Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

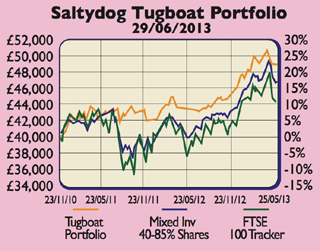

Saltydog Investor aims to boost fund investors' returns via a simple strategy: buy what's rising, avoid what's falling. Read more here. Here, Saltydog's Richard Webb updates us on its cautious portfolio, the Tugboat.

On 24 June, the FTSE 100 closed at 6,029, more than 800 points off its recent peak in May: a fall of nearly 12%. So it's hardly surprising that all the fund sectors exposed to equities have been suffering too. Sometimes when share prices fall, bonds go up in value. But this month they have been falling too. So the only sector to gain in the last four weeks has been the Absolute Returns' sector. For the last few weeks we have only been holding the CF Odey UK Absolute Return fund (up 3.3% since we bought it on 16 May) and the Chelverton UK Equity Income fund (up more than 20% since we bought it more than eight months ago). Overall, the Tugboat portfolio has made an annualised gain of 7.9% since launch in November 2010. We haven't made any changes to the portfolio this week.

By reducing our exposure to falling markets, we have limited our losses during this downturn. But in the last few days, stockmarkets around the world have recovered slightly. So has the correction finished, or is this just a temporary bounce?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the one hand, the Federal Reserve has tried to reassure markets that it won't be too hasty to pull back from quantitative easing, so perhaps investors have overreacted. But we shouldn't be too quick to pile in. As legendary trader Jesse Livermore said: "the desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street, even among the professionals". If there's no clear reason to invest then it makes sense to stay safe until conditions improve. We will be watching the numbers closely, ready to invest if the rally continues.

To sign up for Saltydog's free trial, go to www.saltydoginvestor.com.

| Safe Haven | Cash | 71% | 72% |

| Slow Ahead | CF Odey UK Absolute Return | 22% | 21% |

| Steady As She Goes | PFS Chelverton UK Equity Inc | 7% | 7% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.