Gamble of the week: A reinvented festive stock

There's plenty for investors to like about this vouchers and pre-paid gift cards company, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For years, this festive stock's main business was the selling of Christmas hampers and other goodies. Its business appealed to people on low incomes who would save small amounts of money throughout the year so that they could afford a few treats for the winter holidays.Christmas savings clubs now seem to be something from the dark ages.

The whole industry's image took a battering back in 2006 when rival company Farepak went bust and lots of customers lost their savings. It still offers this service, but it is now a much smaller part of its business.

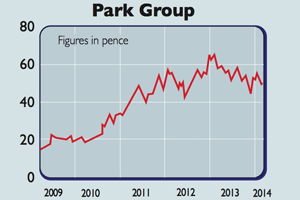

Over the last few years, Park Group (Aim: PKG)has set about reinventing itself as a provider of vouchers and pre-paid gift cards. Its services are used by companies to reward their employees and by consumers buying gifts.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The selling to consumers has historically been done by agents, but a lot more of this is being done over the internet now.

In many ways Park Group still sells to the same type of customer who once bought its hampers. Although they still buy these too, more customers are now also buying vouchers and pre-paid gift cards, spreading the cost over a year.

People can choose to have specific retailer gift cards, or ones that can be used in different shops. Its flexecash pre-paid card is now accepted by 59 different brands and that number is expected to grow.

The business has lots of characteristics that investors should like. Because people pay up front for its vouchers and cards, it has great visibility on its profits and cash flow. It is also able to earn interest on the very big cash balances that it has throughout the year.

It has to make investments in IT, but the company is very good at generating lots of surplus cash in most years.

Peter Johnson, the founder of Park Group, still owns 20% of the business and remains its non-executive chairman. The company pays him and other shareholders a very generous dividend that looks capable of growing.

Park Group may not be the most interesting business out there, but it is a solid one, which looks set to stick around. At 48p the shares trade on 11.5 times forecast earnings and a dividend yield of 4.7%. If you are hunting for an Aim stock for your Isa this year,Park Group is worth a look.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge