Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"The next few months promise to be particularly tricky and volatile for markets," says Pimco's Mohamed El-Erian in the Financial Times. The jittery political backdrop, with military action in the Middle East, Germany's upcoming election on 22 September, and Italy's coalition hitting trouble again, doesn't help. But the main threat stems from central banks.

The attempt to drain all the liquidity they have flooded the markets with in recent years (through quantitative easing, or QE) is fraught with risk. "Wall Street is showing itself loath to give up QE3, even gradually," says Randall W Forsyth in Barron's. Hints from Federal Reserve chairman Ben Bernanke that the Fed will merely seek to buy fewer assets with printed money as opposed to stopping QE altogether have still sent both stocks and bonds lower.

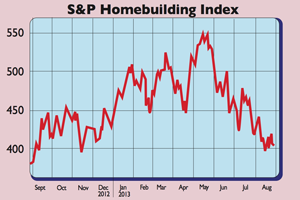

More seriously, bond yields have rebounded around the world due to talk of tapering' QE. That could dampen global growth, which is already slow, says Ed Yardeni of Yardeni Research. For instance, the bounce in US mortgage yields "is depressing mortgage applications, both to refinance and to purchase a home". The US house-building sector scents trouble: it has fallen into a bear market since tapering talk began in May.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, it isn't proving easy for central bankers to talk yields back down again, especially in the UK: markets are sceptical of the Bank of England's intention to keep interest rates low for three years despite inflation being above target. Central banks, says Richard Barley in The Wall Street Journal, may be losing control of global bond markets.

Investor scepticism will only mount if higher rates threaten the world economy to such an extent that central banks panic and throw yet more QE at the markets, which in turn will fuel fears of worse inflation further down the line. The great money-printing experiment is looking less and less likely to end well.

Stay up to date with MoneyWeek:Follow us onTwitter,FacebookandGoogle+

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how