Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

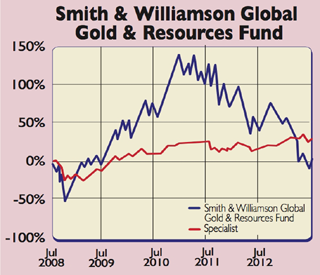

Having a tough year? Spare a thought for Ani Markova and Robert Lyon, managers of the Smith & Williamson Global Gold & Resources Fund. Its price has dropped 33% so far this year and 13% last year. Gold mining is out of favour and it has broad exposure to around 120 stocks of all sizes, and 60% in mid- and small-cap names. Two-thirds are gold miners, with the remainder precious metals and minerals miners.

The fund's skew towards smaller firms means it was hit dramatically when the gold price tanked. Its second-largest holding is Tahoe Resources, a Canadian junior miner worth C$2bn. But this gives the fund a distinct profile, says Markova.

A gold price recovery could be on the cards, says Walters. Currency devaluation and demand from central banks due to inflation concerns could boost gold and there is a lack of supply. If you believe gold will bounce back then this is the fund for you. In the bull market it outperformed its peers, returning 73.8% in 2008 and 65.8% in 2009. The annual charge of 1.75% isn't cheap, although an initial charge of 5% can be waived by buying through a fund supermarket.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Contact: 020-7131 4000.

| Central Fund of Canada Cls A | 5.1% |

| Tahoe Resources Inc | 4.7% |

| Goldcorp Inc | 4.3% |

| Argonaut Gold Inc | 3.8% |

| B2Gold Corp | 3.4% |

| Regis Resources Ltd | 3.0% |

| Silver Wheaton Corp | 3.0% |

| Agnico Eagle Mines | 2.9% |

| Randgold Resources | 2.8% |

| Eldorado Gold Corp | 2.7% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets