Shares in focus: Should you grab a slice of Domino’s?

There's no denying Domino's is a great business. But are the pizza company's shares still worth buying? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's a great business, but the shares look too stodgy for me, says Phil Oakley.

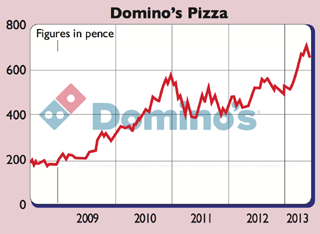

Domino's Pizza Group is a great corporate success story and long-term investors have made a killing owning its shares. It is Britain's leading pizza-delivery company.

Its first store opened in Luton in 1985 and, today, Domino's has the right to own, operate and franchise the business in Britain, Ireland, Germany, Switzerland, Liechtenstein, Luxembourg and Austria.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The key to its success has been its franchise model. This has allowed it to feed on the entrepreneurial spirit of its franchisees, who are empowered by running their own business. Domino's gives them support in areas such as advertising, IT systems, ingredients and training.

In return it gets paid royalties based on how much money they make. By the end of 2012, Dominos had 124 franchisees and 805 stores, mostly located in Britain.

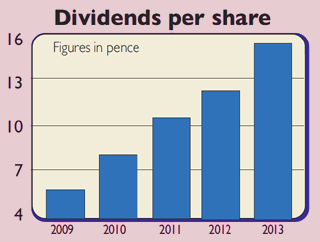

Despite a tough economic backdrop in Britain and Europe, bottom-line profits have more than doubled since 2008, with dividends up by an even greater amount. But can the good times continue?

Can it keep growing?

Return on capital employed (ROCE) for the whole group was in excess of 40%, which by any yardstick is very good.

What's even more impressive is that Domino's British business which makes nearly all the group's profits is thriving in a very difficult market. Not only are many households strapped for cash, but a walk around most British town centres will tell you that the take-away food market is saturated with fast-food outlets.

Overall, Domino's success shows that it has a very powerful brand that customers like and trust. It is therefore no surprise that this type of company is highly popular with investors as well.

Domino's reckons that, from a current base of around 740 stores, it can have 1,200 by 2021 and it plans to open around 60 new stores a year for the foreseeable future. It thinks its existing stores can sell more pizzas to more people.

A typical franchise will sell to around one in every five local households, with the better ones selling to two out of every five. Domino's aims to improve this hit rate with better marketing.

A further profit boost is likely to come from the company's use of the internet. Nearly two-thirds of all British sales now take place online, where Domino's has made some good investments in technology such as smartphone apps.

For the overseas business, the picture is more mixed. Ireland looks to be recovering now, but profits are still 30% lower than their peak levels of 2007. Germany and Switzerland are seen as exciting markets, but have had some teething troubles.

Last week, the company said that losses in Germany would be £2m-£3m more than they had expected this year. It plans to try and trim these by pushing the franchise model more heavily.

Should you buy the shares?

I am pretty sure Domino's will continue to do well it has, after all, continued to deliver returns to shareholders in the past when many thought it wouldn't but I wonder whether profits can grow fast enough to justify its lofty share price. City analysts expect 8% earnings growth this year and 16% next year as overseas losses narrow.

That suggests the current share price leaves little room for disappointment. Meanwhile, the upside looks limited. For that reason, I'd avoid the shares.

Verdict: avoid

What the analysts say

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

UK interest rates live: rates held at 3.75%

UK interest rates live: rates held at 3.75%The Bank of England’s Monetary Policy Committee (MPC) met today to decide UK interest rates, and voted to hold rates at their current level

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension