Shares in focus: Bucking the trend in British manufacturing

The shares aren’t cheap, but is manufacturing group Senior still worth tucking away? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The shares aren't cheap, but Senior is a quality company worth tucking away, says Phil Oakley.

A symptom of Britain's economic woes highlighted by commentators over and over again is the decline in manufacturing. There's no disputing the fact that lots of heavy industry, such as shipbuilding, has gone elsewhere.

It's also true that the share of manufacturing in employment and gross domestic product has fallen steadily since the 1960s. Still, not enough is said about the good manufacturing businesses that are still here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The FTSE 250 index is home to many successful British engineering firms that are doing very nicely. Instead of playing in commoditised markets where all that seems to matter is a low price, they focus on highly specialised, value-added engineering that commands higher prices and is more difficult to compete with.

Hertfordshire-based Senior is a good example of this trend. It is an international manufacturing group with operations in 13 countries and has a significant number of its factories in Britain. It makes high-quality parts that are used in aircraft and vehicles, with the bulk of its sales revenue coming from North America.

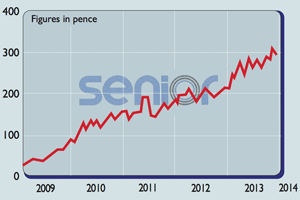

Its shares have been on a storming run since the dark days of 2009, largely due to the booming commercial aerospace markets. Can the good times continue?

How the business has fared

Whether they can or not will be largely dependent on the company's aerospace division, which accounts for just under two-thirds of total profits. Here Senior gets the bulk of its income from selling to commercial aircraft firms such as Boeing and Airbus, or to engine makers such as Rolls-Royce. It also sells into the military aircraft market and to the makers of business and regional jets.

Boeing and Airbus have record order books as the world's airlines look to invest in more modern, fuel-efficient aircraft. If Senior is to grow its profits, then Boeing and Airbus have to increase their production rates.

This is their plan, with Boeing looking to increase the production of its 787 Dreamliner from seven aircraft per month in 2013 to 12 per month by the end of 2016. This would be good news for Senior, given it sells £500,000 worth of parts on each 787 and £250,000 on each Airbus A350.

There is also a good chance of securing new orders of updated versions of the A320, the A400 military planes and Bombardier's C Series passenger plane, which is targeted at the regional jet market. Orders for this plane have been growing steadily and now stand at over 200.

Senior currently expects to sell parts worth around £300,000 on this aircraft, paving the way for £60m of extra sales. The first delivery is expected in 2015. Senior is also expanding its manufacturing capacity in Thailand to capitalise on growth in the Asian aircraft market.

Turbulence ahead?

Aircraft builders are also bearing down on costs, which means that Senior's profit margins are likely to shrink slightly although if build rates increase, profits should still grow.

Elsewhere, Senior has a business called Flexonics, which sells products into the North American heavy truck and European car markets. This business should do all right over the medium term, as Senior's key products are focused on reducing vehicle emissions, an area where regulations look set to get tougher.

At the moment, demand for heavy trucks is lacklustre, while the European car market is flat on its back. Demand should pick up over the next few years as and when economies improve.

Should you buy the shares?

As I've said many times before, it pays to invest in good businesses that are capable of earning high returns on the money they invest.(Check out page eight for a detailed strategy of investing in this type of company.) With a return on capital (ROCE) of 26% during the first six months of 2013, Senior passes this test with flying colours.

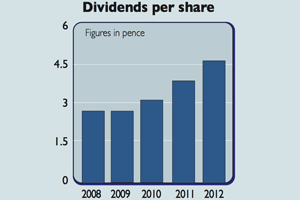

Senior also seems to be good at turning a high proportion of its profits into cash. This allows the company to pay higher dividends, fund investment in the business and get rid of debt. Not that debt is a problem at all.

Gearing (debt as a percentage of shareholders' funds) is a modest 18%, while interest payments are covered ten times by operating profits. City analysts expect the company to be debt free by the end of next year.

Profit growth should be reasonable, although the value of the pound against the American dollar might have an impact on this. Given that Senior has a lot of its business billed in US dollars, the weakness of the dollar against the pound has held back profit growth recently (because Senior needs to earn more dollars to produce a pound of profits).

Analysts expect profits growth of around 7% in 2014, increasing to 9% in 2015. With the shares trading on 15 times 2014 expected earnings, they are not cheap, but if the aerospace markets stay buoyant then paying up for this quality company could make sense for long-term investors.

Verdict: long-term buy

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.