Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

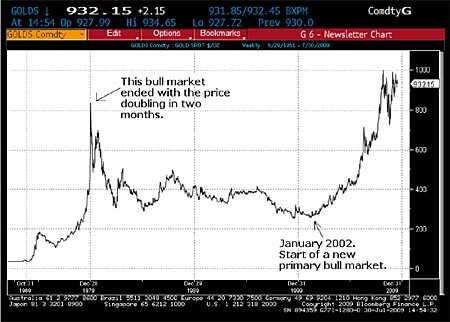

You can see from the long term gold chart below that prior to peaking in January 1980, the price approximately doubled in the last two months. That gold primary bull market then ended. The primary bear market that followed lasted until 2002 when the primary bear market for the dollar commenced and today's primary bull market for gold started.

If gold today, in real terms, was to match the 1980 high, it would be at $2,400/oz. Understandably, we wish to remain invested until this primary bull market has ended because the prize to be won is so great.

The world today is one of competitive currency devaluation. With reduced world trade, the cheapest currency will compete with the best to win exports. Gold cannot be replicated and has, since time began, been the only reliable store of value because of that. It benefits considerably in an environment such as now.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The production of gold is in steady decline, and China is already the world's biggest producer. However, we suspect that they will continue to be net importers on their journey to becoming the world's major economy. Increased gold reserves will give them considerable financial strength. Furthermore, the opportunity to easily swap depreciating dollars for appreciating gold will not be missed.

Is it likely that the IMF could spoil the gold party by liquidating large amounts of its gold holdings (in order to do that they need America's permission) and so flood the market and undermine the price? We suspect if that was genuinely likely, the price would already reflect it. But it does not, and maybe that is because the market knows that surplus gold supply coming from that direction would be picked up by China.

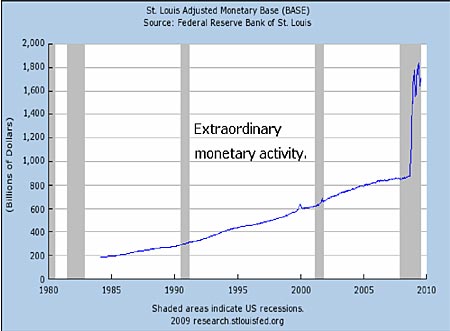

Below is a chart from the Federal Reserve Bank of St Louis showing the growth of the US monetary base. Just one look at that and who wouldn't want to hold gold rather than dollars!

At gold's historic highs in 1934 and 1980, the ratio of the gold price to the Dow Jones Industrial Average was one. There are those who consider that the eventual outcome of these economic and investment conditions will be to bring gold back to that ratio. If that is the case, it means that at some point, if $2,400/oz for gold is the correct target, the Dow will be priced at 2,400. Or if the Dow finishes where we think it will finish, which is to say 5,000, for a conservative ratio of two, gold would be at $2,500/oz. None of that, to us, seems improbable.

If the current economic condition had not occurred, and if you were writing a fiction in which the gold price ballooned, we suspect that you might invent economic conditions not dissimilar to today's. In other words, as we have repeatedly said, the authorities are behaving in a way that is most likely to drive gold ever higher. Why would you not choose gold as the currency most likely to maintain its value, irrespective of the extreme and dangerous monetary behaviour of global policy makers?

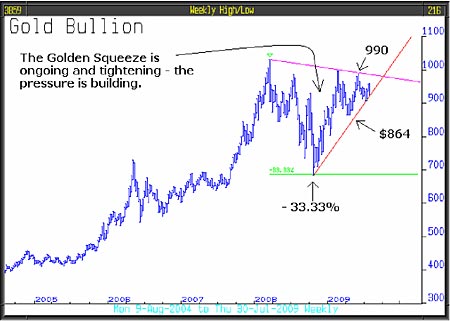

We have a penchant for technical analysis. Investment markets conspire to create a situation in which as time moves on volatility reduces and a "squeeze", not unlike a spring, forms. You can see that from the chart below.

Starting with the 2008 top, we have a declining trend line joining the two tops in 2009. From the October 2008 low, formed following a retracement of 33.3%, a rising trend has formed, thus completing "the golden squeeze". Although not a defining signal, nonetheless it will deliver a strong clue to the future direction of the gold price. The squeeze ends through either of the trend lines. By likening the process to a spring it illustrates the power that's building up as the spring tightens. A move above or below the squeeze will be important. If, as we expect, that happens to the upside, the ensuing action could be very exciting. Below $850/oz the bull market is probably not over but more patience will be required.

Much of what we have written today is work in progress. It will not surprise us if some defining events take place over the next few days.

This article was written by Full Circle Asset Management, as published in the threesixty Newsletter on 31 July 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?