Saga: should you stay onshore for this stock market float?

For investors, will there be more rewarding trips than Saga can offer? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For investors, will therebe more rewarding trips than Saga can offer? Phil Oakley investigates.

Saga began life in 1950, when itsfounder Sidney de Haan bought ahotel in Folkestone and startedselling packaged holidays to pensioners. The business then gradually branched out into Europe and other parts of the world. It focused on selling holidays during off-peakperiods to the over-50s, who generally had more flexibility to travel at these times. Saga Holidays was listed on the stock exchange in 1978 but was taken private by the de Haan family in 1990.

During the 1980s Saga set about diversifying from the holiday business and began selling insurance products. It bought its first cruise ship in the 1990s. In 2007 it began providing home care services for the elderly.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In 2004 the company was bought by its management and Charterhouse private-equity investors. They are now looking to sell a slice of it back to the public on the stock exchange, and pay down debt with some of the proceeds. So should you buy in or leave well alone?

How has the company fared?

That number will grow to 29.1 million over the next 20 years. More importantly, the over-50s are the most affluent members of society.x Many of them are already retired with generous pensions and significant amounts of equity in their homes. In other words, they have plenty of money to spend. Saga thinks that it can profit from these developments and make more money for its new shareholders.

The company currently sells to 2.1 million households in the UK who each buy an average of 2.7 products. It also has 8.4 million customers on its database. While not all of these will buy a product, Saga believes that it can make more money by selling more services to existing and new customers. It also has plans to move into new areas such as home care services and wealth management.

Are there profits in thegrey pound?

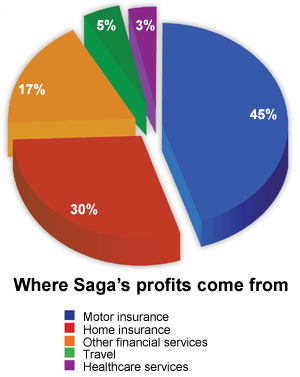

Instead, Saga looks more like an insurance company. If you look at the chart on the left then you can see that more than 90% of its profits last year came from selling insurance (and almost half from motor insurance) and financial services. Travel accounted for just 5% or trading profits of £10m.

Insurance is a tough place to be right now. It is an intensely competitive industry, while at the same time motor insurance premiums have been falling, making companies less profitable. Insurance companies also have to hold more reserves to make them less risky, which also makes it hard to make high returns for investors. If you have a look around at the moment, you'll see that insurance companies do not command high valuations (high price/earnings ratios) on the stockmarket.

As far as travel is concerned, Saga clearly has a good cruise business that operates in a growth market. The trouble for potential investors in the company is that this business is not big enough to transform it. There is also the fact that many people don't want packaged holidays and that low-cost airlines and the internet make it easier for them to make their own arrangements.

Avoid IPOs

Unfortunately, it seems that Saga's shares are going to follow the typical IPO pattern, and be priced at too high a level. Based on the mid-point of the indicated price range of 185p-245p (so 215p), Saga would have a market value of £2.3bn. This would equate to 21 times last year's after-tax profits. With around half of those profits to be paid out as dividends, the indicated dividend yield of around 2.4% is not particularly appetising either. These are the kinds of valuations paid for companies capable of growing their profits at a high rate for a long time. Saga might be able to do this, but its profits have barely grown at all since 2012.

Should you buy the shares?

Key facts

- Share price: 185p-245p

- Market cap: £1.98bn-£2.6bn

- Net assets (Jan 2014): £1.1bn

- Price/earnings ratio (historic) at mid-point: 21.1 times

- Price/book value: 2.1 times

- Yield (indicative): 2.4%

- ROE: 10.0%

- Dividend cover: 2 times

Having a look through its accounts and crunching some numbers, it would seem that Saga is a reasonable but unspectacular business, based on the profits it makes on the money it has invested. Saga made an after-tax profitof £110m last year on equity of £1.1bn a return on equity (ROE) of 10%. For a business to be valued at £2.3bn or more, I would suggest that ROE needs to be a lot higher.

So I'd pass on Saga shares unless they end up being significantly cheaper. However, if you would like to take the risk and buy some shares, the deadline for applications is Tuesday 20 May. Unconditional dealing in the shares will begin on Thursday29 May.

Verdict: avoid

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.