Shares in focus: A health check for Glaxo

There are lots of things to like about GlaxoSmithKline, but the giant pharma is also facing some big challenges, says Phil Oakley. So, should you buy the shares?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The pharma giant faces major challenges, so steer clear of the shares, says Phil Oakley.

GlaxoSmithKline (GSK) is one of the most valuable companies on the London stock exchange and it's not difficult to see why. There are lots of things to like about this pharmaceutical giant. A glance at its accounts shows that GSK is a highly profitable business that generates plenty of spare cash to pay juicy dividends.

But how much should you pay for a business like GSK? Only a few weeks ago, US drug company Pfizer was preparedto spend a lot of money to buy struggling British rival AstraZeneca. The implication is that some drug companies couldbe worth much more in the hands ofa trade buyer than they are on thestock exchange.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's because spending billions of pounds looking for the next blockbuster drug may be a waste of money. Why not just let the existing drugs run off their patents and pocket the money, rather than reinvesting it? Most analysts think that GSK is a better business than AstraZeneca and so could be worth a fortune on this basis.

But this is unlikely to happen. GSK's current price tag of over £77bn means that there are not many companies that could afford to buy the firm, as they would have to pay a big premium to get their hands on it.

So we need to weigh up GSK as a stand-alone business. And there's no doubt that it's getting harder for drug companies to make money. GSK hasn't helped itself by getting involved in bribery scandals in China a key growth market.

Lots of fund managers own GSK shares because of its sheer size. But should you do the same?

The outlook

This makes them more prone to problems such as heart disease and diabetes. These trends all seem to point to a higher demand for medicines, vaccines and health products. That sounds like good news for the likes of GSK.

Unfortunately, it's not as simple as that. Pharma firms face lots of challenges. Successful drugs can benefit from patents that protect them from competition for up to 20 years in places such as the US.

But once the patent expires, sales and profits for these drugs can decline fast. This is a big potential problem for GSK. Its Advair drug for asthma which makes up nearly a third of its pharmaceutical division's sales comes off patent in America in 2016.

But probably the biggest problem facing the drug firms is where the money to pay for their drugs is going to come from. Governments around the world are strapped for cash and are looking at ways to get health-care costs under control.

One of the first things they can do is bear down on the price they pay for medicines.This trend is only likely to get worse with developments such as the Affordable Care Act (otherwise known as Obamacare) kicking in in America this year. In Japan, there is a plan to have 60% of all prescriptions filled by cheaper generic drugs by 2018.

Looking for growth

GSK is becoming more focused. It's concentrating on selling more in emerging markets, vaccines and consumer health-care where there's less pricing pressure.

At the end of 2013 it had 40 drugs that were due to move to the advanced testing stage and it is hoping that some of these will be long-term winners. That said, new drugs only contributed a small amount to overall sales last year.

GSK is also selling assets in areas where it does not have a strong position. It has sold its cancer drugs portfolio to Swiss peer Novartis, in return for Novartis's vaccine business.

The two companies have also combined their consumer health-care businesses, with GSK taking a 65% stake. This looks like a sensible step and should add up to bigger profits in the future.

With extra sales hard to come by, GSK is slashing costs. By 2016 it wants to have reduced them by nearly £4bn compared to 2007. This should help earnings to keep growing modestly for the next few years. GSK is still generating lots of surplus cash, which willsupport dividends and share buybacks.

However, what seems certain is thatGSK will become less profitable in the future as patents expire. Its return on investment (ROCE) is still a very healthy 27%, but it was 36% five years ago.And returns on its current research efforts are just 13%.

I wouldn't sell GSK shares now as the 5% dividend yield looks safe for a while yet. But the challenges it facesare big, and this means I wouldn't buy them either.

Verdict: avoid

GlaxoSmithKline (LSE: GSK)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

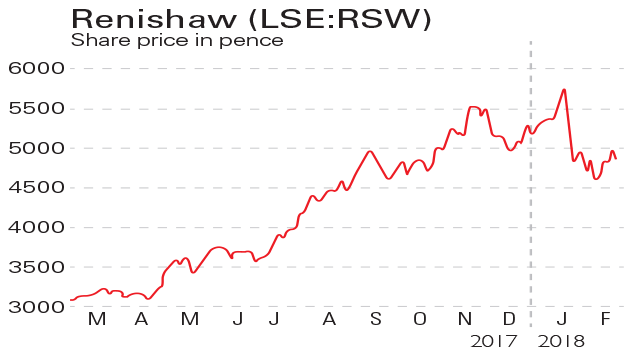

If you'd invested in: Renishaw and GlaxoSmithKline

If you'd invested in: Renishaw and GlaxoSmithKlineFeatures Measuring-equipment maker Renishaw has seen profits leap, but investors are sceptical about the prospects for drugmaker GSK.