Gamble of the week: A buy-to-let lender on a roll

The financial crisis took its toll on this buy-to-let lender, says Phil Oakley. But now the good times are back.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Most of us have learned over the last decade that lending money against property can be a very risky business. But this buy-to-let lender knows this only too well.

When the financial crisis hit it was pushed to the verge of bankruptcy. It was only saved by going cap in hand to its shareholders and slashing costs. But all of this seems a distant memory now that the good times are back.

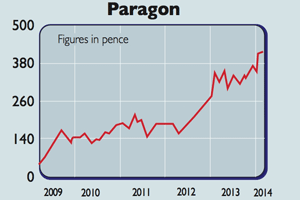

Its share price has been rising sharply for the last two years. The UK housing market is powering ahead and confidence among buy-to-let investors seems very high, with borrowing surging in the last 12 months.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Surely this has been factored in to Paragon's (LSE: PAG)share price? Maybe, but it would not surprise me if the shares kept forging ahead. Despite the government's Help to Buy scheme many people still cannot afford to buy a house, and will rent instead.

There is also talk of pensioners flocking to buy-to-let once they have complete freedom over their pension pots following the recent budget changes. That's all potentially good news for a specialist buy-to-let lender such as Paragon.

In many ways Paragon is a lot less risky than a high-street seller of residential mortgages. Its balance sheet is better financed than, say, Lloyds or RBS.

If you compare the amount of money it has lent out against the shareholders' funds (or equity) that supports them, it is more conservatively funded than either.

Unlike loans from high-street lenders,which are mainly financed with short-termdeposits, Paragon's are generallyfinanced with loan notes, where thematurity matches the money that ithas lent out. Analysts expect steadyprofits growth from mortgages withan increasing contribution fromParagon's growing portfolio ofconsumer loans.

Of course, there's no getting away fromthe fact that buy-to-let lending is stilla high-risk activity. Rents cannot growfaster than incomes forever. Low interestrates have supported the market andlandlords' profits for a long time, butthe general consensus is that they willnot stay this way.

That said, they couldstay low for a good while yet as theBank of England knows how fragilehousehold finances remain. If that's thecase, then Paragon shares on 13 times2014 earnings and growing profits maystill do well.

Verdict: a risky punt

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

UK unemployment hits highest level since 2021 – will interest rate cuts follow?

UK unemployment hits highest level since 2021 – will interest rate cuts follow?UK unemployment reached its highest rate in almost five years by the end of 2025. Is AI to blame and will the Bank of England step in with an interest rate cut in March?

-

Did UK inflation fall in January?

Did UK inflation fall in January?After rising in December, analysts expect the next round of UK inflation data to show that disinflation returned in January