Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Japan v Greece, the world's cheapest market

The final match in the MoneyWeek World Cup is between on old favourite of ours Japan and Greece, which we've been keen on for a while now.

And the winner, by a score of 5-16, is Greece.

For reasons which have been obvious for some time, Greece is cheap. Very cheap. Matthew Partridge decided to buy in over a year ago, when the price/earnings ratio was just 2.5, and the country had been downgraded to an emerging' market. He's done very well out of it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But Bengt Saelensminde isn't so sure. While the low valuations are exciting, he says, Greek companies pay out dividends equivalent to 0.6%.

It's certainly not a market to put all your money into, but if you fancy an adventurous punt, you could do worse than the Lyxor Athens ETF (Paris: GRE).

And as for Japan, The market has stalled this year after a very good couple of years, but we've not abandoned it yet. It might not be cheap any more, with a Cape of 19, but the prospect of more quantitative easingcould easily give the market another boost.

Spain v Chile - a clear winner

The pick of today's games in the World Cup is current holders Spain taking on Chile in Rio.On paper, Spain should walk this. In ten games over 64 years, they have never lost to Chile.

But their team of superstars could still be suffering a hangover from their 5-1 drubbing by the Netherlands, and Chile are on a roll after beating Australia 3-1. Anything could happen.

A punt for the bold

In the markets, however, it's more clear cut an 11-15 victory for Spain. (Lower is better, remember, when talking about the Cape.)

Spain's economy has been in the doldrums for a while. There are signs that it is recovering, but it will be a long, hard slog.

However, it is cheap enough to make it worth a punt for the bold. One way to buy in is via the iShares MSCI Spain Capped ETF (NYSE: EWP).

In contrast to Spain, Chile's commodity-based economy is in good shape and the banking system is sound. It's a major player in Latin America's Pacific Alliance trade bloc, which James McKeigue, who writes MoneyWeek's free New World email, believes will be a major force in shaping Latin America's economic future.

If you want suggestions on how to play the region as a whole, you could do worse than sign up for James's fortnightly updates from the continent.

If you want to play Chile on its own, the db X-trackers MSCI Chile ETF (LSE: XMCL) holds a basket of large- and medium-sized companies, weighted to utilities, mining and industrial stocks.

Russia v South Korea - two cheap markets?

Today's match sees Russia take on South Korea. And it's a walkover for Russia who wipe the floor with Korea and most other markets with a score of 6-15. Russia is way cheaper than Korea.

Investors aren't too keen on Russia at the moment. And it's not really surprising. Corruption is endemic, the country's bureaucracy is famously complex and unfriendly to foreign investors, and the economy is almost entirely reliant on the country's admittedly vast oil and gas reserves.

But there is no denying it is cheap. Russia is trading on a very low price/earnings ratio a Cape of six is second only to Greece.

Many of MoneyWeek's writers, including Bengt Saelensminde, are keen on it for that very reason. And as Merryn Somerset Webb says, "good things happen to cheap stocks".

If you do want to get in to Russia, the HSBC MSCI Russia ETF (LSE: HRUB) invests in some of Russia's largest companies, though it is heavily slanted towards oil. Holdings include including Gazprom, Lukoil, Sberbank and Magnit.

South Korea cheap for Asia

South Korea, on the other hand, is over twice as expensive, with a Cape of 15. But it's still the cheapest market in Asia. Taiwan trades at 16 times, Japan 19, Malaysia 20 and Indonesia a whopping 29 times.

My colleague Chris Sholto Heaton believes there's a very good reason for this. South Korea's huge conglomerates (chaebols) may be good businesses, but they are poor investments. Their "contemptuous attitude" towards investors means dividends are "pitiful".

One way in is via the DB X-Trackers MSCI Korea TRN ETF (LSE: XKSD).

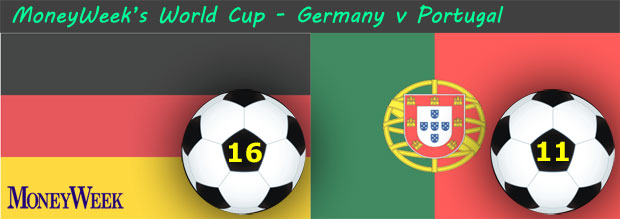

Germany v Portugal payback time

Poor old Angela Merkel. Ever since the eurozone crisis kicked off all those years ago, she has been cast as the pantomime villain by many in southern Europe.

Of course, it's hardly surprising. While thousands of unemployed Portuguese have struggled to scratch a living, they have had to endure the indignity of being told to shape up by the infinitely more prosperous Germany.

And to add further insult, when Portugal was bailed out in 2011, it was the Germans who put their hands in their pockets.

Today, it's payback time if the Portuguese get their way.

Germany face Portugal at the Fonte Nova arena in Salvador. It promises to be a close game.

Game time

But in the equally thrilling MoneyWeek World Cup, Portugal has sealed the win with an impressive 11 against Germany's 16.

These numbers aren't goals, of course they measure how cheap their stock markets are when averaged out over ten years otherwise known as the Cape ratio.

The lower the number, the more lucrative the market is for investors, which is why Portugal comes out on top.

Things have been looking up for Portugal lately. Its benchmark index, the PSI20 is up 23% in the last 12 months compared to Germany's Dax, which has gained an also impressive 21%.

While it's too soon to confine the eurozone crisis to history, bond yields (the price governments have to pay to borrow) have come down. In January 2012, it cost Portugal 17% to borrow for ten years. Now, the yield is around 3.4%.

Add to that the expectation that European Central Bank boss Mario Draghi will fire up the printing presses, and investing in Portugal might make sense.

If you're interested to find out more, read this week's cover story, where James Ferguson explains the best ways to profit from a bout of European quantitative easing. (If you're new to MoneyWeek, subscribe to MoneyWeek magazine.)

England v Italy - who's the cheapest?

Can you bothered to stay up on Saturday night to watch the England v Italy World Cup game? I certainly can't. The match doesn't kick off until 11pm and I can't be bothered to waste 90 minutes of my life watching a dull football match played by overpaid prima donnas.

The MoneyWeek World Cup is over much more quickly.

So, let's crack on and discover the winner of the next MoneyWeek World Cup fixture: England v Italy.

Now, the thing you have to remember about the MoneyWeek tournament is that it's a touch counter-intuitive'. In other words, the country with the lower score wins.

So, as you can see below, Italy has won this fixture: 10-13.

That's because our favourite stock market metric, the Cape ratio, suggests that Italy has a cheaper stock market than England.

So, why is Italy cheaper?

It's pretty obvious really. The economy is still struggling. In fact, Italian GDP is still 2% below its level in 2001, once you've adjusted for inflation.

But even if a country's economy is struggling, you may find that its stock market is oversold due to excessive pessimism.

That's one reason why we're pretty positive on eurozone stock markets at the moment. We also think that we're getting ever closer to full-blown money printing in Europe and that should be a positive driver for European share prices.

You can find out more about our bullish stance on Europe in our latest magazine cover story: Why Europe needs QE now. (If you're not a subscriber to MoneyWeek magazine, subscribe to MoneyWeek magazine and you'll get four editions for free as well as full access to our web archive including our cover story on Europe.)

As for England, the FTSE 100 is obviously the best known index. Of course, to call it an English' index is misleading. Not just because that term excludes Scotland, Wales and Northern Ireland, but also because there are plenty of global businesses listed on the FTSE that do most of their business outside the UK.

But even as a global index, the FTSEdoes look a little overvalued given the high levels of debt we still have in the US and UK.

So, given a choice between Italian shares and UK shares, I'd probably go for Italy. But the best approach would be to buy shares across Europe, because that will probably reduce the risk a little. The Fidelity Index Europe Ex UK fund would be good way to play it a nice, cheap index tracker.

The MoneyWeek World Cup starts Brazil v Croatia

As the World Cup gets underway, here at MoneyWeek, we're launching the MoneyWeek World Cup!

For a selection of World Cup matches, we're going to see which country is the more attractive for investors. At the end of the tournament, we'll see which country picks up the MoneyWeek trophy.

We're going to do this by comparing the Cape ratios for different countries playing in the real World Cup.(We explain the Cape ratio later.)

Whichever country has the lowest Cape ratio will be the winner. The lower the ratio, the cheaper the market.

A bit of fun

Before we get started, we should stress that this competition isn't serious investment advice. We're not suggesting that you put all your money into whichever country wins the MoneyWeek tournament.

A country with a low Cape ratio may appear to be cheap at first glance, but there may be good reasons for that cheapness. No ratio tells you the full story about a country or a company.

Our tournament is really just a bit of a fun.

The first match

The first match in the real World Cup kicks off tonight at 9PM it's Brazil v Croatia, so that's also the first match in the MoneyWeek World Cup.

Sadly there's no clear winner in this first match it's a 10-10 draw. Both countries have the same Cape ratio.

Interestingly, Brazil does look fairly attractive as an investment destination at the moment. The country has a young population, plenty of resources, and an election in October may produce a more business-friendly government. You can find out more about investing in Brazil in this article.

As for Croatia, we didn't have much knowledge about that country's stock market off the top of our heads, but a quick glance at Bloomberg reveals that the Crobex' index contains 25 stocks listed on the Zagreb Stock Exchange. It's heavily weighted (about 45% of the index) towards consumer staples, with Adris Grupa, a cigarette maker, accounting for the biggest weighting in the index (Adris also has a tourism unit, apparently).

The market hasn't exactly been a belting performer since July 2009, the Crobex is up just 8.7%, and that's including reinvested dividends. (For comparison, the FTSE All-Share is up around 95%, with dividends).

That sort of underperformance might pique our interest at some point, but for the moment it's pretty tough for foreign investors to get involved there's no exchange-traded fund tracking Croatia as yet. If anyone is an investment expert on Croatia, feel free to chip in on the comments section below

What is a Cape ratio?

A Cape ratio is a way of measuring how cheap or expensive a particular stock market is.

You start with the price/earnings ratiofor a country's stock market. That compares share prices to how much profit is being made the lower the ratio, the cheaper the market.

Then you look at the average earnings figure for the last ten years, which gives you the Cape ratio (cyclically adjusted price/earnings ratio). It's better to use an average earnings figure because the figure for one single year may be distorted by the ups and downs of the economic cycle.

We'll be back with another match in the MoneyWeek World Cup tomorrow!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.