardwired into borrowing quite knowingly without the ability, or intention, to repay.

The gold-medal winner of the default league table is Spain, which has defaulted 14 times since 1500. Silver medals are shared by Ecuador and Venezuela at nine times. The joint bronze medal winners are a major surprise: France and Germany with eight apiece. And of those who look as if they have the most potential to default today, Portugal has so far managed six and Greece five.

Yet some of these countries have very long histories as nation states so a fairer measure is to take a country's foundation date, then calculate the percentage of years in which it was either in default or unable to borrow internationally.

Step forward Greece, which since its creation has been in default, or a capital pariah, for 52% of its history. Spain is an impressive second equal with already-in-default Argentina, at 25%. Portugal comes third with 15%.

The governments of these nations are like those distant relations who are forever asking for loans that you know they have no intention of repaying. Their financial skulduggery is a matter of record.

What is curious today is that by not defaulting on their debts yet again, these countries have signed up for prolonged, unnecessary poverty. So the question is how long can this continue?

If Greece were to renege on its debt, for example, then within weeks a recovery would commence (assuming that it leaves the euro at the same time). Foreign investors would pour in looking for cheap local assets and manufacturing bases, as would tourists.

Continuous domestic capital flight would reverse and overseas interest payments would cease. It is such a rational course of action to take that it must only be a matter of time. This is why populist parties, such as Syriza, so frighten international institutions with their message of tearing up Greece's IOUs.

It is also why Brussels and the European Central Bank (ECB) have always caved in to default threats from euro members and would likely do so again, save for the growing opposition from the stronger nations of northern and eastern Europe.

What would this mean for the rest of the world? European and global capital markets could probably weather the loss of Iberia, Greece and Cyprus: bank balance sheets globally are stronger than in 2010 and exposure to weak countries is far lower.

Yet the monster under the bed remains Italy, one of the world's top five bond issuers. Since 2000 the Italian economy has shrunk, government debt continues to rise, and tiny reforms face strident opposition hence there have been no major changes. Italy's demographics are terrible and getting worse.

Although the significant support for politician Beppe Grillo appears to have waned, voters are eager to support anyone who offers gain without pain which in Italy's case would be to default. Italians have found it too painful trying to behave like prudent Germans.

When will it happen?

So when might push come to shove? Periodically there are surges in the number of countries going bankrupt. The aftermath of 2008's financial crisis was one, but a better example was Brady bonds' in the late 1980s.

Domestic US banks were chronically overexposed to the many Latin American countries that were about to default. Brady bonds allowed these banks to swap near-worthless Latino loans for bonds guaranteed by the US Treasury. Smoke and mirrors maybe, but it worked, being in principle similar to the ECB's actions from 2010 onwards.

Defaults are also often delayed because of excess savings'. Assume that country A strolls into a financial quagmire, but that country B has enjoyed robust growth, creating financial surpluses. These surpluses need to be invested somewhere so B is often happy to buy A's bonds. This is how America funded its growing deficit in the 12 years to 2009, by tapping into giant surpluses in Japan and China.

Yet now the world economy is in a unique position. The vast Japanese savings pot has all but vanished. What remains is needed at home. The meteoric growth in China's reserves is about to reverse.

Today, every leading nation needs to borrow at record levels so not only are far more government bonds being issued than there are savings to buy them, but this is happening during a period of slowing economic growth, making repayment more difficult.

Hence the novel and desperate innovation of central banks (such as the Bank of England) becoming the dominant buyers of British government debt.

This mirage could endure for a long time. But as the global economy continues to sputter and bond issuance keeps rising, it is inevitable that another spike in the number of sovereign defaults will occur before the end of this decade.

And tiny players such as Greece and Cyprus will matter more than you think, because once one country walks away from its debt and recovers as a result, a domino effect will follow, knocking over the weak debtors such as Spain, Italy and India.

When that happens, markets will panic and even the more sound nations will be dragged down. Then the aforementioned crazies will have a field day.

The four stocks to buy now

It is impossible to predict the timing of the next surge in sovereign defaults, but a crisis seems inevitable by 2020. So these recommendations take a long-term view and ignore the inevitable trading opportunities.

Most government bonds are already bad value, given their record low yields in many cases negative in real (after inflation) terms. Stable Germany's ten-year bonds yield 0.85% (booming' Britain's yield 2.18%), so there are pundits recommending buying higher-yielding bonds within and outside the eurozone.

This is a sucker punch. Greece's ten-year bond yields over 7%, but fails to build in the real risks. (Note that the yield peaked at over 35% in early 2012 see graph.)

Similarly, Spanish and Portuguese bonds (whose ten-year yields are at 2.16% and 3.29% respectively) should be dumped. Italian bonds at 2.48% are collective madness. The bond yields of many less-indebted countries will also blow out (ie, yields will rise, so capital values will fall). This includes Ireland (2.48%), France (1.30%), and, perhaps surprisingly, Belgium (1.23%) in many tests, Belgium only just misses joining the worst countries in the medals box.

Outside Europe, other high yields fail to reflect the true risks India, the Philippines, Thailand and South Africa.

If you still suffer a compulsion to hold government bonds, then the panicked flight to safety if others default is likely to result in negative yields in Germany, and zero in the Scandinavian nations. So capital preservation and even a small gain seem probable for these nations.

It would be foolish to sell all European stocks in the weak countries, but it would also be wise not to raise your exposure significantly. The banks in these nations will be crunched because, bizarrely, prudent capital regulations' have forced them to buy huge amounts of their local wobbly government paper.

These should all be sold, all the more so given the tremendous gains in most markets over the last three years. I have not been a fan of bullion mining shares for the last two years because the tide was going out, but gold and silver should now gradually recover. Panic is an important determinant of demand.

The shares of several large precious metals miners arequite suppressed, so I would pick the larger, better-managed players, such as the world's largest silver producer Fresnillo (LSE: FRES) and the Canada-listed gold company Agnico Eagle (Toronto: AEM), which operates in several countries.

If you are switching equities within the weak eurozonecountries, I find two stocks of particular interest their share prices do not reflect their prospects. Portugal's Galp Energia (Lisbon: GALP) dominates domestic refining in the country, and has a very interesting production and exploration portfolio in Africa and Latin America.

Allegedly, predators are already circling. Italian spirits company Campari (Milan: CPR) earns most of its revenue and profits from outside Italy, has a good balance sheet and has prudently bolted on new brands. Although it's family controlled, who knows if the cousins might want to free up money offshore?

Jonathan Compton spent 30 years insenior positions in fund managementand stockbroking.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets